Need to send out W-2s but don’t know all the details? We’ll dig into what they are and how they work.

Key takeaways:

If you have full-time employees, you need to send out W-2 forms every January, cataloging your employees’ wages and taxes for the previous calendar year. A W-2 is essential for your employees to file their tax returns and is one of the most common forms in the United States.

Here’s everything you need to know about W-2 forms.

|

Taxes can be complicated, but with a capable payroll software like Gusto, you can better track tax information and set up helpful automations. That way, you can effortlessly stay compliant while focusing on other needs of the business. |

Jump to:

The IRS requires employers to submit a W-2 form (Figure A) for each employee. Essentially, a W-2 contains information that employees use to file their federal tax return. It shows how much the employee was paid during a calendar year and how much federal, state and local taxes were withheld from their paycheck.

Figure A

The W-2 forms will also include relevant fringe benefits such as health insurance, health savings account contributions, retirement account contributions, adoption assistance, dependent care assistance and more.

Employees fill out W-4 forms as part of their onboarding process. It tells the employer how much tax to withhold from future paychecks, and that information is used to calculate the correct paycheck and deductions each time the business runs payroll.

In contrast, a W-2 form is filled out by an employer at the end of the year and shows how much tax was withheld from past paychecks based on the information given on the W-4.

The 1099 form is issued instead of a W-2 when an employer does not withhold taxes from the worker’s paycheck. Instead, the 1099 worker is responsible for calculating and paying their own federal, state and local taxes.

So this means you don’t send out W-2s to freelancers, independent contractors, gig workers or non-employees. Instead, you’ll send either Form 1099-MISC or Form 1099-NEC, which document non-employee compensation. The W-2 documents employee compensation.

Full-time employees who are paid more than $600 in a calendar year should receive a W-2 form. If a worker is classified as a freelancer, independent contractor or non-employee, then you’ll send them a 1099 form instead.

From a business’s point of view, W-2 employees have quite a few advantages. They are essentially dedicated to your company during their working hours, so they can commit more time and effort to their tasks for better quality, consistency and familiarity.

While it’s good practice to listen to your employees and new hires and create agreements that benefit both parties, you do have some say over where employees work and when. That way, you can ensure they’re available at optimal times, and you can touch base with them much more easily.

However, in exchange for these perks, W-2 employees receive multiple protections under the law. Some common ones include overtime, minimum wage, family and medical leave, worker’s compensation and unemployment insurance. They also have the right to participate in their employer’s health and dental insurance plans, as well as their retirement plans. So you have to decide if these advantages are worth the cost of providing these benefits.

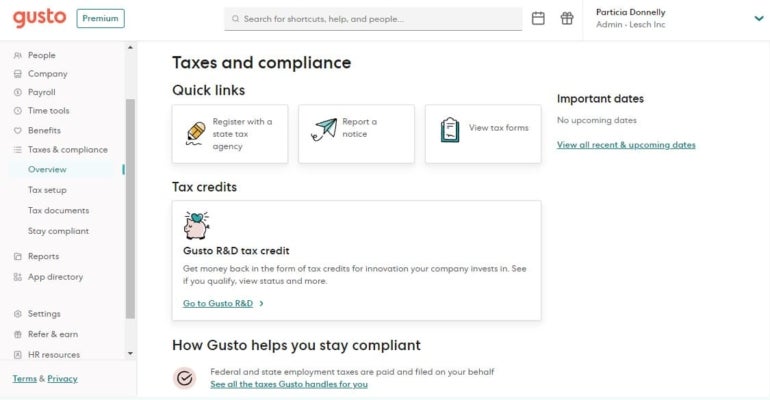

The IRS requires businesses to send out their W-2 forms by January 31st of each year, which means employees should receive their W-2 somewhere around the end of January or the start of February (depending on whether it’s a digital or hard copy). Many companies use payroll software or other services to make employees’ W-2 forms available electronically (Figure B), though this is not required.

SEE: Best Payroll Software for Your Small Business in 2023

Figure B

As an employee, if it’s the first week of February and you still have not received your W-2 form, contact your employer to ask them for a status update and to provide you with an electronic copy if they haven’t already. If you still have not received your W-2 by February 16th, the IRS recommends contacting their toll free help line at 1-800-829-1040 for assistance. You must file your taxes on time even if you do not receive your Form W-2.

Deciphering a W-2 can be tricky if you’ve never done it before, but fortunately, it’s pretty straightforward to interpret if you know what you’re looking at. Here is the information contained in your W-2 form:

First, you as the employer will generate the W-2 form, which may be done manually or by using a payroll software platform or service. After you’ve put together the W-2 form, you send it to both the employee and the IRS.

From there, it’s all up to the employee. They use the information on their W-2 to file their tax return, and they’ll also attach their W-2 form when filing their taxes. The IRS then checks their tax return against the W-2 they have on file from you, the employer — alongside any other relevant forms — to ensure accuracy.

SEE: The Best Cheap Payroll Services for 2023

Ready to find payroll software that can automate the W-2 filing process for your business? Check out our guide that explains how to choose payroll software or read our top picks for the best payroll software of 2023.

Multiplier is a SaaS-based global employment solution, providing payroll, EOR and benefits solutions for over 150 countries across the world including the US, Europe, and APAC.

Payroll can be a time-consuming, administrative task for HR teams. Paycor’s solution is an easy-to-use yet powerful tool that gives you time back in your day. Quickly and easily pay employees from wherever you are and never worry about tax compliance again. Key features like general ledger integration, earned wage access, AutoRun, employee self-service and detailed reporting simplify the process and help ensure you pay employees accurately and on time.

Justworks Payroll is a lightweight solution that simplifies Payroll and HR operations so you can focus on what matters most – running your business. Our user-friendly navigation, paired with reliable support, helps you monitor and maintain compliance, onboard and manage your teams, and navigate the complex world of payroll with confidence.

Designed for today’s needs and tomorrow’s ambitions, our adaptable solutions will elevate your operations & provide the tools for your business to thrive.

ADP Workforce Now serves clients across nearly every industry who are looking to manage their human capital management needs across payroll, HR, benefits, talent, and time and labor, among others. ADP Workforce Now provides clients with custom-tailored solutions that fit their organization, so they can save time and money while getting expert support and accuracy.

Payroll and HR that move you in the right direction. We give you everything you need to navigate payroll, HR, and benefits — so you can keep running your business smoothly.

Get your first month free, or join a demo to see everything we can do!