When it comes to payroll software, Paycom and Paychex are two of the most well known. Paycom is a full-service human capital management (HCM) provider offering HR solutions and payroll services for businesses of various sizes. And Paychex is a software solution that helps businesses automate payroll, HR and other human-capital services.

These platforms have similar features in addition to similar names, but that doesn’t necessarily mean that both options will work for your business. We’ll break them down in this comparison guide to help you determine which one is a better fit for your business.

Jump to:

| Features | Paycom | Paychex |

|---|---|---|

| Starting monthly price | Contact for quote | $39 fixed rate + $5/employee |

| Expense management | Yes | Yes |

| Benefits administration | Yes | Yes |

| HR tools | Yes | Yes |

| Free trial | No | No |

Rippling automatically syncs all your business’s HR data, like hours, leave and absence, with payroll. You never need to fill out spreadsheets and upload to another system— we pay your employees and HMRC directly.

Paycom does not disclose its pricing on its website. Instead, you have to contact the sales team for a demo, and after that, they’ll put together a custom quote based on your specific needs.

Paycom doesn’t offer a free trial option either. Because of the lack of transparency, it’s difficult to compare Paycom and Paychex directly when it comes to affordability.

To learn about estimated costs, see our full Paycom review, and be sure to check out our list of the top Paycom competitors as well.

Paychex Flex offers three pricing tiers but only discloses the pricing for the lowest tier:

Paychex also offers numerous paid add-ons that will increase the price, including paycheck preview, job posting integration and time and attendance tracking. It does not offer a free trial either, although you can book a demo with the sales team before committing to a paid plan.

For more information, see our full Paychex review.

Paycom’s payroll services (Figure A) include direct deposit, payroll cards, tax filing and withholding, deductions, paid holiday tracking and more. Paycom has an automated payroll assistant tool called Beti that helps employees troubleshoot and verify their own payroll. Paycom also debits and deposits payrolls taxes and remits filings on your companies behalf. Paycom can handle garnished wage calculations, payments and record-keeping for companies, while the GL Concierge feature helps business owners maintain their general ledger data.

Figure A

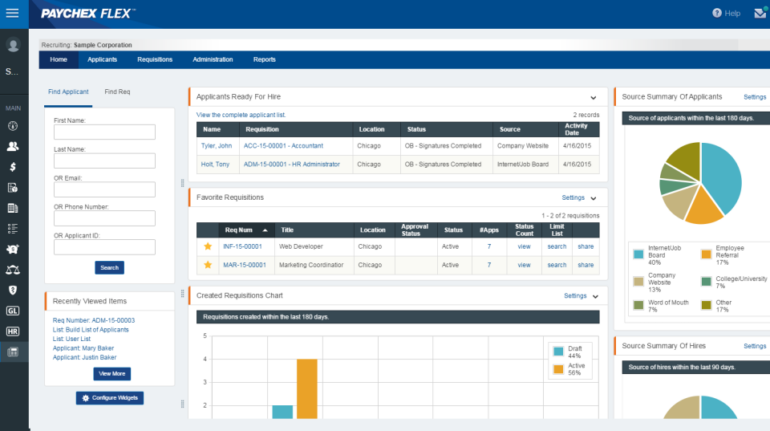

Paychex’s payroll system (Figure B) will automatically calculate paychecks for both hourly and salaried employees and deduct taxes on your business’ behalf. You can choose from many different payment options, including direct deposit, paper checks and prepaid cards. Paychex also offers a precheck feature that lets employees review their scheduled payments beforehand to reduce payment-related issues.

Figure B

Both of them provide mobile apps for iOS and Android so that users can manage payroll on the go. See our list of the best payroll apps of 2023 for more options.

Employees can upload receipts to Paycom’s self-service app to eliminate manual entry or link company credit cards so charges automatically flow into the app. The system also automatically allocates expenses to the appropriate general ledger account, reducing time spent on manual data entry. Paycom also offers convenient mileage tracking for even more accurate reporting and expense management.

Paychex’s automatic expensive reporting lets employees do expenses reporting from any device on the go, and also issues alerts for expenses that violate companies limits and policies. The software lets managers approve expenses with one click, or you can set up rules for preapprovals. Pacyhex also provides reporting and analytics so you can track where your company is spending money.

With Paycom, you can automate the enrollment process and reduce errors that might lead to violations of HIPAA, COBRA, and others. The self-service employee app lets workers make their own enrollment choices on mobile or desktop, while the Benefits to Carrier tool centralizes information from numerous insurance carriers. If you want to outsource your benefits administration, you can even add a Paycom benefits coordinator to the plan.

Paychex also offers benefits administration for an additional fee (Figure C). The HR team can use Paychex to find competitive group health benefits and employee retirement plans, such as 401(k)s. Meanwhile, employees can use their Paychex dashboard to sign up for benefits during enrollment periods, check their benefits, view payslips and see their paycheck deductions.

Figure C

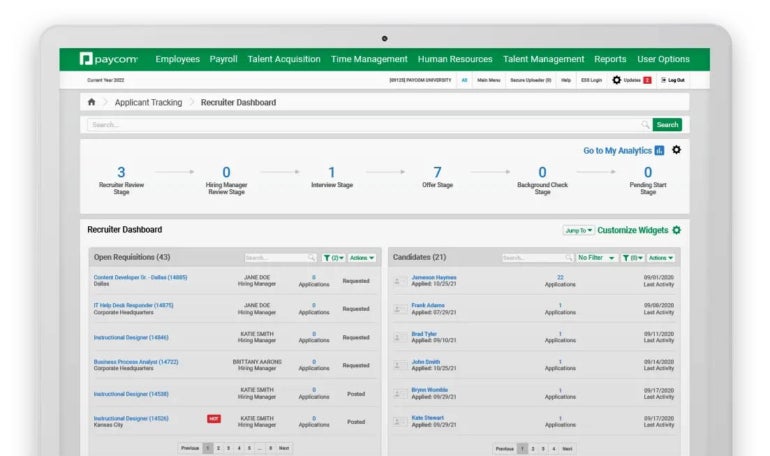

By using Paycom’s talent acquisition tools (Figure D), HR teams can streamline their hiring process to ensure only qualified applicants get through it, reducing the time it takes to find and hire the right people. Employers can also verify employees’ eligibility via Paycom’s e-verify system and run multiple kinds of background checks on candidates to ensure they don’t pose any risks to the business. Additional tools include performance management, learning management, and compensation budgeting, which is why it made our list of the best compensation management tools for 2023.

Figure D

Paychex offers a whole range of HR tools, but most of these are confined to the higher tier pricing plans or are available as a la carte add-ons online. HR features including hiring tools, applicant tracking, employee development and document management. Paychex also offers an entire team of HR experts that can offer more advanced assistance to companies that need hands-on guidance.

SEE: The Best Payroll Software for Accountants in 2023

To compare Paycom’s and Paychex’s payroll solutions, we reviewed software documentation, viewed product videos and evaluated aggregated user reviews. We considered factors such as pricing, payroll processing, HR features and more.

Both Paycom and Paychex are payroll providers that also offer additional tools for HR management.

Paycom is a good choice for medium and large businesses that are looking for a payroll software combined with robust human capital management (HCM) features. However, Paycom might be too complicated and expensive for smaller businesses who simply need an easy-to-use payroll platform and a handful of simple HR tools.

Paychex is a better choice for smaller businesses that are looking for a solution that can scale with them, which is why it made our list of the best payroll software for small businesses (and Paycom did not). The fact that Paychex offers multiple pricing tiers means that businesses can pick and choose which one suits their needs and budget best, then upgrade as needed. That being said, if you want to make the most of Paychex’s features, then you need to be prepared to pay for all the extra add-ons, which can definitely increase the cost.

Since neither platform offers a free trial, the best way to figure out if they are right for your needs is to schedule a personalized demo with their respective sales departments.

If you’re not sold on either Paycom or Paychex, there are many other platforms out there that combine payroll with HR features — not to mention garner rave reviews. See our list of the best payroll software of 2023 to expand your search.

Rippling automatically syncs all your business’s HR data, like hours, leave and absence, with payroll. You never need to fill out spreadsheets and upload to another system— we pay your employees and HMRC directly.