In 2023, the total transaction value of crypto gateway payments recorded worldwide was $1.62 billion. This is projected to grow at a CAGR of 17% from 2023 to 2030. Since most crypto transactions are through direct wallet-to-wallet transactions, the actual value of cryptocurrency transactions used for payment of goods may actually be significantly higher than this value.

Businesses looking to get a piece of that pie are exploring ways to start accepting cryptocurrencies beyond the usual wallet-to-wallet crypto transactions. A crypto payment gateway allows businesses to accept cryptocurrencies such as Bitcoin, Ethereum, and Tether as payments within a more secure payment flow. Crypto payment gateways may also allow merchants to keep the payments as cryptocurrencies, convert cryptocurrencies to fiat currencies, and accept cross-border payments.

RELATED: Top Cryptocurrency Predictions for 2024

Aside from the increased adoption of crypto payments, some other benefits of accepting cryptocurrency payments are lower transaction costs, no risk of chargebacks, enhanced security, and access to a unique customer base.

The best crypto payment gateways offer a combination of seamless integration, extensive cryptocurrency support, robust security features, and competitive pricing. The comparison table below illustrates the transaction fees, number of crypto and fiat currencies supported, and e-commerce plugins for each crypto payment gateway.

| Our rating (out of 5) | Transaction fee* | Cryptocurrencies | Fiat settlement currencies | E-commerce plugins | |

|---|---|---|---|---|---|

| NOWPayments | 4.54 | 0.5% (if no currency exchange) | 200+ | 20+ | 9 |

| BitPay | 4.30 | 1%–2% + 25 cents | 15 | 9 | 6 |

| Coinbase Commerce | 4.25 | 1% | 13 | 1 | 4 |

| OpenNode | 3.98 | 1% | 1 | 8 | 6 |

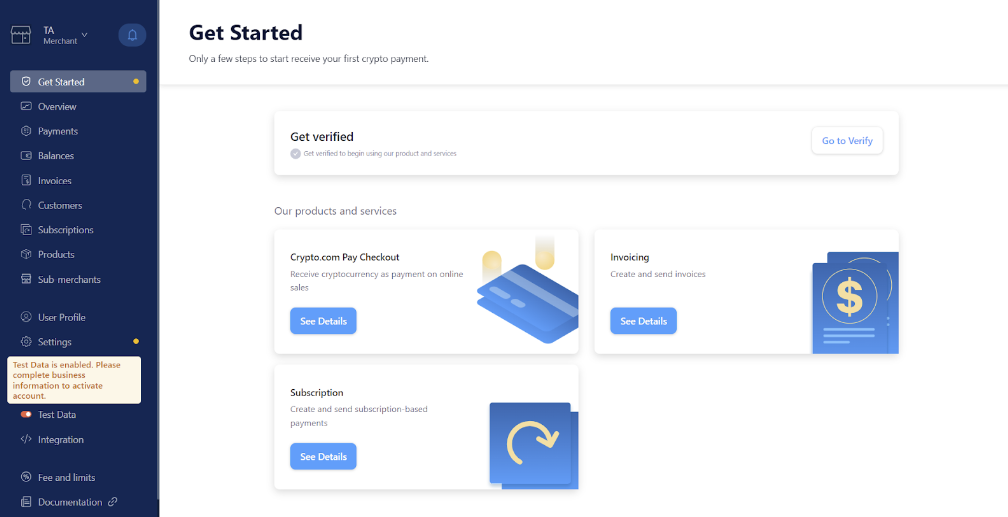

| Crypto.com | 3.98 | 0 | 30+ | 4 | 6 |

| *Crypto transactions always incur a network or gas fee for executing operations on the blockchain. The transaction fee charged by the payment gateway is a separate fee. | |||||

Our rating: 4.54 out of 5

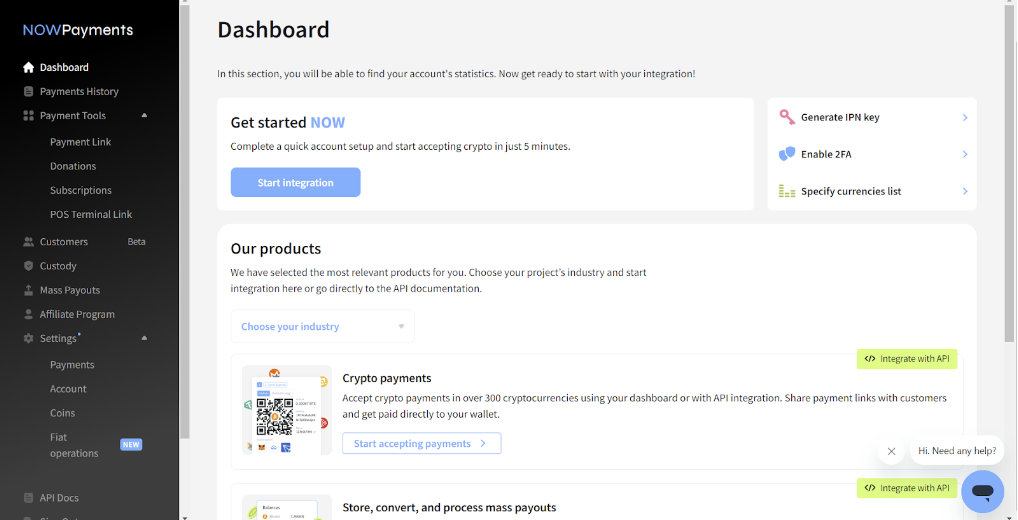

NOWPayments is a flexible cryptocurrency payment gateway that allows businesses to accept both crypto and fiat payments. It offers a range of integration options and settlement methods, giving merchants control over how they manage their funds.

NOWPayments’ biggest strength is the complete flexibility it provides to merchants when it comes to accepting payments. It allows merchants to receive both fiat and cryptocurrencies. Upon receiving the payment, the merchant has continued flexibility on what to do with it (keep it in the same currency or convert it to a different currency) and where to put it (keep the payment in custody or withdraw it to a crypto wallet or bank account).

Aside from the settlement flexibility, NOWPayments offers all the possible ways to accept crypto payments. Its Custody feature allows merchants to accept cryptocurrency payments without a crypto wallet and make currency exchanges without paying network fees. It also has a network fee optimization that can help minimize blockchain fees when converting or transferring cryptocurrencies.

NOWPayments offers a more comprehensive set of features than other crypto payment gateways on this list. This makes it an excellent fit for businesses seeking full control and flexibility in managing their crypto payments.

| Pros | Cons |

|---|---|

| Settlement flexibility. | Complex refund process. |

| Custody feature to save on network. fees for currency exchanges. | Limited reporting tools. |

| Accepts both crypto and fiat payments. | Minimum payment fluctuates. |

| API integration with any mobile POS terminal. |

Our rating: 4.30 out of 5

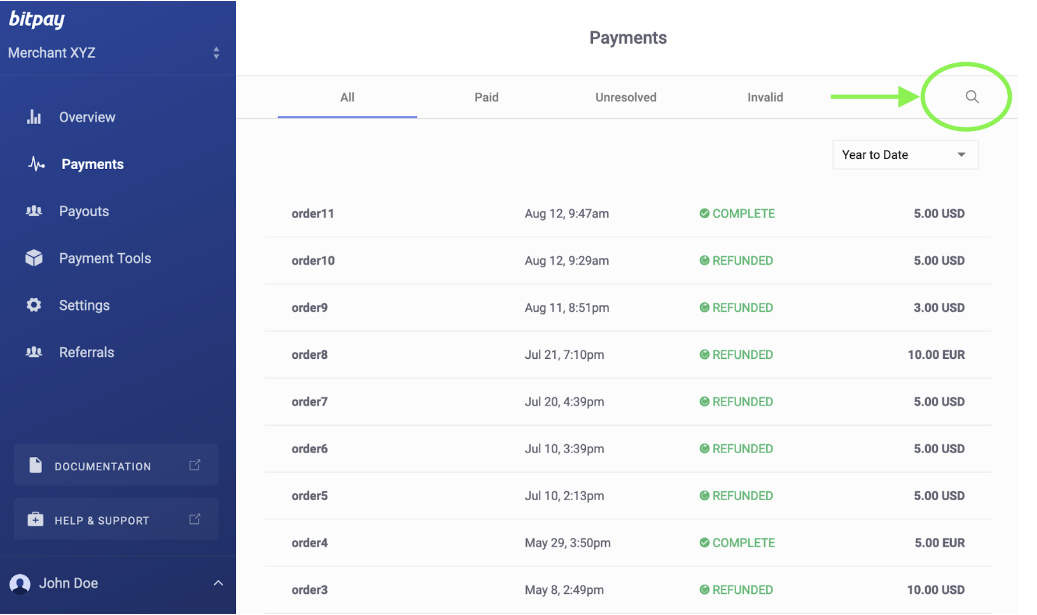

BitPay is a cryptocurrency payment gateway known for its user-friendly interface and multi-user account capabilities. It offers tiered transaction fees that decrease with higher monthly volumes. However, it provides limited flexibility to merchants as payments are automatically converted and settled into the merchant’s bank account or cryptocurrency wallet.

BitPay is the only crypto payment gateway on this list that allows multi-user access. This makes it a great choice for businesses that require multiple team members to manage payments. It also locks in exchange rates at the time of purchase, which helps protect merchants from crypto price fluctuations.

While its transaction fees may be higher than others on this list, BitPay is a reliable and well-known provider, and its mobile POS app makes it easy to accept crypto payments in-store.

| Pros | Cons |

|---|---|

| Multi-user capability. | Fewer e-commerce plugins. |

| Mobile POS app for accepting payments in-store. | Application fee. |

| Locks in rate at time of purchase. | Higher transaction fees, even with the automatic volume discounts. |

| Low minimum withdrawal amount. |

Our rating: 4.25 out of 5

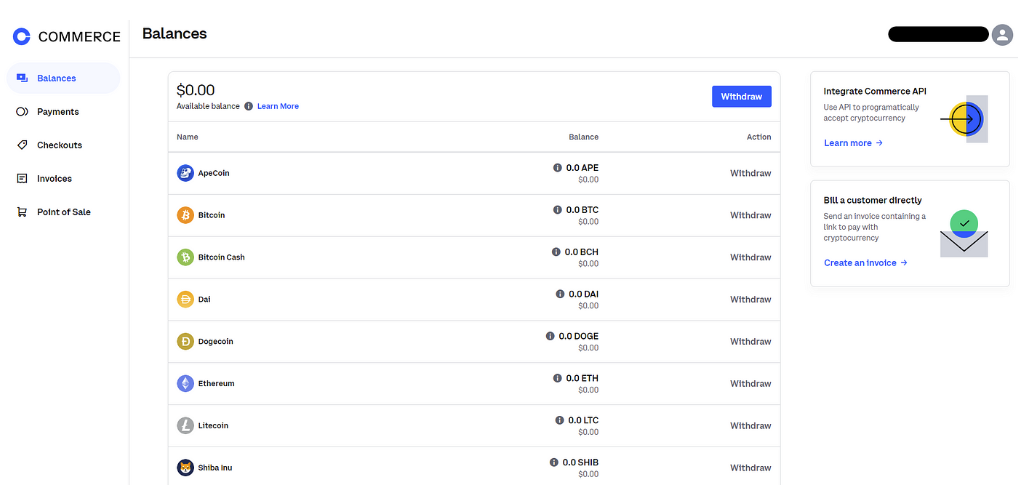

Coinbase Commerce is a cryptocurrency payment gateway that makes it simple and straightforward for businesses to accept cryptocurrency payments. It automatically converts incoming crypto payments into USD or USDC and offers instant settlement to the deposit address provided by the merchant.

Businesses that are just exploring crypto payments and would like to start small will find Coinbase Commerce simple and easy to use. Unlike other gateways on this list, Coinbase Commerce does not provide the option to keep other currencies except USD and USDC. Instead, it locks in exchange rates at the time of purchase and transfers funds directly to the merchant’s chosen deposit address.

While it lacks currency exchange options and is limited to website payments, its ease of use and support for popular e-commerce platforms like Shopify and WooCommerce make it an ideal choice for businesses prioritizing straightforward, hassle-free transactions.

| Pros | Cons |

|---|---|

| Simple and straightforward. | No currency exchange. |

| Instant settlement eliminates rate volatility. | No sandbox environment for testing. |

| All incoming payments are converted to USD or USDC. | |

| Only for accepting payments on a website. |

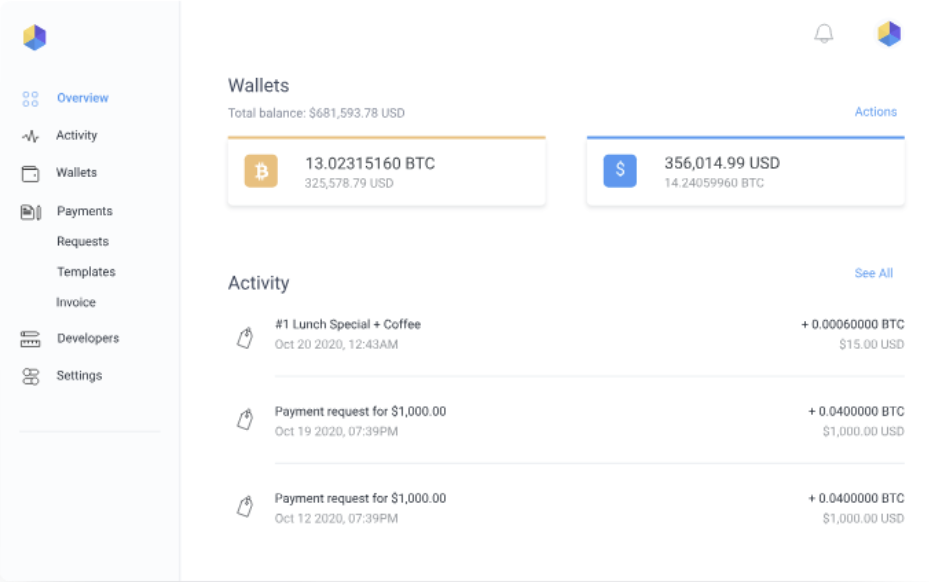

Our rating: 3.98 out of 5

A cryptocurrency payment gateway focused exclusively on Bitcoin, OpenNode offers features such as split settlement and scheduled payouts. Its Lightning network support makes it highly efficient for Bitcoin transactions.

OpenNode stands out as the best option for businesses that want to accept Bitcoin and nothing else. Its features, like custom automatic settlement schedules, multiple ways to accept crypto payments, and limited settlement currencies, make it an ideal option for businesses that want to limit their crypto payment acceptance but would like to accept it in various payment channels.

Although limited to Bitcoin, OpenNode’s simplicity, combined with strong e-commerce integrations, makes it a great fit for businesses focused on Bitcoin payments.

| Pros | Cons |

|---|---|

| Merchants may set a custom automatic settlement schedule. | Bitcoin only. |

| Lightning network support. | Withdrawal fee for on-demand bitcoin payout. |

| Split settlement. |

| Pros | Cons |

|---|---|

| Merchants receive the exact price of the goods/services. | Limited fiat and cryptocurrencies for settlement. |

| Allows merchants to choose pricing currency in fiat or crypto. | No POS option for in-person payments. |

| Merchant is not subjected to exchange rate volatility. | No advanced reporting tools. |

Using a crypto payment gateway offers some advantages for businesses, including:

When choosing a cryptocurrency payment gateway for your business, consider these key factors:

For this list of the best crypto payment gateways, I focused on solutions that offer flexibility, security, and ease of use for businesses looking to accept cryptocurrency payments. I evaluated each gateway based on specific criteria: integration, developer tools, and user experience (25%); supported cryptocurrencies and payment options (25%); security, compliance, and privacy (20%); pricing and transaction fees (15%); and customer support and resources (15%).

My research included a thorough review of product documentation, pricing pages, customer feedback, and hands-on testing or demo environments where available. The goal was to recommend gateways that offer a strong balance of features, ease of use, and security for businesses across different industries.

This article and methodology were reviewed by our retail expert, Meaghan Brophy