Sage’s fast facts |

|---|

| Pricing: Starts at $7.50 per month |

Key features:

|

| Learn More on Sage’s Site |

Sage Accounting offers a low-cost option for small-business accounting software. While it doesn’t have all the bells and whistles of some other brands, Sage software does have key tools like unlimited invoicing and multi-currency support at a competitive monthly price. That makes Sage Accounting a good option for invoice-heavy businesses that care more about keeping costs down than having the latest features.

That means Sage Accounting won’t work well for every business. If things like time tracking, advanced analytics or even a modern interface matter to you, consider an alternative accounting software instead.

Jump to:

Sage Accounting gives you two choices of plans: the Sage Accounting Start plan (the entry-level option) or Sage Accounting (the full-featured option).

You can test out either plan at no cost with Sage’s 30-day free trial.

Price: $10 per month

The Sage Accounting Start plan costs $10 per month for basic accounting tools. You’ll get features like invoicing creation, accounts receivable and accounts payable management and a Stripe integration to accept payments.

The low price and basic features make Sage Accounting Start a good option for self-employed business owners with minimal accounting needs. Most small businesses, though, will want the higher-tier Sage Accounting plan.

Price: $25 per month

The standard Sage Accounting plan costs $25 per month, but you can get 70% off your first six months ― making it a steal at just $7.50 per month. Even at full price, the Sage Accounting plan costs less than premium plans from competitors.

With this plan, you get all the features from the Start plan (like unlimited invoicing), but you’ll also get tools for quotes and estimates, cash flow forecasting and multi-currency support. Plus, this higher-tier plan gives you unlimited users ― a nice feature, given that other companies often charge extra for multiple users.

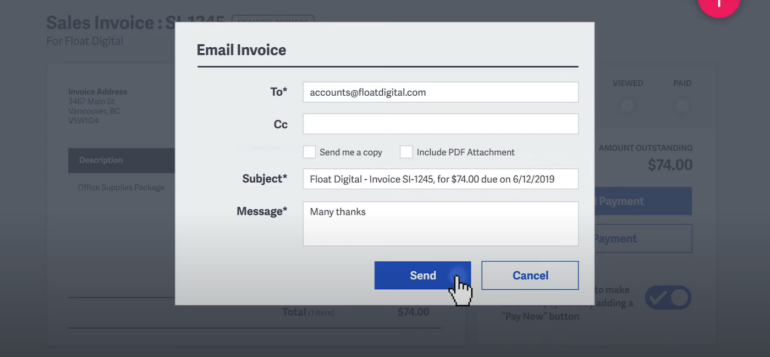

Sage Accounting lets you create and send unlimited invoices ― unlike other software that often limits how many you can send per month. That difference makes limitless invoicing one of the best Sage Accounting features. You can choose from and customize Sage’s nine different invoice templates, saving you time on design. Sage also lets you automate recurring invoices, reducing busywork for you.

Figure A

With the standard Sage Accounting plan, you can also create quotes and estimates. Then, if your customer moves ahead, you can make your quote or estimate into an invoice with the click of a button.

Sage also gives you the option to accept payments by adding a “Pay Now” button onto your invoice. Unfortunately, Sage does limit you to Stripe payments, so you’re out of luck if you use a different payment processor. If you do use Stripe, though, Sage will match any payments to invoices and keep your accounting software updated for you.

Sage Accounting integrates with over 40 different software products. That includes payment processors (like Stripe), data entry (like BillBjorn) and payroll software (like Gusto). Plus, Sage software integrates with Zapier ― which allows you to make and create additional integrations, complete with automation. Simply put, you can get more out of Sage and your existing software by linking them together.

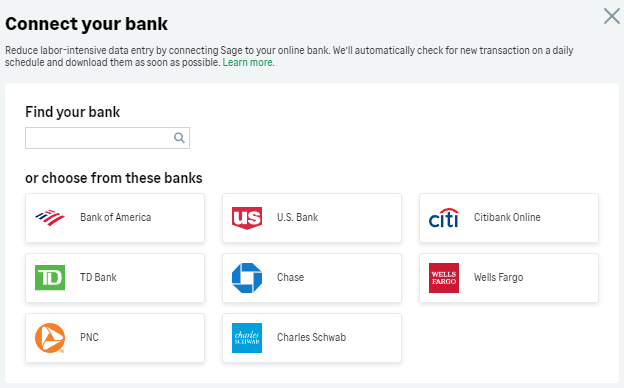

Figure B

You can also connect Sage Accounting software with your bank. When you do that, Sage will automatically enter new transactions into your accounting software for you. Sage has hundreds of bank integrations (including popular choices like Chase and Wells Fargo), meaning it will likely work for you.

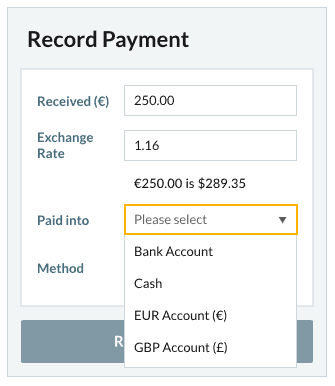

For businesses that deal with vendors or customers outside the U.S., Sage Accounting offers multi-currency support. You can select different currencies for each supplier, record payments in various currencies and even monitor how exchange rates affect your cash flow.

Figure C

So whether you have the occasional international customer or you make regular transactions across country lines, Sage Accounting can keep up.

Sage Accounting costs less than many comparable accounting software tools, making it a bargain for businesses on a tight budget. Even at that price, you get features like unlimited users (on the standard plan), which can save you from paying extra fees elsewhere.

Sage accounting has an excellent online library and tons of trainings. You’ll get access to a wealth of information about accounting best practices and how you can use Sage Accounting to improve your bottom line.

If you still have questions or concerns, customers report that Sage Accounting has standout customer support. User reviews say Sage Accounting support is very responsive and very helpful ― so you can get help and get back to work sooner.

For many businesses, the biggest con to Sage Accounting is its lack of scalability. With just two plans (with one of the two meant for microbusinesses), Sage Accounting may not keep up with rapidly growing businesses with complex accounting needs. If you need enterprise accounting software, you’ll want to look elsewhere.

Even smaller businesses may notice certain missing features, like time and mileage tracking. Likewise, if you plan to use mobile receipt tracking, you should know that Sage Accounting charges extra for that feature.

Many teams may not like Sage Accounting’s outdated user interface. While customers report that the software works just fine, it’s not as pretty or intuitive as other options.

While Sage makes you pay extra for receipt capture, Xero includes it on all plans. It also has excellent document management and data backup features. That makes it a good alternative for businesses that handle lots of financial documents. Keep in mind, though, that unlike Sage, Xero does limit how many invoices you can create.

Freshbooks has a richer set of features than Sage, including tools for time tracking, mileage tracking and project profitability tracking. It has more plan options, too, including a customizable enterprise plan. Some Freshbooks plans do limit how many clients you can invoice, though, and the premium and enterprise plans cost more than Sage.

Wave offers even more affordable accounting software than Sage. It offers accounting and invoicing tools for absolutely free. You’ll only pay if you add extra features like payroll processing, bookkeeping assistance or payment processing. Just note that Wave keeps things pretty simple, so don’t expect tools like invoice automation or robust multi-currency support.

To write our Sage Accounting software review, we investigated Sage and graded it on dozens of different factors, from pricing to features to customer support. We used our standardized rubric to see how Sage compares to other accounting software options ― and to figure out where it excels and where it falls short.

Read next: Top ERP software vendors for 2023

Acumatica Cloud ERP offers powerful finance and business intelligence tools to streamline company-wide accounting processes. Track costs, control billing, and manage time/expenses with multi-currency support and powerful financial reports. Acumatica makes real-time financial data available anytime, anywhere, on any device. Harness this data to make informed accounting decisions, reduce workloads, close the books faster, accelerate growth, and transform how you do business in the digital economy.

Multiview Financials’ ERP provides a single point of truth within your organization, enabling visibility across divisional, regional, or product line silos. It goes beyond traditional finance and accounting to add the sophisticated capabilities that today’s complex organizations demand.

QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime. It presents organizations with a clear view of their profits without manual work and provides smart and user-friendly tools for the business.

NetSuite cloud financials and accounting software helps finance leaders design, transform and streamline their processes and operations. NetSuite seamlessly couples core finance and accounting functions, which improves business performance while reducing back-office costs. With real-time access to live financial data, you can quickly drill into details to quickly resolve delays and generate statements and disclosures that comply multiple regulatory financial compliance requirements.