Xero’s fast factsPricing: Starts at $15 per month. Key features:

|

Xero is a cloud-based, double-entry accounting software tool that is designed with small businesses in mind. More than 3.5 million users all over the globe use Xero to manage their billing and invoicing each month. In this Xero accounting software review, we’ll break down the pros and cons to help you figure out whether Xero is the right accounting tool for your needs.

Xero offers three transparent pricing places: the Early plan, the Growing plan and the Establish plan. Xero offers a 30-day free trial period, so you can try out all the software’s features before committing to a paid plan.

The Early plan costs $15 per month and lets users send up to 20 invoices and schedule up to 5 bills per month. Other features include reconciling bank transactions and capturing bills and receipts with Hubdoc.

The Growing plan costs $42 per month and includes unlimited numbers of invoices and bills. In addition to the features on the Early plan, the Growing plan includes bulk transaction reconciliation to speed things up.

The Established plan costs $78 per month and includes unlimited numbers of invoices and bills. In addition to all the features of the other two plans, the Established plan includes the use of multiple currencies, tracking time and projects, claiming expenses and viewing in-depth analytics.

Xero offers the option to add full service payroll support from Gusto to any plan. This Gusto-Zero integration starts at $40 per month plus $6 per employee. If you are looking for payroll software in addition to accounting software, be sure to check out our guide to the best payroll software for 2024.

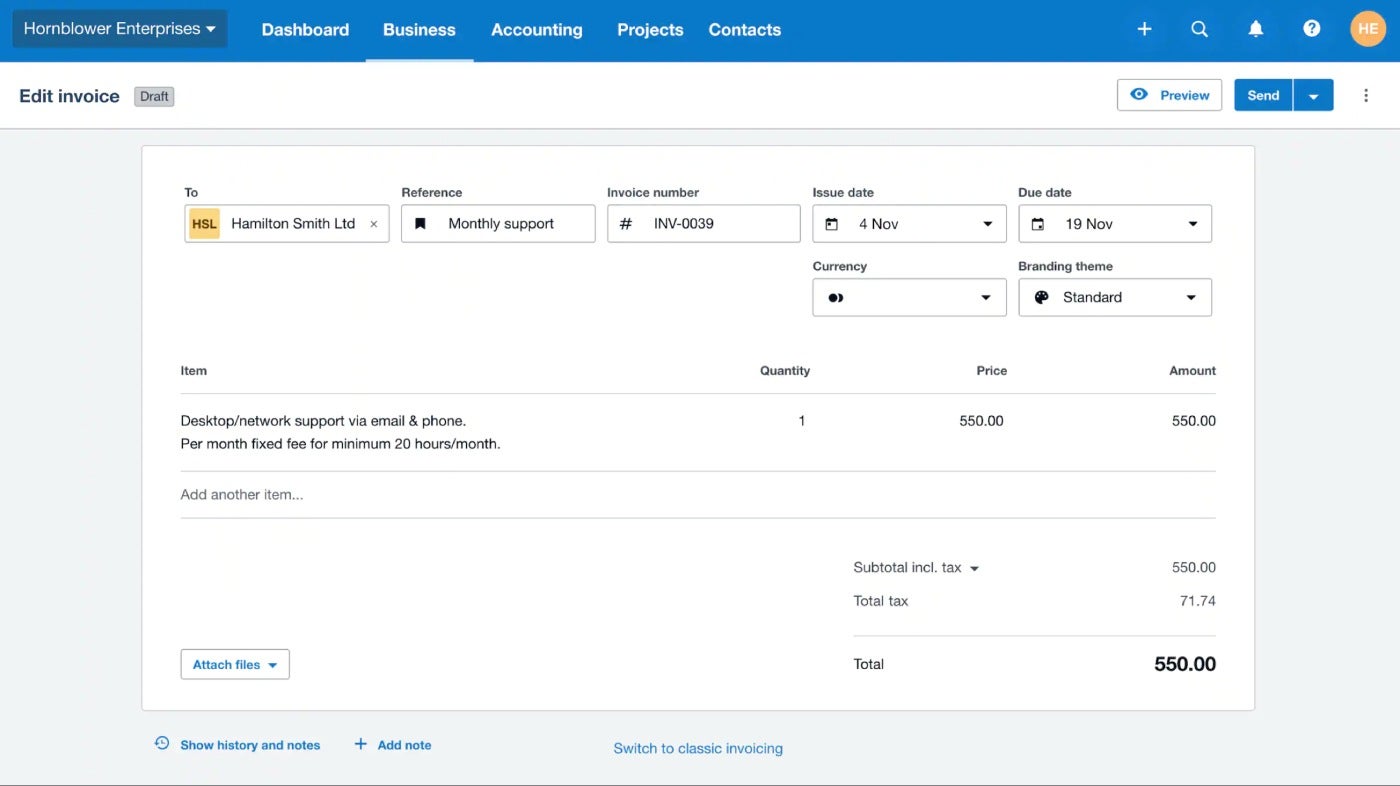

Xero’s simple invoicing tool (Figure A) makes it easy to upload your logo and choose from several branding themes, but I’d love to see more extensive customization options. Xero does offer an invoice template to help get you started, and you can choose to create and save your own templates. Once customers receive the invoice, they can pay you directly from it by clicking the “pay now” button and using a credit card, debit card or direct debit. You can also accept payments from popular services such as Stripe and GoCardless.

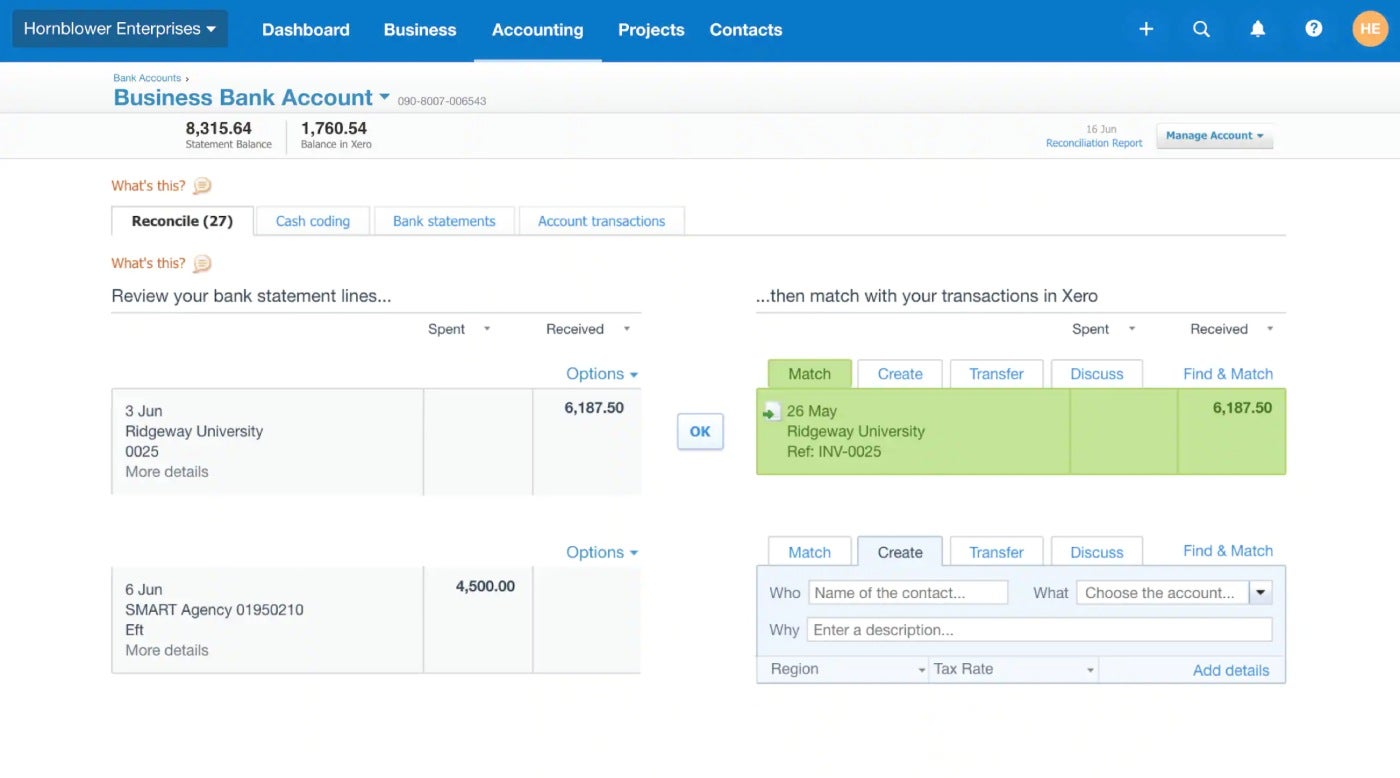

Xero connects to more than 21,000 financial institutions around the globe, meaning the chances are very high you’ll be able to connect to your business bank accounts and automatically import transaction info. If your bank doesn’t already have a connection, you can import PDF statements.

Once you’ve got your bank information in Xero, the software will help you match up your transactions for reconciliation (Figure B). Keep in mind that bulk reconciliation is not included with the cheapest Early plan, so you might have to pay to upgrade if you want this feature. I wish it was included in all plans, because manually reconciling one transaction at a time is very tedious for many businesses.

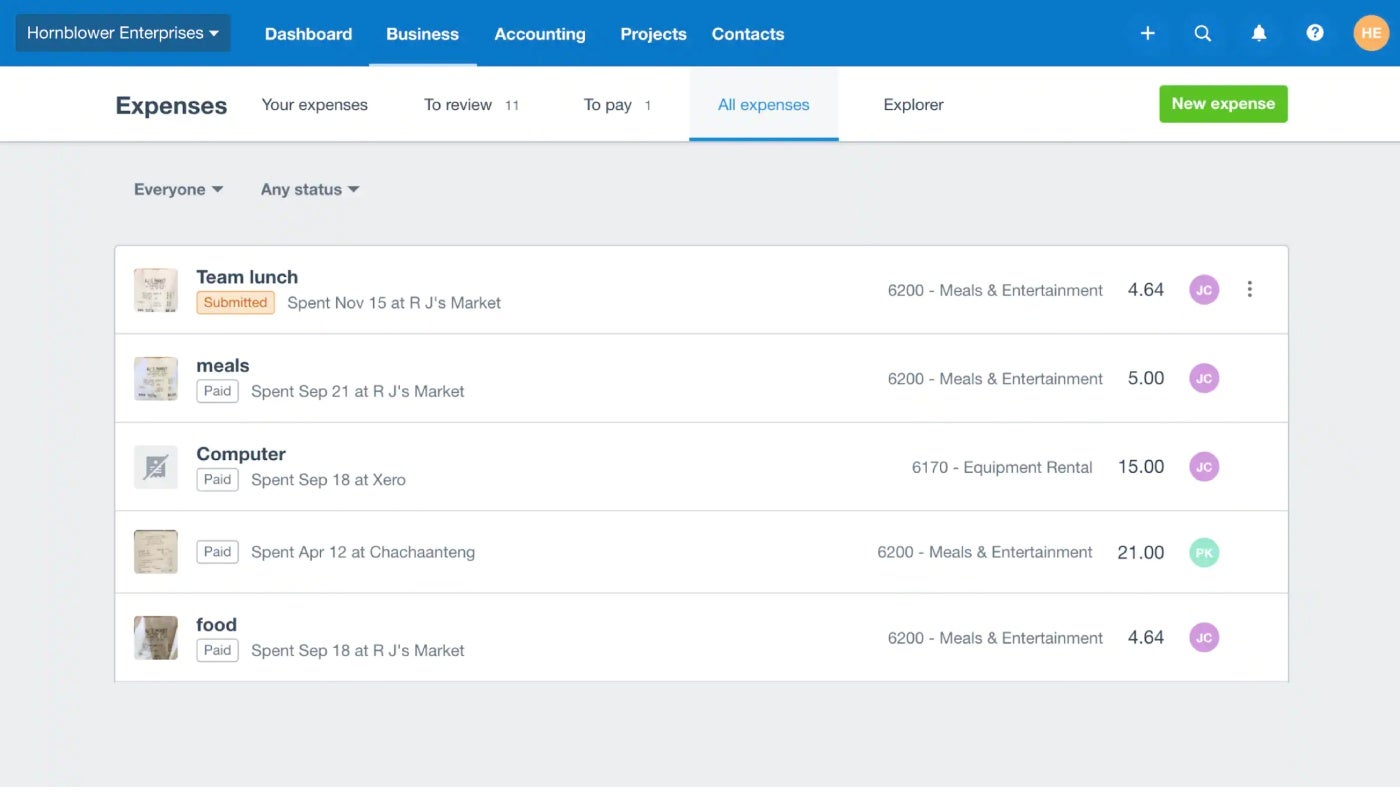

Xero has a mobile app, Xero Expenses, that allows you to snap pictures of receipts and create an expense instead of having to manually enter all the information. This feature is available on all pricing plans; which I appreciate since some accounting software charges extra for mobile receipt capture. Employees can submit a reimbursement request as soon as their receipts are uploaded, and the business owner can track expenses totals by category as they are submitted (Figure C).

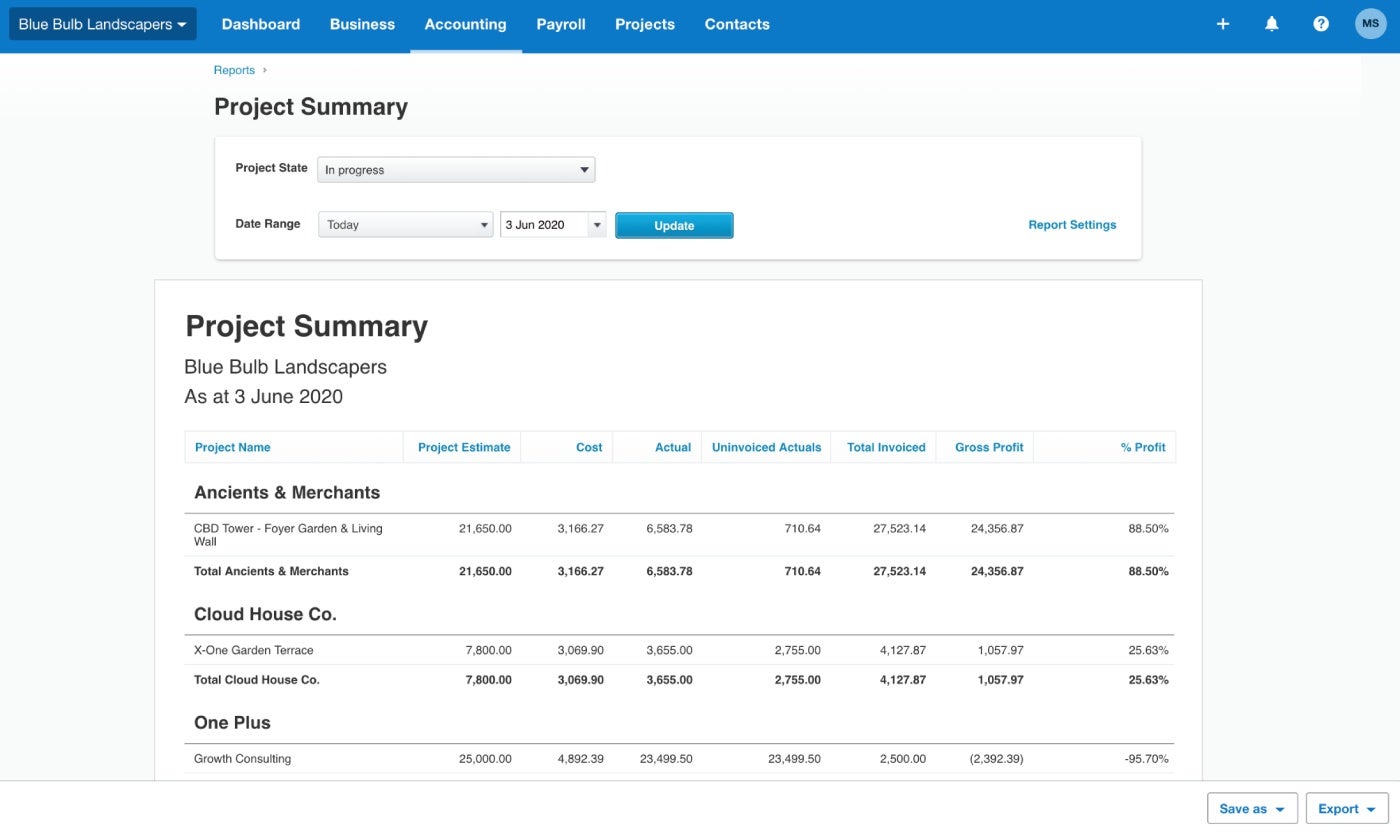

The Established plan gives users access to Xero’s native project and time tracking tool, so they can track how much time they spend on tasks and invoice it to a specific project. This feature is helpful for businesses that charge an hourly rate or that want to track how much time they’re spending on jobs to ensure they stay profitable.

But if you’re on a tight budget and don’t need the extra features on the Established plan, then I recommend checking out our recommendations for the best free project management software, which offer many of the same tools at no cost.

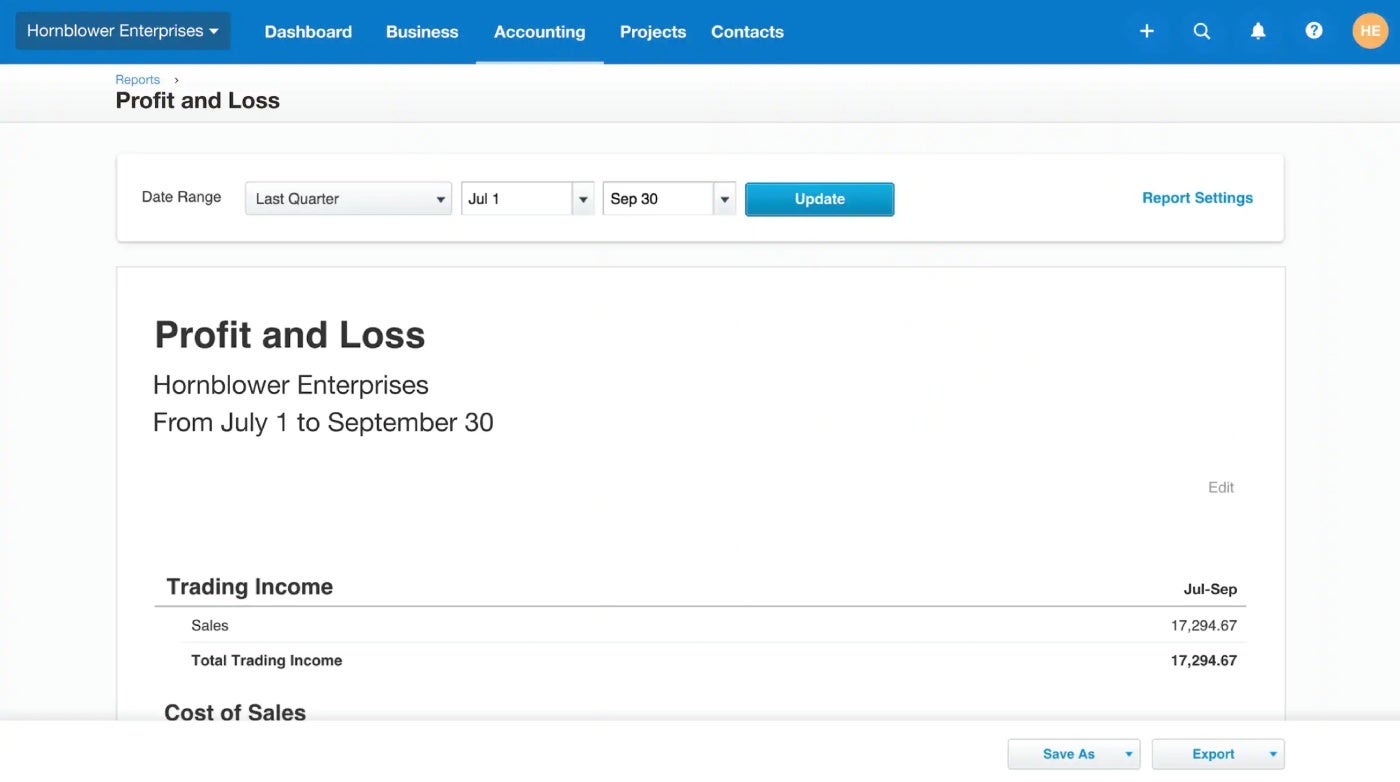

In addition to billing and invoicing capabilities, Xero goes one step further by providing financial and accounting reporting features; options include a 1099 report, a balance sheet report, aged receivables report, aged payables report, inventory report and more (Figure E). These reports help small business owners identify areas for improvement and make evidence-based decisions in real time. Xero doesn’t offer as many pre-built reports compared to Xero alternatives such as QuickBooks.

Unlike many other competitors that cap the number of users per plan (looking at you, QuickBooks), Xero offers unlimited users even on the lowest tier plan. This is beneficial to small businesses that need multiple people to be able to log into the accounting software and don’t want to pay extra or upgrade to get more seats.

If there are a lot of other apps you need to connect your accounting software to, I’ve got good news: The Xero app store offers more than 1,000 pre-built connections that integrate with third-party apps. For perspective, this is far more integrated than all its main competitors, including QuickBooks and FreshBooks.

If you’re new to accounting apps, don’t fear: Xero offers a highly guided setup process that walks you through every module with pop-up windows and tutorials. It also provides a demo company account that allows you to practice on dummy data, which I found very helpful during the writing of this review.

The tradeoff for Xero’s unlimited users on the Early plan is that it enforces pretty stiff limits on other things, only allowing 20 invoices and 5 bills per month. Most small businesses will exceed that limit quickly and be forced to upgrade to a more expensive plan. Most of Xero’s more advanced features — including multiple currencies and time tracking — are limited to the most expensive plan, meaning that businesses must be willing to shell out $78 a month to get access to them.

In contrast to allowing unlimited users, Xero does limit you to one organization or business per subscription. In other words, if you need to do accounting for more than one business, you’ll need to purchase an account for each one. This is a real drawback for owners of multiple businesses or bookkeepers who work with multiple clients.

Xero doesn’t provide a phone number where you can call the company directly, even though it claims to offer 24/7 online support. The Xero help website states: “We don’t have a support phone number, but we do call customers if we need to. If you come across a phone number on the internet that claims to be Xero support or charges for support, it’s fraudulent.”

| Feature | Xero Accounting | QuickBooks | FreshBooks | Wave Accounting |

|---|---|---|---|---|

| Automatic bank import | Yes | Yes | Yes | Paid plan only |

| Unlimited invoices on cheapest plan | No | Yes | Yes | Yes |

| Unlimited users | Yes | No | Extra fee | No |

| Free plan | No | No | No | Yes |

| Free trial | Yes | Yes | Yes | Yes |

| Starting price | $15 a month | $30 a month | $19 a month | $16 a month |

QuickBooks is the name to beat in accounting software, but it’s far from the cheapest option on the surface: Pricing starts at $30 a month after the signup discount ends. Features include branded invoice templates, budgeting capabilities, automatic matching between payments and invoices, and a user-friendly mobile app.

Unlike Xero, QuickBooks allows unlimited invoices on the cheapest Simple Start plan — but limits you to 1 billable user and 2 accountant firm users. If you need only 1 person to use the software but plan to send a high number of invoices and bills, QuickBooks may be a more cost-effective choice than Xero.

To see how QuickBooks stacks up, check out our QuickBooks vs. Xero comparison.

FreshBooks starts at $19 per month after the signup discount and incorporates standout features like team roles and time tracking on all plans. The basic plan allows users to send unlimited invoices and estimates and track unlimited expenses up to 5 clients, so if you have more clients than that, you’ll need to upgrade.

The number of users is also technically unlimited, but FreshBooks does charge an extra fee of $11 per user per month. This additional fee means FreshBooks could be a good choice for small businesses that need to send more invoices than the Xero basic plan allows, but need more users than the QuickBooks basic plan allows and aren’t willing to upgrade to a more expensive QuickBooks plan.

To see how FreshBooks stacks up, check out our FreshBooks vs. Xero comparison.

If you’re on a tight budget, then check out Wave Accounting, which offers a forever free Starter plan — yes, you read that correctly! You’ll get unlimited clients, invoices and bills on the free program, but you’ll need to upgrade to the $16 per month Pro plan if you want to auto-import bank transactions and digitally capture unlimited receipts.

Given that Wave’s single paid accounting plan is cheaper than all the other alternatives we’ve listed here, and that it offers a forever free plan, this is absolutely the best option if you need to save cash. However, Wave’s features are more limited than many competitors in order to keep the price low, so it may not suffice for growing businesses.

To see how Wave Accounting stacks up, check out our Wave vs. Xero comparison.

To review this software, I signed up for a free trial of the Xero Established plan. I also reviewed official product documentation, watched demo videos, consulted user reviews and cross-referenced software reviews in industry publications.