Trucking companies have unique payroll needs that often require specialized software to manage the complexities. The best payroll software for trucking companies should add efficiency to managing payroll. Other essential features include tracking driver miles and hours worked, automating payment processing, International Fuel Tax Agreement reporting, integrations with transportation management systems and ensuring compliance with federal and state regulations.

SEE: Payroll Processing Checklist (TechRepublic Premium)

This guide provides an overview of the best payroll software for trucking companies, with information about features, pricing and important factors to consider when choosing the best payroll software for your business.

Jump to:

| Product | Built-in IFTA tracking | Expense tracking | Contractor payment plan | Starting price |

|---|---|---|---|---|

| Axon Software | Yes | Yes | No | Custom |

| QuickBooks | No | Yes | No | $45/mo. + $6/payee |

| Gusto | No | Limited | Yes | $40/mo. + $6/payee |

| ADP | No | Limited | No | Custom |

| Axis TMS | Yes | Yes | No | $99/mo. |

| TruckLogics | Yes | Yes | No | $29.95/mo. |

Axon Software is a cloud-based transportation management system and payroll software solution designed explicitly for the trucking industry. Its payroll-specific features help trucking companies to manage their payroll and track driver hours.

Unlike ADP and Gusto, Axon software calculates IFTA, fuel taxes, and other trucking-specific taxes and fees. It also provides a secure payroll platform that complies with federal and state regulations.

Axon Software offers customizable reporting and integrates with other trucking-specific systems such as TMS, electronic logging devices and accounting systems.

Pricing information is available upon request. Potential buyers can also book a free demo to evaluate product features.

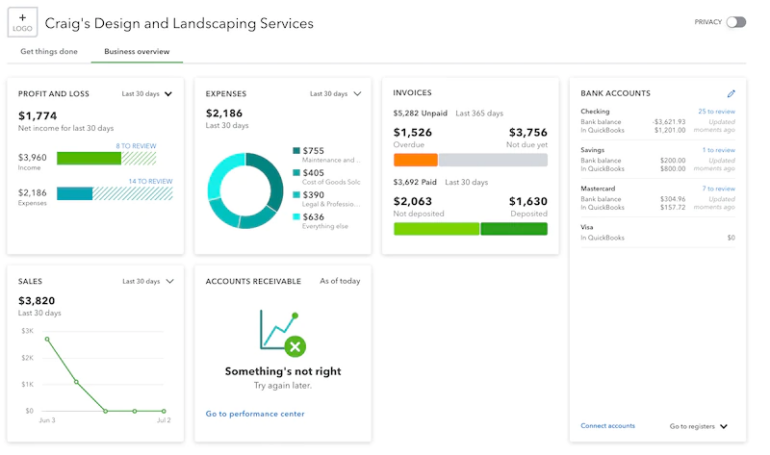

QuickBooks Online Payroll is one of the most popular and widely used payroll software solutions for trucking companies. Most QuickBooks Payroll users already use QuickBooks Online, a comprehensive accounting software program that manages finances, tracks income and expenses, creates invoices, and generates financial reports. QuickBooks also offers integrations specifically tailored to the trucking industry for fleet management, dispatch and driver tracking.

Additionally, QuickBooks Online integrates with tools such as HyperTrack and RAMA Logistics Software, allowing users to easily monitor fleets, track mileage, track load status, dispatch trucks and freight, and pay drivers and carriers. Integrating these tools makes it easy for users to stay on top of their company’s transportation operations and ensure timely payments.

Using QuickBooks Payroll in conjunction with trucking-specific integrations, trucking companies can easily import truckers’ hours worked, generate paychecks, submit payroll taxes and calculate workers’ compensation premiums.

For more information, see our QuickBooks Online Payroll review.

QuickBooks offers multiple pricing plans — and frequent discounts — so trucking businesses can choose the features they need while staying within their budget. QuickBooks Payroll also comes with either a 30-day free trial for 50% off the monthly base price for three months:

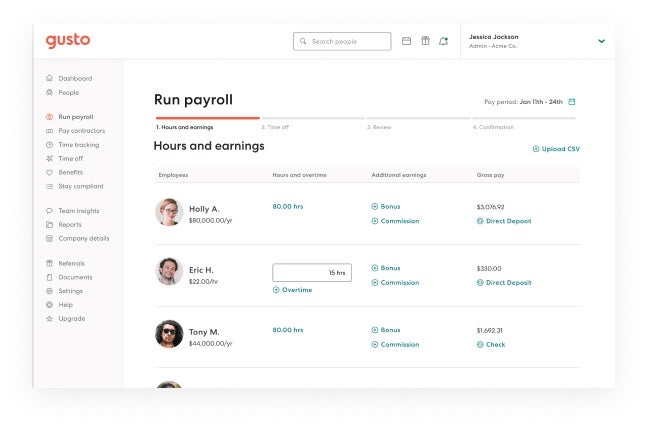

Gusto is one of our best payroll processing solutions for small businesses, which includes many trucking companies. The platform provides businesses with the resources they need to manage payroll, benefits, HR and compliance for driver staff, contractors and other employees. It is a cloud-based service that can be accessed from anywhere, making it ideal for employers managing remote teams.

Gusto also offers several other useful features for trucking companies, including an automatic time-tracking feature that records hours worked by drivers and contractors across different projects or sites. Gusto integrates with Timeero — a time, mileage and GPS tracking software solution — but compared to QuickBooks, Gusto lacks key TMS or fleet management integrations. This may limit Gusto’s utility for larger trucking companies.

To learn more about Gusto, read our comprehensive Gusto payroll review.

Gusto offers three pricing plans, plus a contractor-only payment option:

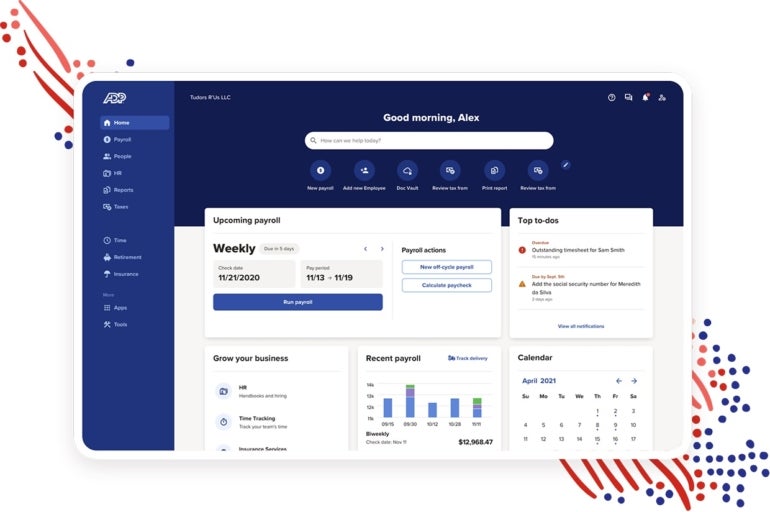

ADP, otherwise known as Automatic Data Processing, is a payroll software provider that offers businesses of all sizes and industries — including trucking companies — a suite of services that can help with payroll and other HR management tasks.

The company’s payroll platform includes tax filing and direct deposit options, as well as integrations with TMS solutions such as TripLog. The platform also includes support for managing driver and non-driver employee designation benefits, like retirement accounts or health care contributions. It’s customizable, so users can tailor the features and modules to specific business needs.

ADP offers a variety of products to suit multiple business sizes across multiple industries. The best ADP solutions for trucking companies include ADP Workforce Now, an HCM solution for midsize and large businesses, and ADP RUN, a payroll/HR software solution.

Find out more about which ADP payroll product could be right for you by reading our ADP Workforce Now and RUN Powered by ADP reviews.

ADP offers four payroll plans. Specific information about each pricing plan is available upon request.

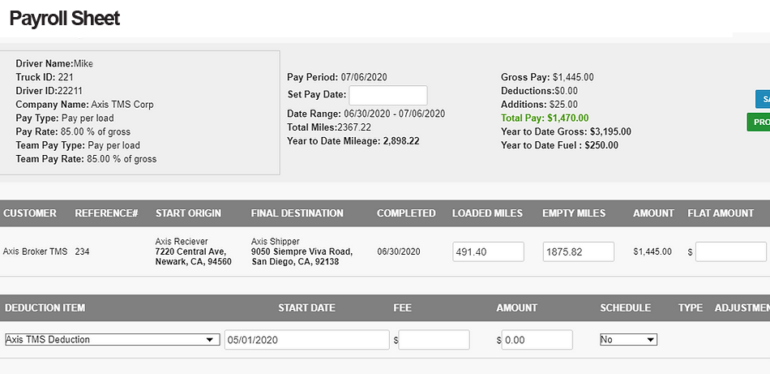

Axis TMS is a cloud-based trucking management software that provides carriers and fleets with an end-to-end solution for managing their business. This platform enables users to easily track, manage and improve the efficiency of their trucking business operations.

Axis TMS provides users with a wide range of features to streamline processes related to driver payroll, customer invoicing, dispatch, route optimization and fuel tax reporting. Trucking company users can work with both software and hardware solutions from Axis TMS; hardware solutions include tablets for drivers, dash cameras, asset trackers and sensors.

Axis TMS pricing is categorized into two groups: Monthly payment plans for customers with less than 150 trucks and enterprise plans for customers with over 150 trucks. Driver payroll is included in all plans.

Plans for small, midsize and large trucking businesses start at $99 per month. Enterprise-level pricing is available by request.

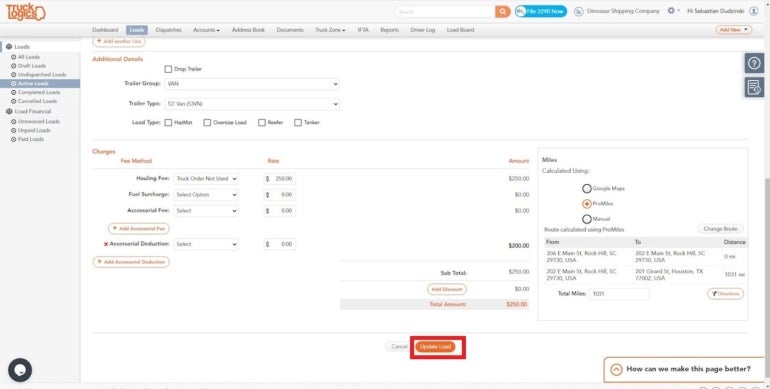

TruckLogics is an online trucking software platform that helps trucking companies manage their business operations. It provides tools to manage customer relationships, route optimization, driver management, dispatching, fuel tracking, invoicing and fleet tracking.

TruckLogics also offers features for compliance, analytics and reporting. Its integrated payroll module allows you to manage driver payroll, calculate wages and track driver hours. It also includes tools for IFTA and document management.

TruckLogics offers a 15-day free trial. The company offers various plans for different business sizes that are payable monthly or annually:

Trucking payroll software is an invaluable tool for any trucking business. It can simplify payroll management, save time and money, and improve accuracy and compliance with transportation-specific tax regulations.

SEE: Travel and business expense policy (TechRepublic Premium)

When selecting trucking payroll software, it is important to consider the following features:

Look for software that automates payroll processing, from calculating taxes and deductions to making payments to employees. This will help streamline your payroll process, eliminating the need to enter information manually and ensuring accuracy.

Tax compliance is paramount for trucking businesses. Make sure the software you select can accurately calculate federal, state, and local taxes and deductions. The software should also be able to generate all necessary forms, including W-2s and 1099s.

Consider software that provides comprehensive reporting capabilities. This will make tracking employee hours, wages and taxes easier. It should also provide the ability to generate reports, such as employee payroll summaries.

It’s ideal to find a trucking payroll solution that can easily integrate with other systems used in the trucking industry, such as transportation management systems. This will enable you to streamline data entry and reduce manual processes. It will also make it easier to manage payroll information, run reports and make payments.

Trucking companies must comply with various interstate travel regulations, which require proper reporting of fuel taxes and IFTA filings. Look for payroll software that simplifies this process by automatically collecting and processing relevant mileage information, allowing you to generate compliant IFTA and fuel tax documents quickly. Some trucking payroll solutions may offer built-in document management tools, which allow you to store these documents securely and retrieve them easily when needed.

Make sure the payroll software you select offers an intuitive user interface that is easy to navigate. This will help ensure employees can quickly complete payroll tasks without confusion or frustration. It’s ideal if the software provides guidance or tutorials to help users understand how to use the system correctly.

It is important to choose a payroll provider that offers customer support options like phone, email or live chat. This will give you someone to turn to if you encounter issues or questions while using the software.

When selecting payroll software for your trucking business, look for easy setup, automated payroll processing, compliance with federal and state regulations, reporting capabilities and integration with other accounting software. More importantly, consider the strengths of your internal operators and drivers alike.

The right payroll solution can make running your business much easier and more efficient, but it’s crucial to consider what you really need from the software and how much it will cost to get those features and services.

Read next: The Best Payroll Software for Your Small Business (TechRepublic)