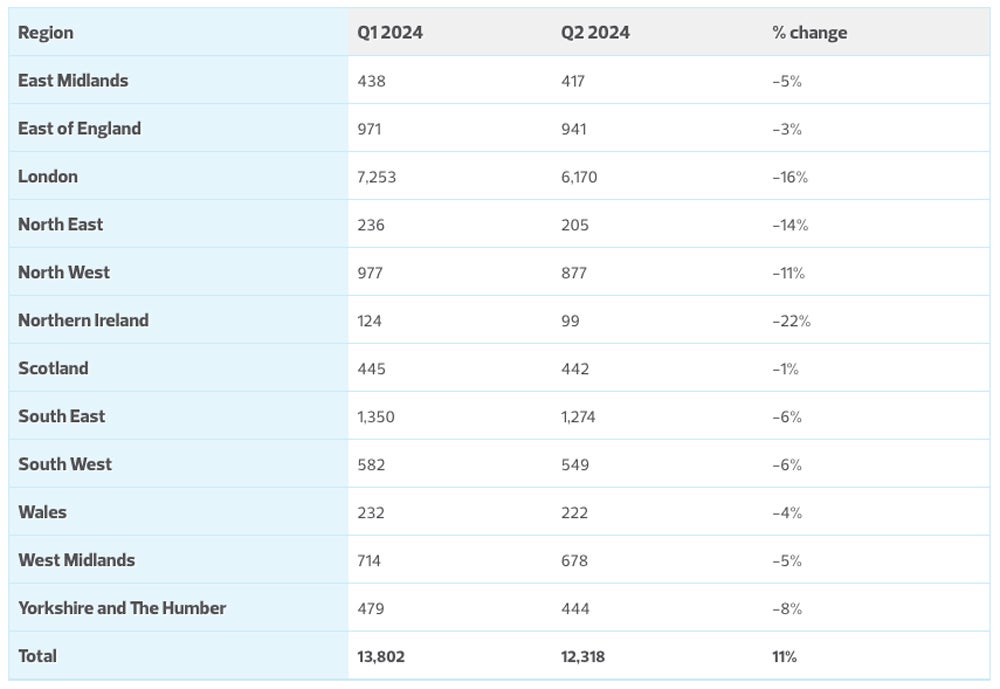

The number of tech startups being founded in the U.K. has suffered its first “marked decline” since 2022, according to accounting firm RSM UK. There were only 12,318 new tech incorporations in the second quarter of 2024 compared with 13,802 in the first quarter — an 11% decline.

The number of tech incorporations is seen as a good indicator of industry growth and, up until now, this figure has suggested prosperity. Q1 2024 saw the highest number of tech incorporations in five years, while the total number of startups formed in 2023 jumped by 22% from 2022, representing the largest percentage increase on record.

Ben Bilsland, partner and head of technology at RSM UK, said in a press release the latest figures suggest “the tide may be turning on tech growth.”

“Whilst on one hand the new government is grappling with a £22 billion budget shortfall, on the other, it can’t afford to take a strong tech sector, that contributes around £150 billion a year to the UK economy for granted,” he said.

“With that in mind, and with high interest rates and sticky inflation continuing to present economic challenges, we would encourage government to do all it can to maintain growth in the sector.”

Last week, it was revealed that the new Labour government had scrapped £1.3 billion worth of funding that had been earmarked for AI infrastructure by the Conservatives. The King’s Speech in July also made scant mention of the tech sector and did not formally announce any new legislation surrounding it, including the anticipated AI Bill.

Bilsland said, “We need a renewed focus on the bigger picture from government, supporting the sector to develop technology which enables the UK to compete on the global stage. In the US, tech behemoths such as Google and Amazon create huge economic growth. This begs the question can the UK government afford not to invest in the tech sector?

“The King’s Speech felt like a missed opportunity to address the tech skills gap with further training and tackle the AI landscape. Despite limited resources, we’d urge the new Labour government to consider helping the sector at the next Budget, with improved tax reliefs and access to deep computing to support AI advancement.”

London accounted for the highest number of incorporations in Q2 of 6,170. However, the figure was down 16% from Q1. In fact, all U.K. regions saw decreases in the number of tech incorporations from the previous quarter, with the largest being Northern Ireland, which saw a drop of 22%.

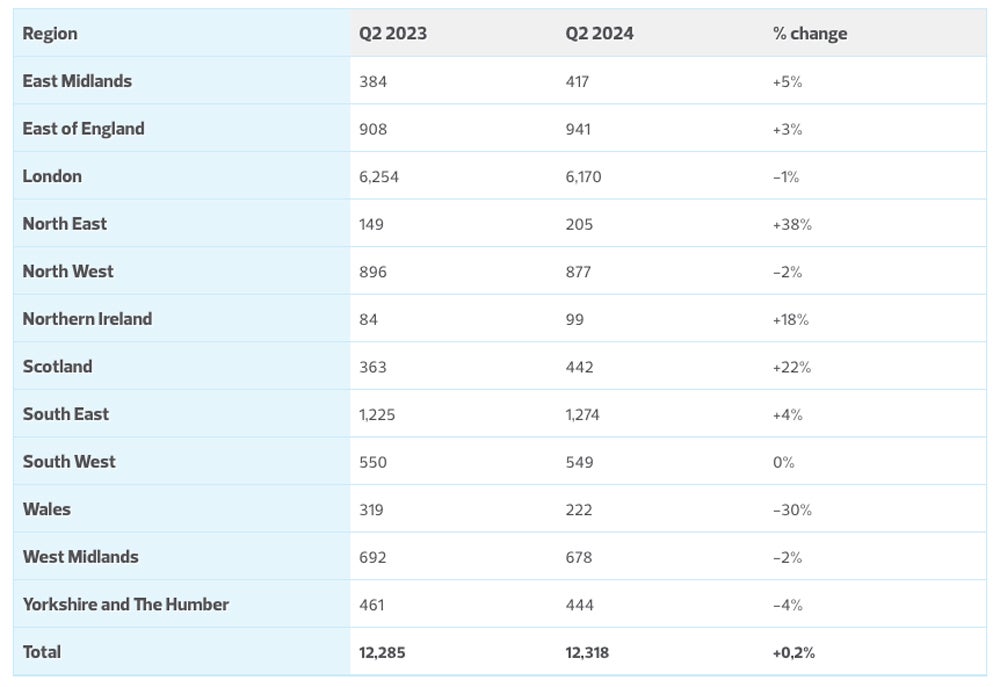

Despite the reduction in new tech startups over the last six months, most regions did see more tech incorporations in Q2 2024 than Q2 2023. This is particularly true for the North East and Scotland, which saw year-on-year increases of 38% and 22%, respectively. The number of tech incorporations in the whole of the U.K. for Q2 2024 was 0.2% higher than the same figure for Q2 2023.

On Monday, shares in the “Magnificent Seven” U.S. tech companies — NVIDIA, Meta, Alphabet, Microsoft, Amazon, Tesla, and Apple — had all dropped dramatically, losing a combined $1.3 trillion over five days. The selloff is related to several factors, but a primary one is that investors are becoming concerned about the return on investment of AI.

Alphabet spent $13.2 billion in the second quarter as a result of investments in AI infrastructure, 91% more than Q2 2023, putting pressure on profit margins. Meta CEO Mark Zuckerberg also remarked on an earnings call that he expects it will be “years” before the company monetises its AI products.

Goldman Sachs stock analyst Jim Covello wrote in a recent report, “Despite its expensive price tag, the technology is nowhere near where it needs to be in order to be useful … Over-building things the world doesn’t have use for, or is not ready for, typically ends badly.”

Sequoia Capital partner David Cahn argued in a blog post that the AI industry would have to generate $600 billion a year to pay for its hardware spend.

Semiconductor companies face their own issues, with shares in Intel, Samsung, TSMC, and SoftBank Group, the parent Arm Holdings, all diving on August 1.

Intel’s stock fell 26%, its worst day in 50 years, after suspending its dividend and laying off 15% of its workforce. These moves are the firm’s attempts at clawing back to a dominant industry position after being overtaken by numerous competitors in the S&P 500, but they simultaneously dragged down global semiconductor stocks. Rumours that NVIDIA will delay the release of its new chip due to design flaws also contributed to its shares falling by 6.3%.

Investors are also preparing for imminent U.S. interest rate cuts, meaning they are prioritising small-cap stocks, which tend to benefit more from lower rates.