Automated Clearing House (ACH) payments are electronic bank transfers that move funds between accounts through the ACH network. Unlike credit card transactions, ACH payments pull money directly from the customer’s bank account and offer lower processing fees. They are ideal for recurring payments and large transactions. In fact, the total volume of ACH payments for the second quarter of 2024 is $21.6 billion, a 7% increase over the same period in 2023.

A good ACH payment processor should provide easy integration with your existing systems, low transaction fees, customizable API support, and various ways to accept ACH payments. Additionally, good customer support and clear settlement times are important factors in ensuring smooth operations.

Processing fees, API quality, security features, and payment capabilities are among the key factors I considered when evaluating various ACH payment processing companies. All the ACH processors that came out at the top of my list offer zero monthly fees.

| Our rating (out of 5) | Transaction fee | Ways to accept ACH payments | Payout speed | |

|---|---|---|---|---|

| Stripe | 4.32 | 0.8%, capped at $5 |

|

2–4 business days |

| Square | 4.19 | 1%, minimum of $1 |

|

3–5 business days |

| QuickBooks Money | 4.17 | 1% |

|

Same day |

| Melio | 4.07 | None |

|

3–5 business days |

| GoCardless | 4.00 | 0.5% + $0.05, capped at $5 |

|

3–5 business days |

Our rating: 4.32 out of 5

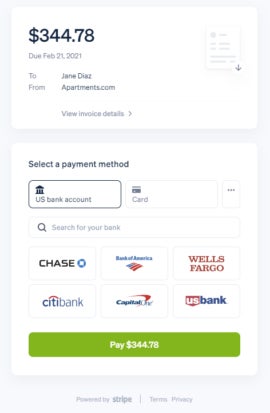

Stripe is a powerful, developer-friendly payment processor known for its robust API and seamless integration capabilities. It supports a wide range of payment methods, including ACH, credit cards, and international transactions. Businesses seeking customization and scalability in their payment processing will find Stripe highly suitable, whether it’s for ACH or credit card payments.

I selected Stripe as the best overall ACH payment processor. Its powerful API and extensive developer resources make it especially appealing for tech-savvy businesses and developers. Compared to other providers like QuickBooks Money and GoCardless, Stripe offers far more flexibility, which allows businesses to easily integrate ACH payments into their existing systems with minimal friction. Its scalability also sets it apart from Square, making Stripe a better fit for companies experiencing rapid growth or managing high transaction volumes.

Additionally, Stripe supports a wide range of payment options, such as credit card payments and mobile wallet payments, unlike GoCardless, which focuses primarily on ACH. This versatility enables businesses to offer multiple payment methods through a single platform. Stripe’s combination of advanced tools, security features, and competitive pricing makes it a top choice for businesses that require both performance and flexibility.

| Pros | Cons |

|---|---|

| Powerful API. | Additional fees for other services. |

| Transparent pricing. | Slow settlement times. |

| Options for instant verification. | Complex setup for businesses that prefer an out-of-the-box solution. |

Related: Best payment gateways

Our rating: 4.19 out of 5

Square is a versatile payment processing platform known for its easy-to-use tools and integrated payment solutions. It provides an all-in-one system that supports both in-person and online transactions. Among the payment methods it accepts are ACH payments through Square Invoice and Bank on File.

I chose Square as the best option for businesses needing an all-in-one payment solution because of its user-friendly platform that supports both in-person and online transactions. Unlike Stripe, which excels in customization and developer tools, Square offers a more streamlined, out-of-the-box setup, making it ideal for businesses without dedicated tech teams.

Although Square only accepts ACH payments through invoices and bank-on-file, its ability to handle multiple payment methods within one system makes it a convenient choice for businesses that want simplicity. For companies that prioritize ease of use and a unified solution, Square provides the perfect balance of functionality and efficiency.

| Pros | Cons |

|---|---|

| User-friendly interface. | Limited customizations. |

| All-in-one payment solution. | Slightly higher ACH transaction fees. |

| Mobile app. | ACH payments are only through invoicing and recurring billing. |

Our rating: 4.17 out of 5

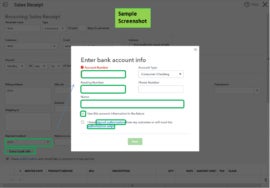

QuickBooks Money is a no-monthly-fee payment processing service from Intuit, the same company known for the accounting software QuickBooks Online. It offers a straightforward pricing model where businesses only pay per transaction.

With QuickBooks Money, users can maintain full control over their business finances without the hassle of extensive bookkeeping. The service includes features such as a dedicated business bank account, the ability to send invoices, and same-day deposits to improve cash flow. Additionally, businesses can earn a competitive 5.00% APY on their funds.

QuickBooks Money allows non-QuickBooks subscribers to accept payments without signing up for QuickBooks. However, it is still best for those who already have QuickBooks or are planning to use it for their accounting needs. This integration streamlines financial management by automatically syncing payment data with accounting records, reducing manual entry and minimizing errors—an advantage over other processors on this list that require more manual tracking or integration with other accounting tools.

Users can easily generate invoices, track payments, and monitor cash flow directly within the QuickBooks ecosystem. Compared to providers like Stripe, which excels in customization, QuickBooks Money offers a more straightforward approach. Additionally, it comes with a QuickBooks Checking account and Visa debit card, allowing same-day deposits and making it valuable for businesses that need quick access to their funds. Other extra perks of QuickBooks Money is that it accepts PayPal and Venmo payments, something that other providers on this list cannot do.

| Pros | Cons |

|---|---|

| Seamless integration with QuickBooks. | ACH transaction fees are slightly higher. |

| Accepts PayPal and Venmo payments. | Limited customization options. |

| Funds can earn interest. | No integration options without a QuickBooks subscription. |

Our rating: 4.07 out of 5

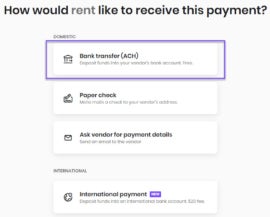

Melio is a versatile payment processing platform that allows businesses to both accept and send ACH payments. Aside from allowing merchants to accept ACH payments from customers, it also facilitates vendor payments through ACH transfers. This dual capability allows businesses to streamline their accounts payable and receivable processes, enhance cash flow management, and maintain greater control over their financial operations, all from a user-friendly interface.

Businesses looking for a zero-cost way to accept ACH payments will find Melio as the best option. Aside from not charging any monthly fees, Melio does not have any ACH payment processing fees. This is in glaring contrast to other ACH processors on this list that have a processing fee per ACH transaction.

Aside from being cost-effective, Melio has a straightforward interface and dual functionality for both accepting and sending ACH payments, which simplifies financial management and improves operational efficiency. For businesses looking to minimize expenses while maximizing payment flexibility, Melio is an excellent choice.

| Pros | Cons |

|---|---|

| Free ACH payment processing. | Limited customizations. |

| Unlimited users. | No advanced fraud prevention tools. |

| Allows businesses to pay vendors. | Payments are through invoicing only. |

Our rating: 4.00 out of 5

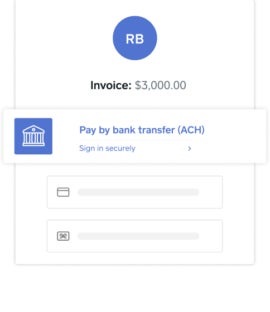

GoCardless is a payment processing platform specializing in ACH and bank debit payments, offering businesses a simple way to collect recurring and one-off payments directly from customers’ bank accounts. Designed for businesses that operate internationally, GoCardless provides seamless cross-border payment capabilities and ensures low transaction fees compared to traditional credit card processing. Its streamlined approach makes it ideal for businesses focusing on bank transfers rather than card payments, particularly for recurring billing and subscription models.

GoCardless is an excellent option for businesses focused on recurring ACH and international bank payments. Unlike other providers like Stripe or Square, GoCardless is built specifically for handling direct bank payments, which makes it a great solution for companies prioritizing ACH over credit cards. Its international capabilities also set it apart, allowing businesses to easily collect payments from customers in multiple countries without incurring hefty fees typically associated with cross-border transactions.

GoCardless also excels in subscription billing management, offering tools that simplify recurring payments, making it ideal for businesses with long-term customer relationships.

| Pros | Cons |

|---|---|

| Global payment capabilities. | Limited payment methods. |

| Developer-friendly APIs. | Limited customizations. |

| Automated payment failure handling. |

ACH payment processing offers several advantages that make it an attractive option for businesses looking to reduce costs and streamline operations. Here are some key benefits:

Selecting the right ACH payment processor involves several key considerations:

In compiling this list of the best ACH payment processors, I prioritized solutions that deliver efficiency, security, and ease of use for mid- to large-sized businesses. Each processor was evaluated based on specific criteria: integration and developer tools (30%), pricing and contract (30%), features (25%), and user experience and customer support (15%).

My research involved a comprehensive review of product documentation, pricing information, user reviews, and hands-on testing where possible. The aim was to recommend ACH payment processors that provide a strong combination of affordability, functionality, and robust support, ensuring businesses can streamline their payment operations effectively.