Reconciling your bank transactions to your business book is essential to the financial health of your company. However, if you’ve never reconciled your company’s transactions before, the process can sound a bit intimidating.

Read on to discover the essential steps in bank reconciliation and to see several examples of what a bank reconciliation might look like.

A bank reconciliation statement compares a company’s bank account balance to the balance on its accounting records. A bank reconciliation will show any discrepancies between the two accounts. Bank reconciliation helps companies detect both accidental errors and intentional fraud.

Bank reconciliation benefits companies in numerous ways. First of all, the bank reconciliation process will help you discover and fix errors in your books. It will also help you identify fraud, wrongful payments, excess fees and other improper payments that are costing your business money.

Bank reconciliation also helps you stay on top of the financial health of your business. The bank reconciliation process allows you to track your business’ profitability over time. You will be able to classify tax-deductible expenses as you go through your records, helping you get tax breaks and ensuring you’re ready to file taxes.

In addition to completing an overall bank reconciliation, you may also wish to do a reconciliation for only certain kinds of transactions. Here are five types of bank reconciliation that every business owner should know:

Vendor reconciliation helps you spot any differences between payments to suppliers and the general ledger. It involves comparing statements from vendors to the transactions on the general ledger to ensure the overall balance is accurate.

If you let customers buy your products or services on credit, then you’ll need to conduct a customer reconciliation. During this process, customer transactions made on credit are compared to the accounts receivable ledger as well as the receivables control account, which is part of the general ledger.

In contrast to customer reconciliation, credit card reconciliation involves purchases your own business has made on credit. During this process, you will compare transactions made on company credit cards to receipts and expense reporting to ensure all purchases are accounted for and that no bills go unpaid.

Businesses with retail locations will need to conduct a cash reconciliation at the end of each work day. In a cash reconciliation, cashiers verify that the amount of money remaining in the register matches up with the transactions conducted that day.

Balance sheet reconciliation confirms that all of a company’s financial statements are accurate. During this process, the balances on the balance sheet are compared against the general ledger as well as other supporting documentation like bank statements and invoices.

To conduct a bank reconciliation, you will need your bank records for a set period of time, usually the past month. You can access this data by referring to your last banking statement or logging into your online business bank accounting.

Some accounting apps will also automatically import your banking transactions, speeding up the reconciliation process. You will also need access to your company books for that same period of time, whether that’s in a spreadsheet, logbook or accounting software.

Once you’ve got all your documents together, compare your books to your bank statements to identify discrepancies. For instance, you might have logged a payment to a vendor in your books, but that payment might not have actually hit your bank account yet. Create a list of all the discrepancies and try to determine the cause of each.

Once you’ve got a master list of discrepancies, you need to add your missing book transactions to your bank account and your missing bank transactions to your books. Make sure all withdrawals and deposits are accounted for during the period you’re reconciling.

Once you’ve made all the necessary additions and subtractions, it’s time to compare the book balance to the bank balance. If you’re done your calculations right, these two numbers should be exact and equal, and you’ll have finished with the bank reconciliation process.

Common accounting errors will impact a bank reconciliation. Some frequent mistakes to watch out for include data entry errors, omissions errors, transposition errors, fraudulent transactions and an incorrect beginning cash balance. Also, watch out for service fees you’ve forgotten to account for.

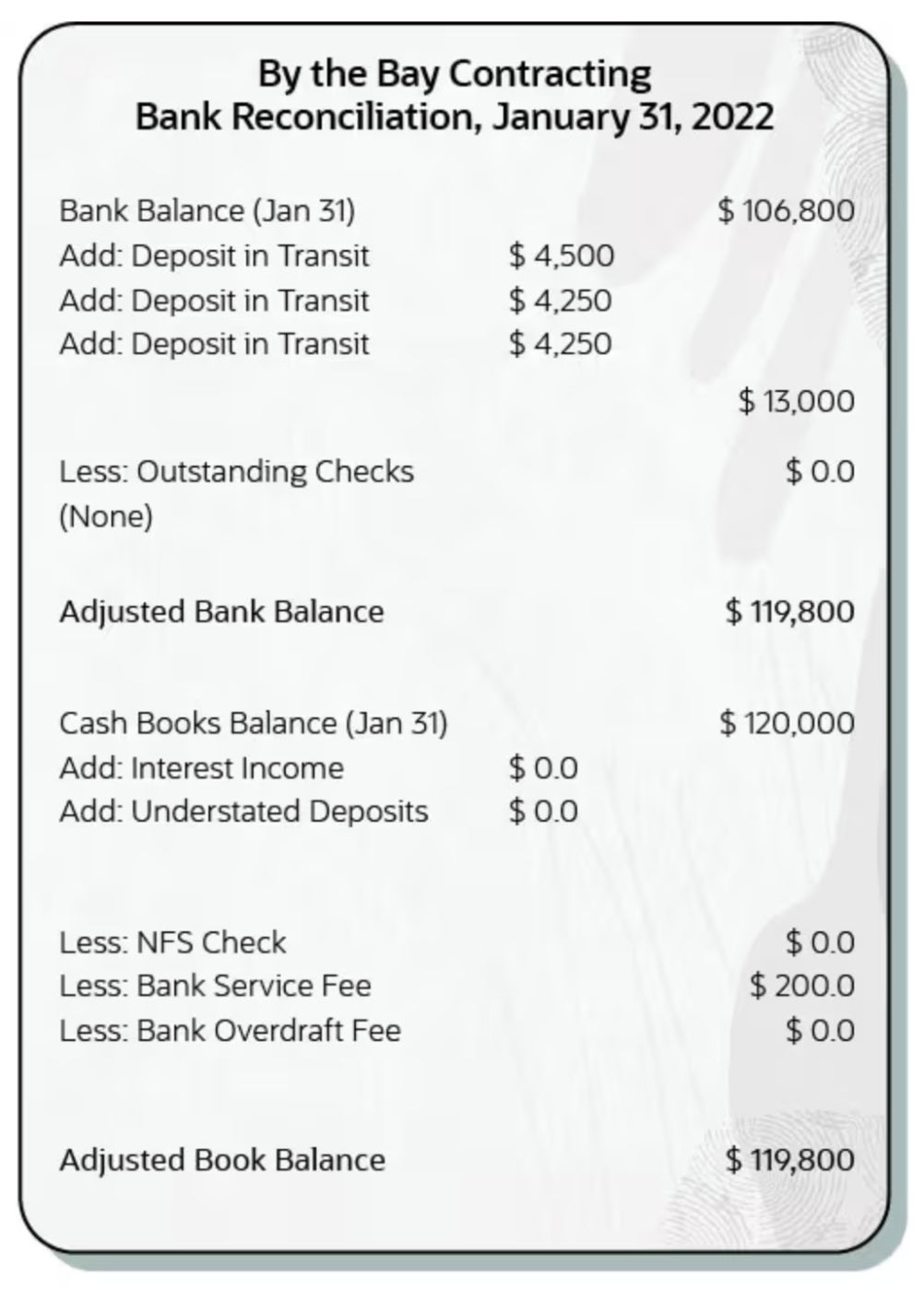

Our first bank reconciliation comes courtesy of NetSuite, an enterprise accounting software, and features a mock company called By the Bay Contracting. As you can see in this simple example, the company needs to add $13,000 in total to its bank balance and subtract $200 in fees from its books to make everything balance out.

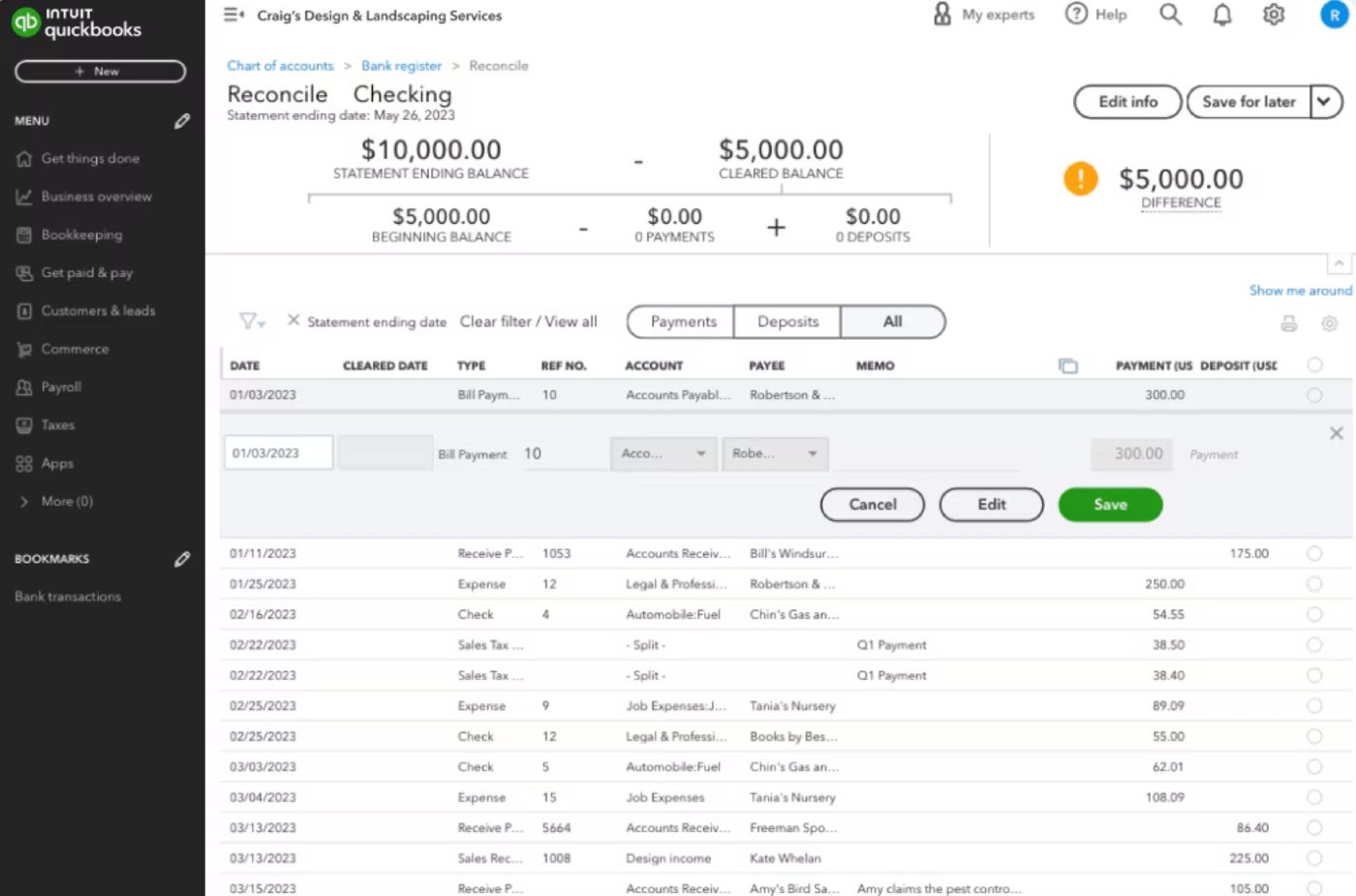

Our next example shows a more complicated bank reconciliation in QuickBooks. As you can see, there is a $5,000 discrepancy between the statement-ending balance and the cleared balance for Drag’s Design and Landscaping Services. The business owner needs to add all outstanding payments and deposits until the two balances match up.

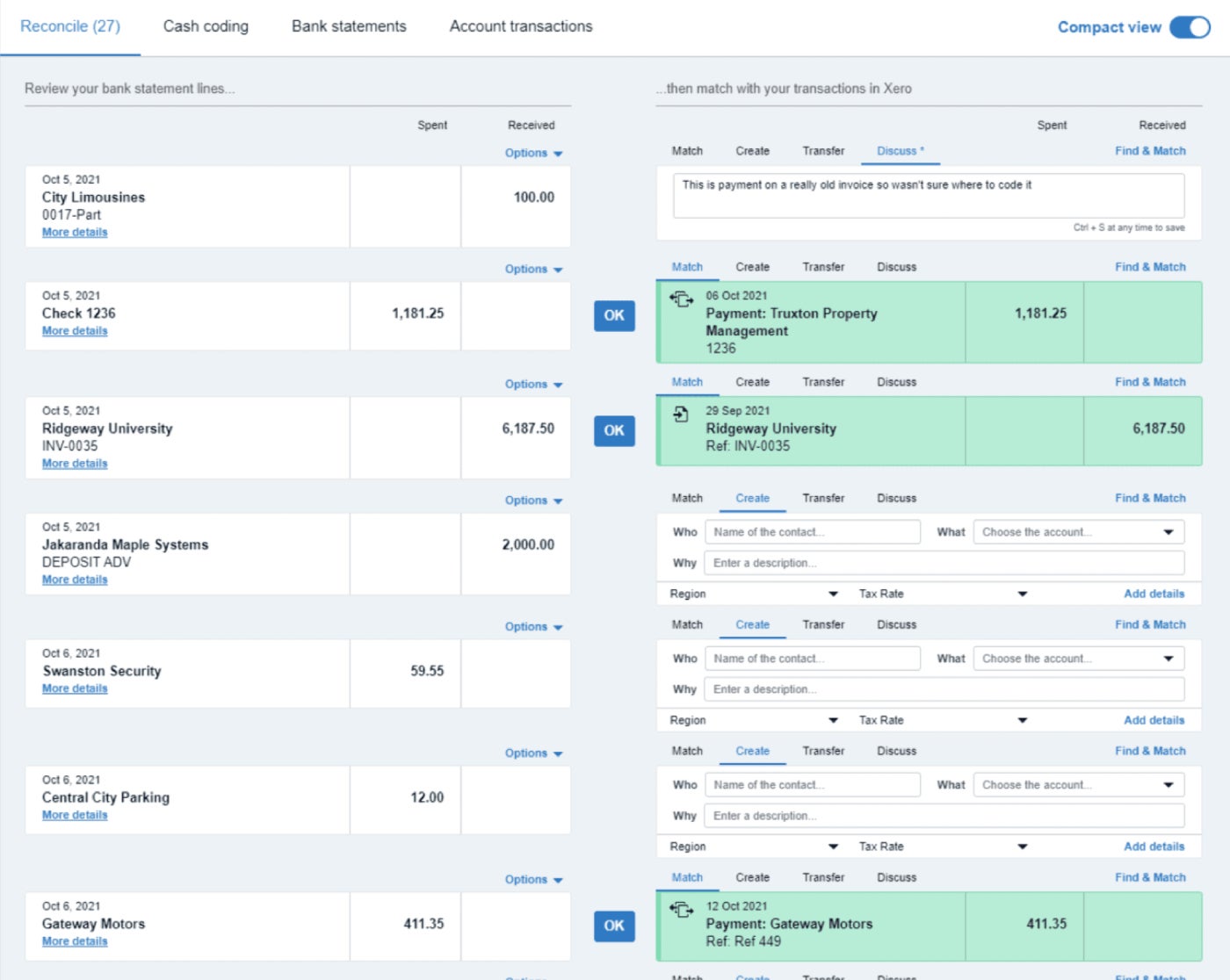

Our final bank reconciliation example demonstrates how a software like Xero can import and categorize bank transactions to speed up bank reconciliation. As seen in the example, the accounting software automatically matches bank statement links to recorded transactions in Xero and prompts you to add unrecorded bank transactions to your books.

Bank reconciliation is the process of comparing a company’s bank account balance to the balance on its accounting records to confirm that all transactions have been accounted for.

The purpose of a bank reconciliation is to review all transactions that have been recorded on your bank statements and books. Creating bank reconciliations helps identify unrecorded transactions and fraudulent or erroneous charges.

After gathering your documents, the four main steps of bank reconciliation are comparing your books and bank statements, adjusting the books and bank to correct discrepancies, comparing the adjusted balances to each other and fixing any remaining errors if necessary.

If a company’s bank statements show that it has $10,000 in cash, but the books only show that they have $9,000, then the company must perform reconciliation to identify the missing $1,000 in deposits.