Square is a provider of payroll software for businesses to manage their employee payroll processes. It is especially favored by small to medium-sized companies who desire automated solutions to take the stress out of their payroll-related operations. It can streamline and simplify tasks like accurately calculating payroll taxes, generating payroll reports and processing employee wages.

SEE: How much does Gusto cost, and how does it work? Find out in a detailed payroll software review.

Square payroll is an efficient service for managing employee payroll, but it is one of many payroll processing software solutions available for businesses on the market. Read on to learn more about this solution’s unique features, pros and cons, so you can determine whether you should adopt Square software for your business or consider one of its competitors instead.

Our star rating: 3.7 out of 5 stars

Pricing: Starts at $5/person for the Pay Contractors Only plan, or $35/month plus $5/person for the Pay Employees & Contractors plan.

Key features:

Jump to:

Square Payroll’s software solutions can be purchased as a subscription-based service. The company’s pricing page boasts its all-inclusive pricing, which has no hidden fees or commitments. But unfortunately, they do not offer a free trial version of their software.

Square Payroll has two different pricing plans based on whether the business wishes to pay both employees and contractors, or just contractors. Here is a general overview of the pricing model:

Pay Employees & Contractors: This plan is for businesses that need to process payroll for employees and contractors. It includes features such as tax filings and payments, full-service payroll processing, unlimited monthly pay runs, direct deposit and customer support. The pricing for this plan includes a monthly base fee of $35, with additional charges of $5/month per person paid.

Pay Contractors Only: This plan is designed for businesses that only need to pay contractors. It provides capabilities including unlimited monthly pay runs, 1099-NEC form mailing, contractor payments and customer support. The pricing for this plan depends on the number of contractors the business uses, as it is $5 per person paid.

Square Payroll pricing may vary depending on the number of workers that the business pays. However, its plans require no commitment and companies can cancel their subscriptions at any time.

Businesses that use Square Payroll can run their payroll processes efficiently thanks to Square’s multi-state payroll software. The U.S.-based software operates in all 50 states. This also means that businesses can run their payroll across multiple states and pay their dispersed team members, whether they are in different localities, in-office or working from home.

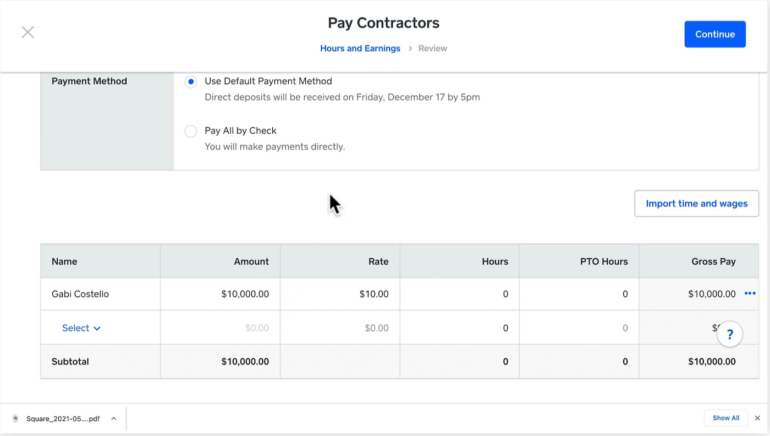

With Square Payroll, businesses can easily calculate and process their payments for their employees and contractors (Figure A). The software enables them to pay W2s/1099s and process hourly, salary or custom amount payments. In addition, business administrators can use simple tools to choose their payment methods, review their workers’ hours and earnings, make adjustments and send their payroll easily within the system. Furthermore, Square can distribute payments as checks, direct deposit or even Cash App for no additional charge.

Figure A

Square processes automatic quarterly and annual tax filings, so businesses can always complete their tax filings on time. The service calculates, withholds and files all federal payroll taxes on the business’s behalf. As for state payroll tax forms, Square files payroll taxes to all appropriate state agencies as applicable and considers compliance with state taxes and withholdings to ensure a smooth and accurate process.

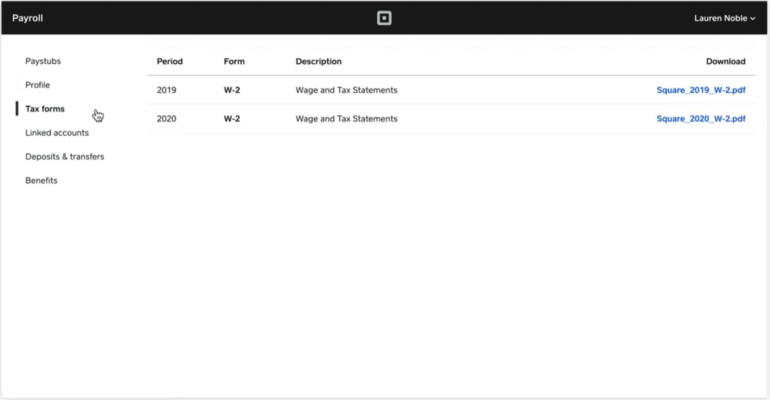

While some payroll solutions require additional fees for filing tax forms, Square Payroll generates, files and mails all necessary W-2s and 1099-NEC forms for businesses on their behalf at no additional charge. Once these forms are processed, companies can access and view the documents within their Square platform (Figure B).

Figure B

Square Payroll users can further simplify their payroll and tax processes by integrating their solution with other Square software tools. For example, Square tools, such as Square POS and Square Team Management, can help businesses ensure accuracy when processing their payroll by connecting their relevant data regarding tips, timecards and commissions. Square also provides solutions with features that are specific to different business types. For example, Square has an all-in-one restaurant POS system that can be integrated to provide a more helpful payroll system for restaurant businesses.

Of course, Square also plays well with third-party solutions. For example, Square Payroll can connect with partners like QuickBooks Online to automatically sync data and simplify payroll operations. This is especially helpful for businesses looking to streamline their HR alongside their payroll solution, as Square offers healthcare and retirement benefits that automatically sync with the payroll software through their partner Bambee.

Businesses that use Square Payroll will also benefit from the software’s simple team-management capabilities. Administrators can use the solution to review the hours and sales information as it is synced from its integrations to other software systems like Square Team Management. In addition, businesses can sync timecard data from other Square solutions or third-party software integrations to benefit from automatic time tracking. This can make it possible for leaders to get a better view of their team members’ activity and processes right within the Square Payroll platform.

Team members will also likely appreciate how Square Payroll provides integrated benefits options for health insurance, workers’ compensation and retirement benefits. For example, through its partnership with Next Insurance, Square Payroll provides pay-as-you-go workers’ compensation which automatically syncs with the payroll solution for easy management. And by conducting benefits through Square’s partner Bambee, businesses can easily stay on top of their HR compliance.

Alternatively, businesses can apply their existing benefits within the Square Payroll platform to gain taxable benefit deductions and contributions to their employees’ profiles. Square Payroll partners with Guideline401(k), AP Intego and SimplyInsured to provide support in syncing their workers’ benefits.

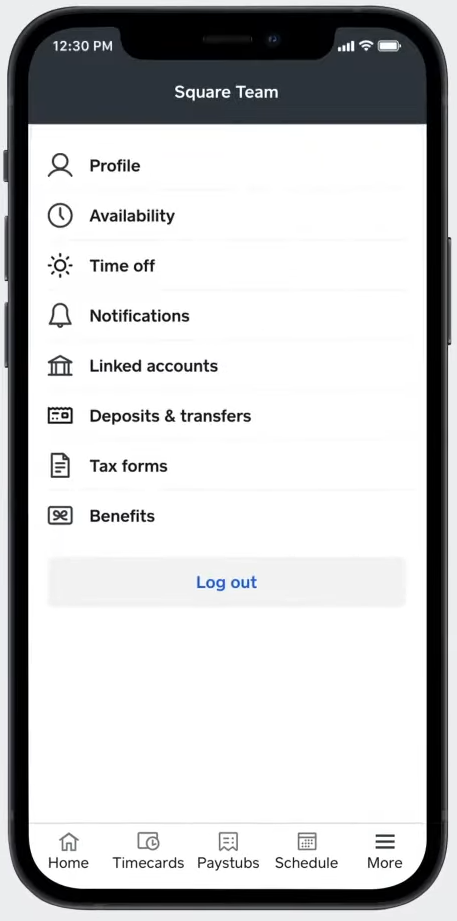

Square payroll is a stand-out solution for businesses due to its ease of use. Administrators can use the platform to run payroll or perform other team management tasks efficiently online. Alternatively, they can use the Square Payroll App to gain visibility into their teams and manage their payroll operations on the go. Additionally, team members can access their payroll and tax information online through their Team Member dashboard or through the Square Team app (Figure C).

Figure C

If users do have questions about their payroll solutions, they can contact customer support for assistance. Payroll specialists with the Square sales team are available for all Square Payroll users from Monday through Friday, 6 am to 6 pm PT.

OnPay’s full-service payroll and HR solution provides comparable payroll features with an easy-to-understand pricing model of $40 per month plus $6 per person paid. In addition, it includes tools and capabilities for automating taxes, payroll, HR processes and team management without requiring extra fees. Businesses can simplify their payroll operations by using OnPay to create custom payroll reports, perform PTO management and even streamline their employee onboarding. OnPay even offers a free one-month trial to new users.

SurePayroll is another helpful option for businesses seeking robust reporting features within their payroll solution. The software simplifies payroll processes while allowing business leaders to gain valuable reports from various areas of their business operations. These customizable reports enable businesses to gain insights into employee, benefits and payroll data. In addition, SurePayroll automates payroll for easy use and can be a helpful tool for catering to the unique needs of specific business settings, like nonprofit organizations and restaurants. Businesses can visit the SurePayroll sales page for a price quote.

Like Square Payroll, Justworks is an excellent payroll software for Mac users. However, it is a scalable solution that can be exceedingly beneficial for growing teams. With time-tracking features, payroll processing capabilities, 24-hour customer support and more, Justworks can handle almost all of a business’s payroll needs, and more. The Basic plan starts at $59/month per employee for payroll features, as well as benefits, compliance, and HR tools. However, one key difference between Square and Justworks is that Justworks only performs tax filing through third-party integrations. Still, the platform provides many helpful perks to streamline the payroll process for businesses.

This is a technical review using compiled literature researched from relevant databases. The information provided within this article is gathered from vendor websites or based on an aggregate of user feedback to ensure a high-quality review.

To calculate our star rating, we considered Square Payroll’s pricing, payroll features, ease of use and customer service.