APAC companies are struggling with wasteful cloud spending, according to a commissioned study conducted by Forrester Consulting. Also, cloud cost management initiatives and tools are being introduced too late or without a full picture of their environment to be very effective.

In the new study, commissioned by IPaaS provider Boomi in December 2023, it was found that 87% of APAC companies had exceeded their set cloud budgets over the past two years, and 69% foresee their cloud budgets to be exceeded during the current fiscal year.

The results come as regional cloud workloads are predicted to increase rapidly over the next two years. Workloads for applications in IT ops (51%), hybrid work (55%), software creation platforms and tools (42%) and digital experiences (40%) are expected to rise the fastest.

The Forrester Consulting survey, which engaged 420 cloud and real-time data decision-makers around the globe, found most APAC companies in its survey sample are exceeding their cloud budgets despite widespread use of cloud cost management and optimisation tools.

Globally, the survey found:

The Forrester Consulting study put this down to cloud workload growth and tools often only showing part of the cost picture after the fact. “They do not enable the proactive optimisation of costs at the cloud architecture level, where choices about service adoption and integrations can have a far-reaching impact on cloud costs,” the report said.

SEE: Cloud strategies are facing a new era of strain in Australia and New Zealand

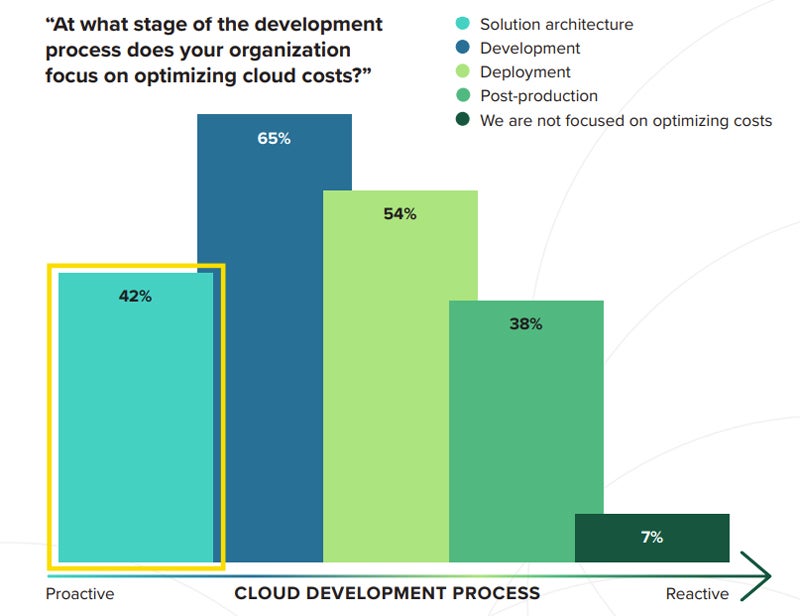

Part of the problem seems to be timing (Figure A). APAC companies have realised introducing cost control management and optimisation measures too late in the cloud development process leads to difficulties later in managing and reining in costs. The study found:

Organisations say they have problems tracking different areas of cloud spending with CCMO tooling. From the pool of global survey responses that labelled areas either “moderately difficult” or “extremely difficult,” data management was the most difficult to track with CCMO tools (Figure B).

In APAC, this result was mirrored. APAC companies also saw egress charges — charged whenever data is moved in and out of the cloud — and the time and resources needed to build and maintain app integrations as the second and third most difficult areas to track, respectively.

This is seeing APAC companies running “blind” cost management strategies, Boomi said, because of a lack of visibility at the architecture level. About six in 10 APAC respondents (63%) believed CCMO recommendations were only as good as the data their company could provide.

Nearly half (44%) said third-party CCMO tools were not consistent with reporting requirements, while 35% said remediation recommendations given by tools are too late in the development process.

In addition, 27% of global respondents said that CCMO tool recommendations do not address the root cause of cloud spend in the organistion’s architecture design, while 19% said that they did not trust the native CCMO solutions that were on offer from major cloud providers.

Global results showed only 14% of organisations have no challenges with CCMO tools.

FinOps practices have emerged as a key way for organisations to keep cloud costs under control in a cost constrained environment. Forrester’s report points out that the FinOps Foundation in the US has grown rapidly, with 48 of Fortune 50 companies now participating in it.

However, FinOps practices are not being as effective as they could be at reining in costs.

The survey found:

SEE: IT Leaders Fighting Budget Pressures With Financial Transformation, FinOps

Reducing cloud spending has become one of the highest priorities on cloud strategy agendas globally; the only higher priorities named in the report by respondents were the execution of modernisation initiatives and the consolidation of data for analysis.

However, while APAC organisations are aware they could optimise cloud costs at the solution architecture level, less than half actually have the strategy in place to resolve the common problems they face that are driving up costs. Common problems named include excessive storage (52%), lack of integration strategy (44%) and bandwidth overconsumption (42%).

Forrester Consulting said modernisation and integration were the solutions. “Seventy-two per cent of decision-makers indicate that cloud architecture integration and modernisation initiatives have the potential to transform their company’s ability to reduce cloud spend,” the report said.

“Successfully executing these initiatives at the solution architecture level helps avoid unnecessary cloud spend and also enables companies to better align with FinOps best practices, shift resources toward innovation, and improve cloud ROI,” it concluded.