So, let’s help you find a cloud POS vendor that will align with your particular needs:

An on-premises software solution (on-prem) is like a manual transmission. It used to be the industry standard, and still has a number of very specific optimal use cases. But, the vast majority of the market has transitioned to a new design paradigm. For vehicles, that’s an automatic transmission. For business information technology, it’s cloud-based solutions.

Honestly, the advantages are hard to argue with. An on-prem implementation might work if you only need a single register or if you’re large enough to set up and maintain the necessary server infrastructure locally. But the reality for most businesses is that cloud POS systems provide the flexibility and mobility that are critical to smooth operations.

Here’s a comparison of our top cloud POS recommendations, focusing on pricing, mobile compatibility, and whether or not you can bring your own payment processor.

Our rating: 4.59

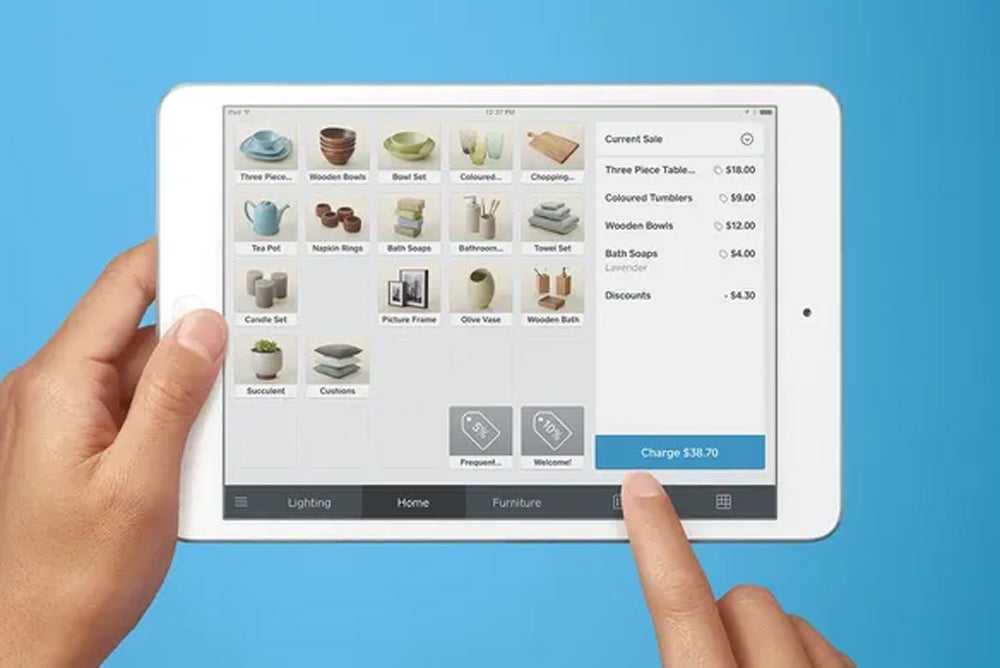

Square is, in many ways, the industry standard for cloud-based point-of-sale solutions. Initially breaking into the market with their mobile card readers that could be used with phones, the Square brand has grown tremendously in the past two decades.

These days, Square still leads the pack for mobile-friendly payments. Its hardware offerings have expanded from just peripheral card readers to now including full-fledged POS terminals. Its platform enables payment processing across numerous channels, marketplaces, and websites.

Square is a straightforward, user-friendly, and broadly applicable cloud POS solution. It’s compatible with a wide range of platforms, industries, and digital storefronts. Entry-level users of the POS system don’t pay a subscription, just transaction fees (and they get a free card reader to boot).

It’s not a perfect fit for every business; some industries will find it missing functions critical to their particular vertical. But most will find it suitable, and many will find it a solid fit.

Just getting started with Square doesn’t cost a dime. There’s no base subscription fee, though you’ll still be charged transaction fees. You can opt for dedicated hardware or operate the system on an iOS or Android device. As for the per transaction processing fees, here’s a quick gander:

| Pros | Cons |

|---|---|

|

|

Our rating: 4.55

We often spend a fair amount of time in these lists discussing the needs of smaller, up-and-coming businesses. And while there are plenty of businesses that might stand to benefit from discussions focused that way, there will always be a few larger organizations asking similar questions with very different needs.

On that note, Revel is our pick for the top cloud POS for mid-to-large businesses. Designed around multi-location organizations, use cases that require custom integrations, and even full-scale enterprise management, Revel can equip enterprise-level brands with the tools needed to handle POS, inventory, customer engagement, and a lot more.

Marketed as “the most flexible cloud POS system for multi-location growth,” Revel is uniquely built to handle the demands and increased complexity of larger brands with many moving parts. With a heavy focus on data visibility, scalability, and customer support, it’s a solution that tailors its offerings specifically to larger organizations.

Revel does not publicly list its pricing for its POS system or hardware. Customer reviews point to a starting subscription price of $99 per month, though POS hardware costs extra.

| Pros | Cons |

|---|---|

|

|

Our rating: 4.42

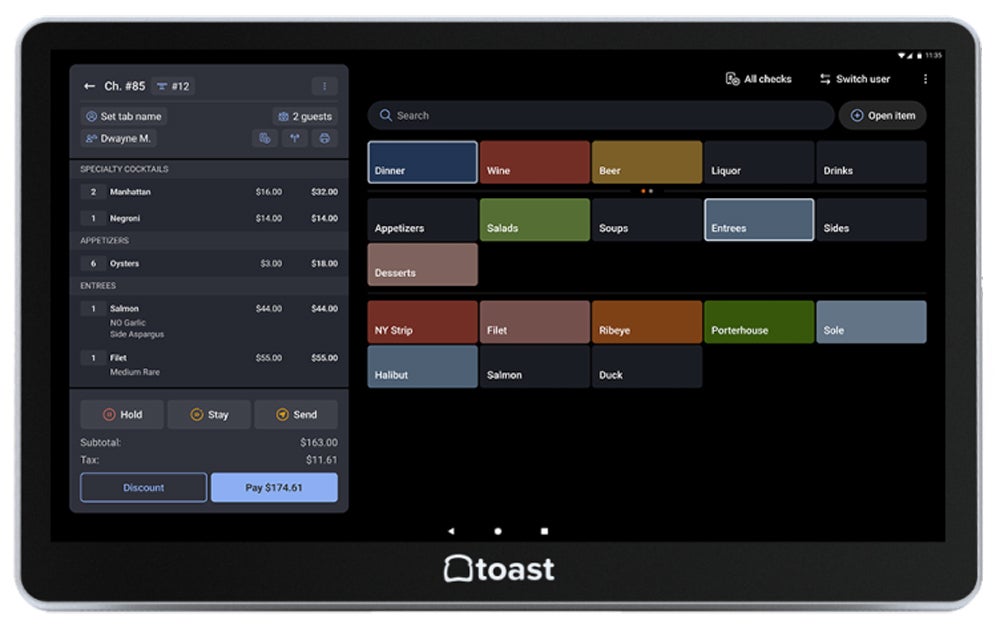

Another specialized solution, Toast is the POS of choice for food services, restaurants, and the like. With built-in features like online ordering and table management, plus a variety of POS options (including the option to let your patrons both order their meal and pay for it right from their phone), it’s a more curated flavor of POS functionality for those who, well, deal with things like “taste” and “flavor.”

There are a few restaurant-centric POS solutions on the market, but Toast is our leading candidate. While the more industry-agnostic picks in this list may work fine in some cases, most food service brands will find better value and satisfaction with their point of sale when it’s garnished by the ancillary features that matter most to their industry.

Toast has three main pricing structures: Starter, Point of Sale, and Build Your Own. With the Starter Kit, you pay $0 upfront and $0 monthly for hardware or software, but have higher payment processing fees.

With the Point of Sale plan, you pay for your hardware outright upfront and a monthly software fee. However, you enjoy lower payment processing fees. Finally, the Build-Your-Own plan is as it sounds — you choose what hardware and software you need and receive a custom price.

As for the base plan options, Toast has three:

Add-ons and custom plans are also available. Toast frequently runs bundles and deals for new restaurants.

| Pros | Cons |

|---|---|

|

|

Our rating: 4.38

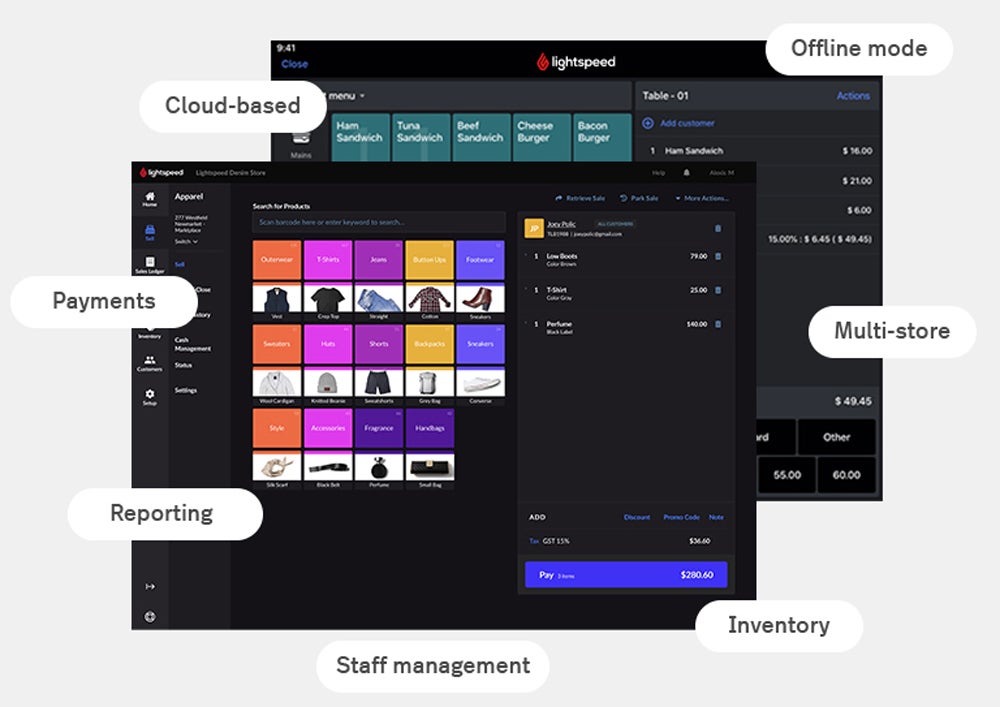

Some inventory catalogs are just more intricate than others. Or, conversely, the products being sold may be straightforward, but the bill of materials is much less so. Whatever the case, POS systems are a lot more effective when they can accurately reflect what’s available in stock to both the merchant and the customer.

Lightspeed helps businesses with this very problem, as its core point of sale software comes paired with advanced inventory tracking capabilities baked right in.

For a lot of brands, tracking inventory by hand or spreadsheet is just not realistic (at least, if you want to get any sleep at night it’s not). Lightspeed’s added inventory functionality makes this dilemma much less onerous and facilitates smoother operations.

Your pricing with Lightspeed will vary depending on how many locations you run and how many registers you have in use. In other words, you’ll want to look up their website and use their price estimator tool for a more accurate picture of what to expect. That said, we’ve listed the base prices below for US businesses, with one location and one register.

| Pros | Cons |

|---|---|

|

|

Our rating: 4.26

Now, let’s talk about the “where.” Not every business sells online, and those who do may not have enough demand on those channels to justify using a POS built to prioritize it. Some, though, do nearly all of their business through the internet. If that’s you, this is the POS you’ll want to check out first.

Shopify is a household name in ecommerce circles. It integrates into nearly every major platform on which you might have a digital storefront. In fact, it’s the foundation on which a significant portion of internet-based retail happens. As such, it’s the go-to choice for any brand wanting a piece of that particular market pie chart.

Though known for ecommerce, Shopify’s POS solution is notable in its own right. It offers streamlined inventory and customer management. And, of course, you can do many of the core ecommerce tasks, all with the same solution. Order management, conversion rate optimization, order shipping, and more.

Where Shopify truly shines as a POS is in its ability to offer cross-channel experiences such as buy online return store, buy in-store and ship to customers, buy online pick-up store, and more. All of your inventory, customer, and transaction data syncs across channels.

The pricing on Shopify’s site can be a little confusing at first glance (but at least everything is listed publicly). It makes a lot more sense once you know that they separate their standard ecommerce offerings from the in-person only POS plans.

An important detail here is that per transaction costs go down steadily as monthly fees go up, even with 3rd-party payment providers.

| Pros | Cons |

|---|---|

|

|

Our rating: 4.12

Our last pick is our recommendation for those who just need a POS solution. If you’ve already been doing business — and you have a merchant account and a processor you’ve been using for a while — you might be surprised to learn how hard it can be to find a top-tier point-of-sale vendor that will play nice with them.

Even with providers that allow for 3rd-party processors, there are often heavy commission fees, disincentivizing the very thing you picked them for.

Options like Square and Shopify are excellent, if you don’t mind them being the one handling payments for you. If you have a preferred processor already, though, you’re better off with Clover, which can work with any payment processor operating on the Fiserv network.

Because Clover is available through resellers like payment processors and financial institutions, its pricing will vary depending on where you purchase it.

However, POS plans typically start at $14.95 per month. Hardware fees and contract terms will vary.

Note that while Clover can work with any payment processor on the Fiserv network, it cannot be reprogrammed. So, make sure to purchase Clover from your preferred vendor. We link to Clover’s main site below.

| Pros | Cons |

|---|---|

|

|

Consider your core business needs, your budget, customer support, and user reviews. Here’s a more thorough breakdown of what to consider:

Costs are always a factor in business decisions, but the complexity here is tied directly to whether or not you’re using separate solutions for POS and payment processing.

If the answer is no, then things are fairly simple. Compare options based on how well they incentivize the kind of payments you take most. That might be based on the kind of card, the transaction type, the volume bracket you find yourself in, and so on.

If you’re using separate vendors, then you also have to account for whether or not that’s even possible with the system, and then whether you’ll be hammered with extra fees for doing so.

We didn’t dig too deep on this one in this article. But it bears mentioning here that support, uptime, reliability, and similar details can make or break a point of sale. The system has to have internet connection, and their servers go down? Suddenly you can’t take payments.

Something breaks, and you need to call and get it fixed. You’d better hope they have someone you can talk to at that time of day and that day of the week.

In many ways, it doesn’t matter how shiny and polished a tool is if it’s never functional when needed. So, we highly recommend taking advantage of free trials to test-run the system yourself and reading user reviews.

Do you plan to use smartphones or tablets to run your POS? Make sure the system has a highly rated iOS or Android app. Do you want to use a desktop computer as your POS? Make sure there is a browser or other desktop-compatible deployment.

Some POS systems offer proprietary solutions like all-in-one terminals or even require you to use the company’s proprietary hardware — like Toast and Clover.

Payment processors aren’t the only sticking point when it comes to integrating with external platforms and systems. Websites, marketplaces, business applications — there are plenty of other verticals in an organization’s tech stack that may need to communicate with your POS.

Some industries, markets, and product/service niches don’t lend themselves very well to generalized solutions. It merits doing a little digging to determine what, if anything, is “well, obviously” for you and your industry peers but is more “uh, no, why would we?” for other business categories.

For anything that makes that list, put it at the top of your criteria when vetting options, and don’t mark anything as “yes” unless it’s stated explicitly.

For this list of cloud POS providers, we researched leading market options to create our list of candidates. Using a standardized scoring rubric and considering as much relevant information as possible (branded marketing, review aggregator sites like G2, hands-on demos, and free trials, as well as feedback and reviews from current and past users), we reviewed candidates and assigned scores. We then assembled our picks from the top-ranked vendors (with an eye toward the needs of common use case flavors) into the article found above.