Android devices have made significant technological advancements in recent years. Like iPhones, they can now be used as payment terminals thanks to NFC technology and payment apps available on the Play Store, its app marketplace.

To find the best credit card reader for Android, I considered affordability, payment option flexibility, transaction fees, and, more importantly, reliability and security. I evaluated dozens of Android credit card readers against a 22-point rubric and tested them myself as a payor and payee.

Alongside pricing, some important features set the mobile credit card readers for Android apart. The table below illustrates which of the top five Android card readers include these key features.

| Square Reader | |||||

| Stripe M2 | |||||

| SumUp Plus | |||||

| PayPal Zettle Reader 2 | First reader discounted to $29 |

||||

| Shopify Tap & Chip Card Reader |

Our rating: 4.63 out of 5

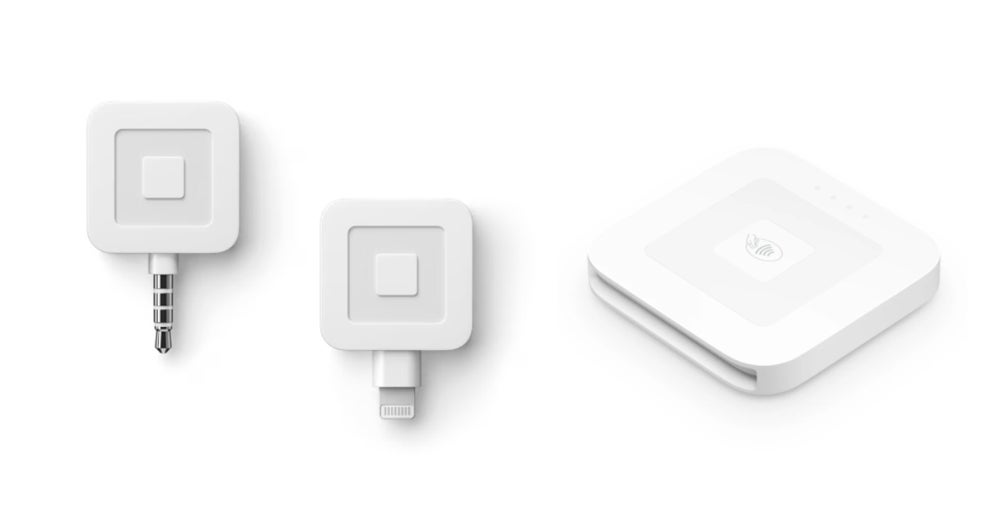

Square Readers consistently rank among our top picks for credit card readers for Android and iPhone devices. They are highly rated by users and experts alike. Their sleek design and handy size make them an excellent choice for accepting payments anywhere, together with the Square POS app.

Square lets you accept payments for free — it doesn’t charge monthly fees or require monthly minimums; you can even get your first magstripe reader for free, making it suitable for the casual user. And yet, it provides a fully-featured POS system ideal for full-time businesses.

I like how Square remains affordable and still lets you accept a full range of payment options. You also pay the same transaction rate no matter which card a customer uses — even American Express, which is infamous for having higher fees.

Among the card readers I have evaluated, it’s one of the card readers that got perfect marks for card reader features (free POS app and reader, great aesthetics, and a digital receipts feature) — SumUp being the other one.

Aside from the usual tap, dip, and NFC payments, Square lets you accept gift cards and echecks (with an additional charge). You can also accept international cards, but you must be in the country where you activated your Square account (no cross-border payments).

But what I like best about Square is its active fraud prevention and dispute management feature. It has an excellent chargeback policy — no chargeback fees except for the usual processing fee that the sale incurred. In fact, Square and SumUp are the only providers in this list that do not charge dispute fees.

| Pros | Cons |

|---|---|

|

|

Related: Best Free Credit Card Readers for iPhone & Cheap Alternatives

Our rating: 4.41 out of 5

Stripe is best known for its highly customizable checkout pages, and that extends to its payment terminals, too. If you have the means to hire a developer (or have the know-how yourself!), you will certainly appreciate Stripe’s flexible terminal tools — you can really customize in-person payment experiences.

Moreover, you can use the Stripe M2 reader with your own POS app or integrate it with other apps for inventory or customer relationship management.

Given all the high level customization options you get with Stripe, I like that it still offers a low-cost card reader option, allowing you to sell in-person. Stripe is mostly known for online payments, and while its in-person sales features are not as well known as that of Square — it scored above average on most categories during my evaluation.

Stripe and SumUp are the only card readers on this list that accept magstripe (swipe) payments, along with chip and tap. While this technology is not often used anymore, it can come in handy when the connection (NFC or Bluetooth) becomes spotty. Due to its top-notch security and fraud detection, Stripe is the best credit card swiper for Android.

Also worth mentioning is the app’s high user review scores, 4.50 out of 5 — one of the highest scores among the apps I feature in this list. I noticed Stripe actively listens to user feedback — the most recent review as of this writing requested a feature and Stripe added the functionality in the app right away.

| Pros | Cons |

|---|---|

|

|

Our rating: 4.35 out of 5

SumUp is primarily designed to be an end-to-end mobile payment processing solution. Aside from affordable card readers, you can accept payments via invoicing and virtual terminals. There are no monthly minimums and contract fees. And unlike the Square Reader, SumUp Plus accepts magstripe payments (swipe cards) and includes a screen to show transaction details.

Compared to other feature-rich POS systems like Stripe and Square, SumUp’s functionalities are basic at best. However, for businesses on a budget and only have straightforward payment needs, SumUp is a great option.

If we are talking exclusively about card readers for mobile app payments, SumUp’s readers are top-notch. Its entry-level card reader (available in black and white versions) is among the cheapest readers I have reviewed.

SumUp is the only card reader, aside from PayPal Zettle, that features a screen to show transactions on its device and has a PIN feature. It is also tied with Square for scoring perfect marks on card features. However, SumUp is the top card reader when it comes to payment options — Zettle doesn’t have an offline mode, and Square Reader can’t do swipe payments. SumUp Plus can do both.

However, SumUp is quite limiting if you need a full-featured POS system and ecommerce integrations. Unlike others on this list, It only offers basic reports like transaction and revenue summaries.

| Pros | Cons |

|---|---|

|

|

Our rating: 4.10 out of 5

PayPal Zettle is the best option if you need to accept a variety of payments in person at a low cost and with no commitments. Aside from tap and dip (EMV chip, contactless, and digital wallets), Zettle can accept Venmo and PayPal payments. QR payments are possible with the help of the POS app, too.

If you have a seasonal business or a side hustle, the Zettle Reader is a terrific option. It offers very affordable transaction rates: 2.29% + 9 cents.

Aside from the added payment options PayPal Zettle can accept, I like that it provides an added security feature to transactions, having a PIN feature when processing payments. It also has a display screen. Among those on this list, only Zettle Reader and SumUp Plus have these features.

PayPal Zettle also has the lowest card-present (in-person) transaction rate among the card readers featured in this guide. However, note that PayPal Zettle is best for accepting payments on the go and nothing more. It doesn’t offer plan upgrades or integrations for online selling.

| Pros | Cons |

|---|---|

|

|

Our rating: 3.99 out of 5

The Shopify Tap & Chip Card Reader is the most suitable and convenient option for accepting payments in person if you have an online business and, more so, use Shopify as your ecommerce platform. You don’t have to pay an additional monthly fee.

Like the Square Reader, the Shopify Tap & Chip Card Reader is exclusive to Shopify’s payments and ecommerce ecosystem. Shopify’s connected ecosystem allows sales and inventory to sync seamlessly across your sales channels.

I have over a decade of experience working with primarily online-first businesses, and Shopify has been my consistent pick for ecommerce platforms. Even though Shopify is known for ecommerce, I have experienced its equally robust POS platform for mobile and in-store sales — further cementing Shopify as the best solution for multichannel sellers.

The Shopify mobile card reader is no exception. While it has limited offline functionality, I like that it accepts many payment options — credit card, contactless, digital wallets, online payments, gift cards, international/cross-border, and even cryptocurrency — rivaling PayPal Zettle.

| Pros | Cons |

|---|---|

|

|

Related: The 6 Best Mobile POS Systems for 2024

The best Android credit card reader for your business is one that matches your business needs and is compatible with your Android device’s operating software. Prioritize mobile card readers with high security and minimal reports of downtimes or failed transactions. Connectivity should also not be a problem. It should be easy to connect with your mobile payment app.

Specifically, you should consider:

Based on my experience helping retail businesses launch their ecommerce stores and streamline their in-store and online sales operations, I looked at the top payment providers and merchant services that have mobile apps and provide card readers for Android.

From my initial list, I graded them using an in-house rubric of 22 data points based on pricing, payment types, card features, security and stability, and user reviews. I prioritized Android card readers with high reviews on security and reliability — minimal failed transactions and downtimes.

This article and methodology were reviewed by our retail expert, Meaghan Brophy.

The main differences between Android credit card readers are the payment methods they accept and their transaction rates.

You can accept credit card payments on your Android phone through Tap to Pay. Your device will serve as a payment terminal through a mobile payment app. You can also accept credit card payments on your Android device with the help of a compatible card reader.

Yes, there are Android credit card readers that work offline. Square, Stripe, and SumUp are a few great examples.

Yes, there are free Android card readers. Square provides your first magnetic stripe reader for free, and PayPal Zettle also offers a discounted rate for your first card reader.

Most Android card readers can accept NFC payments and mobile wallets such as Google Pay. Square, SumUp, Stripe, PayPal Zettle, and Shopify have great card readers that process Google Pay payments.

Square, PayPal Zettle, and Stripe mobile card readers accept Samsung Pay.