Discover what a payroll account is, its importance for businesses, and how it simplifies processes like salary deposits, deductions, taxes, and compliance.

If you’re a small-business owner wondering whether or not you need a separate bank account to run payroll, you’ve come to the right place. In this guide, we’ll explain what a payroll bank account is, how payroll bank accounts work and the benefits of having a separate payroll bank account.

Jump to:

A payroll bank account is a bank account that is used solely for paying employees. It is separate from your personal bank account and other business bank accounts as well. A payroll bank account is not used to pay other business expenses, including vendor contracts and supply orders — those should be paid out of a different bank account.

You can use the same bank account to disburse wage payments and payroll taxes, depending on local and state laws as well as your preferences. However, you may wish to have an account that is solely used for wage payments and a separate account for tax payments.

As we explain in our how to do payroll guide, a payroll or business bank account is one of the most important things you need to set up payroll. If you calculate payroll manually, you’ll figure out how much to pay each employee for each pay period, then you’ll either initiate a direct deposit or write them a check. You’ll also need to deposit all necessary payroll taxes using the Electronic Federal Tax Payment System (EFTPS) (Figure A).

Figure A

Payroll software can help automate the calculations and transactions for you. It can automatically figure out what taxes you need to deduct from each employee’s paycheck, and it can also transfer money from your payroll bank account to each employer’s financial institution with ease.

Many payroll software allow you to run payroll with only a few clicks, and some allow you to completely automate it so you don’t even have to lift a finger — just make sure you verify the information before the automatic run.

You can also opt for an outsourced payroll service to get experts to take care of your payroll for you. For more information about your payroll options, see our explanation of why you need a payroll service.

While you are not required to open a separate payroll account, it’s a smart business move that can make the payroll process easier. Having a dedicated account for payroll only keeps your money organized. Since payroll can be a business’s biggest expense, there’s a strong case to be made for giving payroll a separate account.

Having a dedicated payroll bank account also makes it easy to see how much money you have left to spend on other expenses since those funds are in a different account. This is especially useful if you pay employees with physical checks, in which case there may be a delay before they deposit the checks and the money is withdrawn from your business account.

For instance, let’s say that you pay an employee $2,000 for their biweekly pay on the first of the month, but they don’t cash the check for another week. Until that check clears, your bank account will read $22,000, even though you actually only have $20,000 in other funds. By putting that payroll money in a separate account, you don’t have to continually factor in outstanding transactions.

Having a separate payroll account provides other benefits beyond just keeping your money organized and separate.

First of all, having separate bank accounts for payroll and business expenses makes it easier for either you or your accountant to reconcile your books. This improves the accuracy of your accounting and helps shield your business from the risk of a potential audit.

Having a separate payroll bank account can also reduce the chances of overdrafts. Since payroll expenses are consistent, you can deposit the same amount of money each month, which then goes right back out the door based on your payroll schedule.

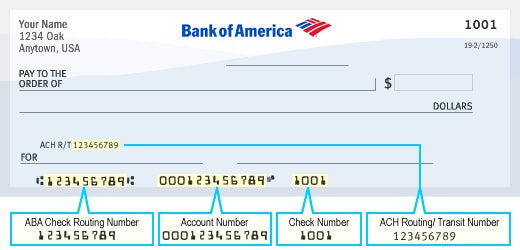

Finally, a separate payroll account offers a layer of financial security. This is because the bank account number is printed on payroll checks, as you can see in this example check from Bank of America (Figure B). If you have a separate payroll account, only that bank account would be exposed to potential fraud instead of your entire business account. So in case of a breach, their access would be limited to only your payroll account.

Figure B

While having a separate payroll account presents many advantages, there are also a couple of disadvantages you should know about.

For starters, having a separate payroll account means you’ll have to manage more than one bank account. Small-business owners trying to stay on top of their accounts may find this a hassle. Having both of your accounts at the same bank can help streamline the process.

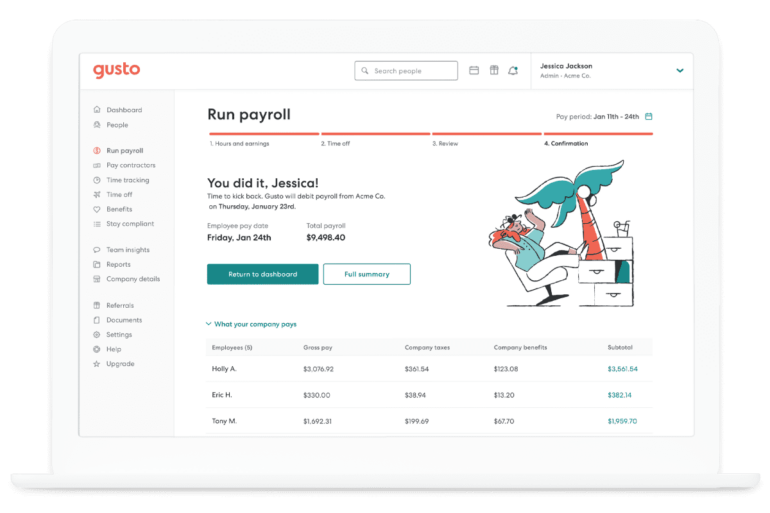

Fortunately, many modern payroll and accounting software platforms, like Gusto (Figure C), allow you to sync multiple bank accounts. All your information will then be visible on a single centralized dashboard, and you can generate financial reports with a click of a button. This makes it easier to manage multiple accounts and get a full picture of the financial health of your business.

Figure C

You will also likely incur additional fees for each business account you open, such as monthly maintenance fees. It might make sense to look at what fees different banks charge for business accounts so you can choose a cost-effective option that still meets your needs.

Ready to find software that can help you manage your bank accounts and automate payroll? Check out our top picks for the best payroll software of 2023.

Deel’s full-suite of HR tools allows companies to manage the entire employee lifecycle—from recruitment and onboarding and beyond—in 150 countries. All this from a single, easy to use interface. US and Global Payroll allows you to pay any type of worker in 100+ countries, and all 50 states, in whatever currency you choose. And with 200+ in-house legal experts and entities in 120+ countries, using Deel means you’ll always be compliant with local regulations.

Rippling automatically syncs all your business’s HR data, like hours, leave and absence, with payroll. You never need to fill out spreadsheets and upload to another system— we pay your employees and HMRC directly.