To make evidence-based decisions for your business, you need financial reporting software that makes it possible to import and analyze your financial data and accounting statistics. However, the financial reports of a small business are very different from that of a large enterprise, which can make it tough to find the best financial reporting software for your needs.

To help you narrow down your search, we’ve rounded up the best financial reporting software for businesses of all sizes.

Besides price, there are many other features to consider when choosing a financial reporting software platform. This chart summarizes some of the main things to look for:

| Starting price | Pre-built reports | Custom templates | Forever free account | Free trial | ||

|---|---|---|---|---|---|---|

| QuickBooks Online | $30 per month | 60+ | Yes | No | Yes | Visit QuickBooks |

| Sage Intacct | Contact for quote | 150+ | Yes | No | No | Visit Sage |

| NetSuite | Contact for quote | Not disclosed | Yes | No | No | Visit NetSuite |

| Xero | $15 per month | 22 | Yes | No | Yes | Visit Xero |

| Spotlight Reporting | $35 per month | 17+ | Yes | No | Yes | Visit Spotlight |

| Zoho Books | $15 per month | 24 | Yes | Yes | Yes | Visit Zoho |

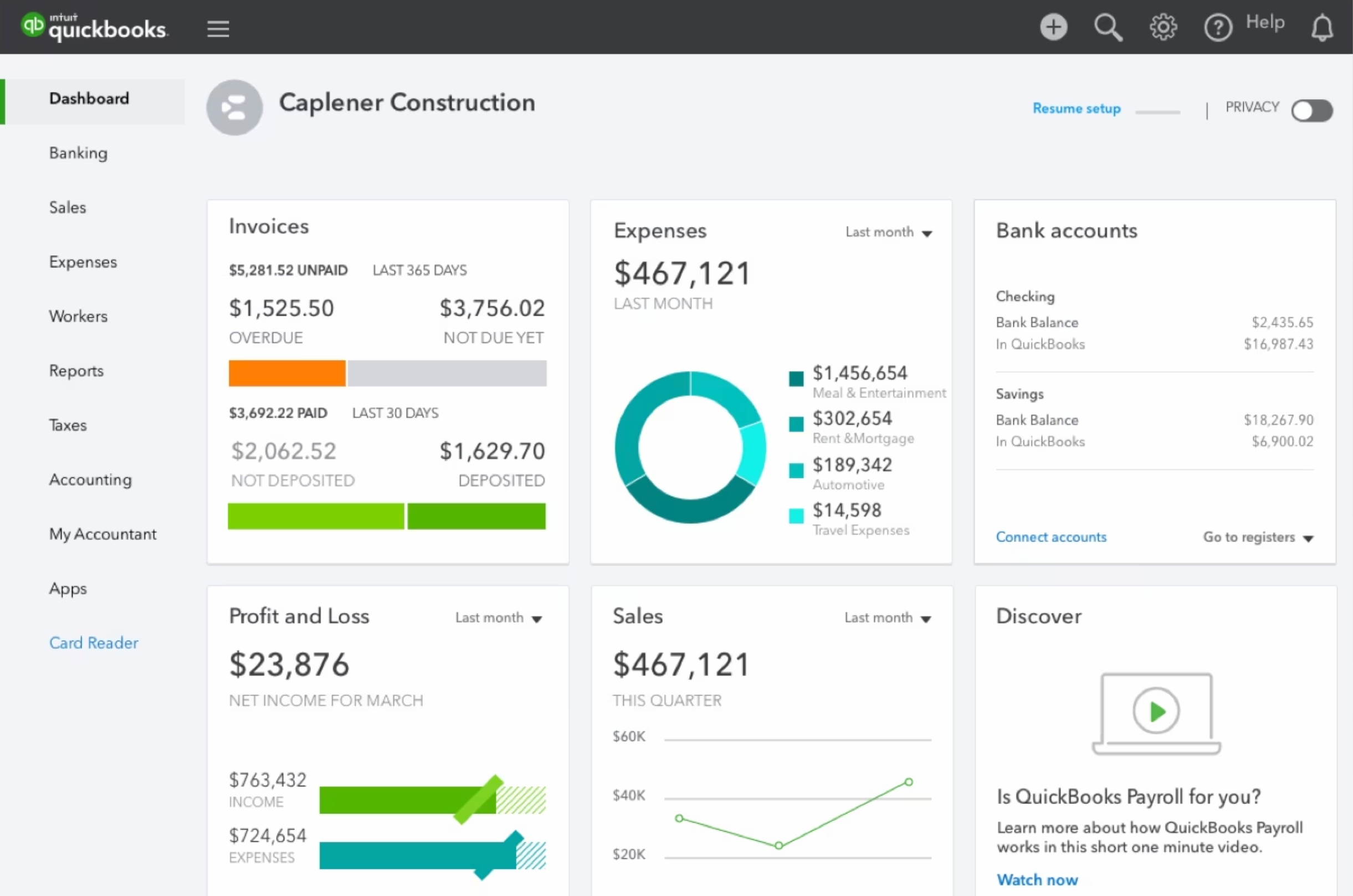

QuickBooks is known for its accounting and bookkeeping software, but it actually offers a very robust library of financial reports as well. The entry-level Simple Start plan already comes with dozens of reports, and the Plus plan provides access to more than 60 different reports to choose from. QuickBooks also comes with plenty of other advanced features, including time tracking and inventory management, depending on what plan you decide on.

QuickBooks Online offers four different pricing tiers to choose from:

First-time QuickBooks customers can choose to explore QuickBooks without committing to a plan by signing up for a 30-day free trial. You can also skip the free trial in favor of locking in 50% off for your first three months — but you can’t choose both.

For more information, read our full QuickBooks Online review.

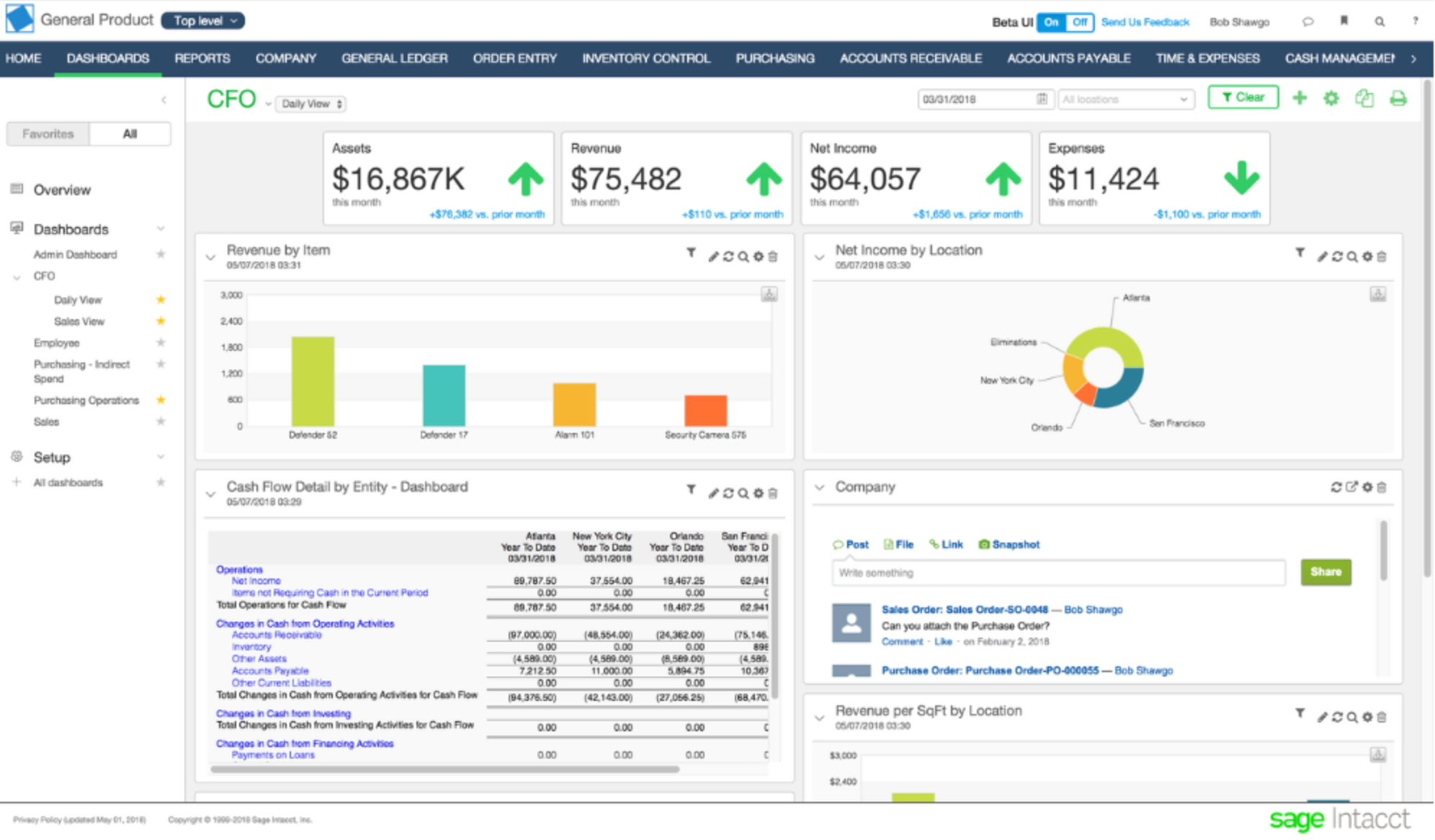

Sage Intacct offers more than 150 pre-built financial reports to choose from, plus the ability to generate custom reports. This comprehensive financial reporting software tracks both financial and operational data and even allows you to combine data from multiple entities so you can look at the high-level numbers. You can also slice and dice data according to 10 pre-built dimensions or define your own to get granular and enhance your financial reports.

Sage Intacct does not publicly disclose its pricing information. You’ll have to contact their sales team for a custom quote.

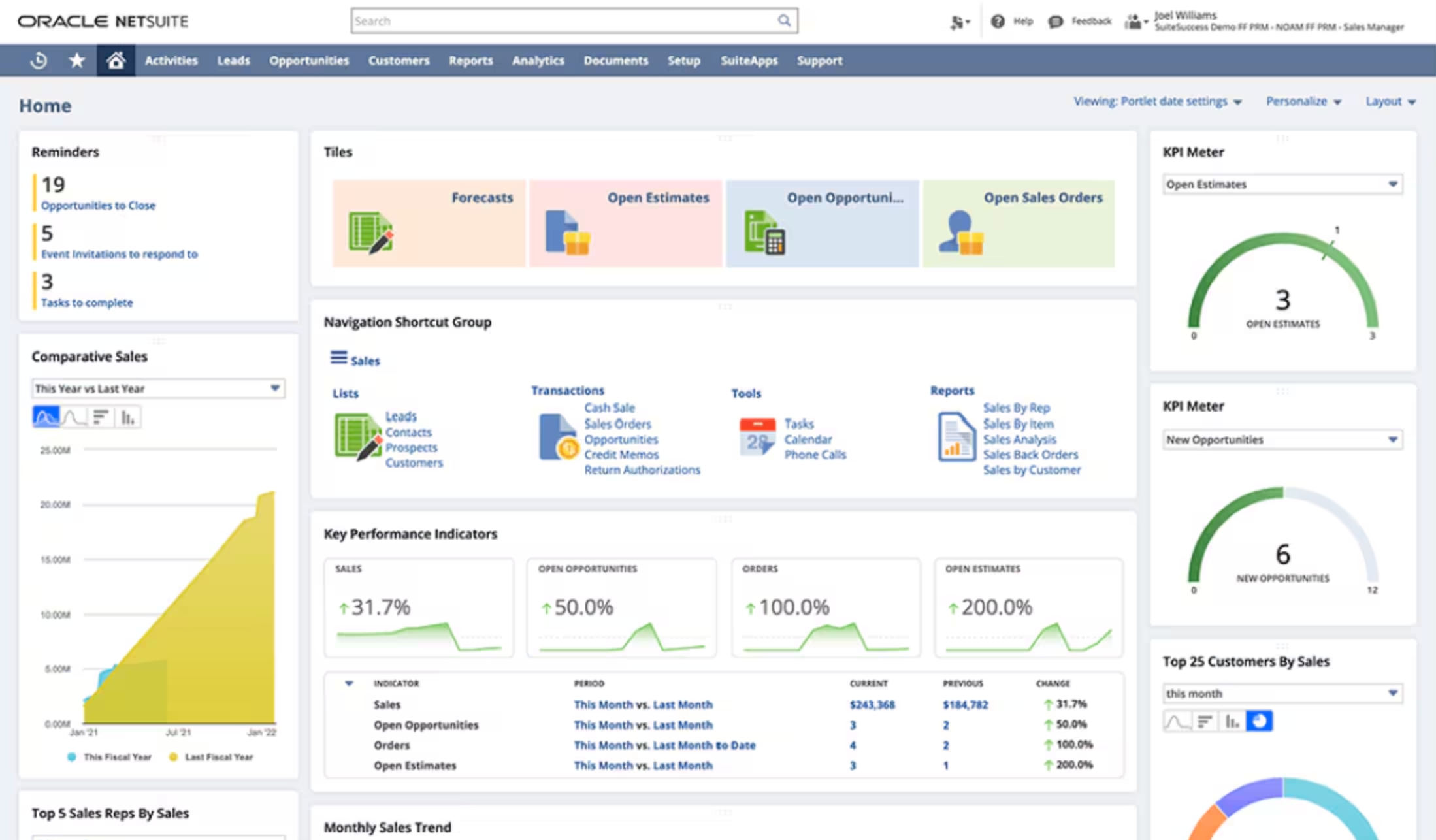

NetSuite is a full business software stack solution that includes robust options for financial reporting. Since NetSuite was specifically designed for large enterprises, it includes reporting features that support their needs, such as combining financial, operational and statistical data into one report. You can also create custom versions of the same report to present to different audience, so you can highlight different aspects of the same data set.

NetSuite does not publicly disclose its pricing information. You’ll have to contact their sales team for a custom quote.

For more information, read the full NetSuite review.

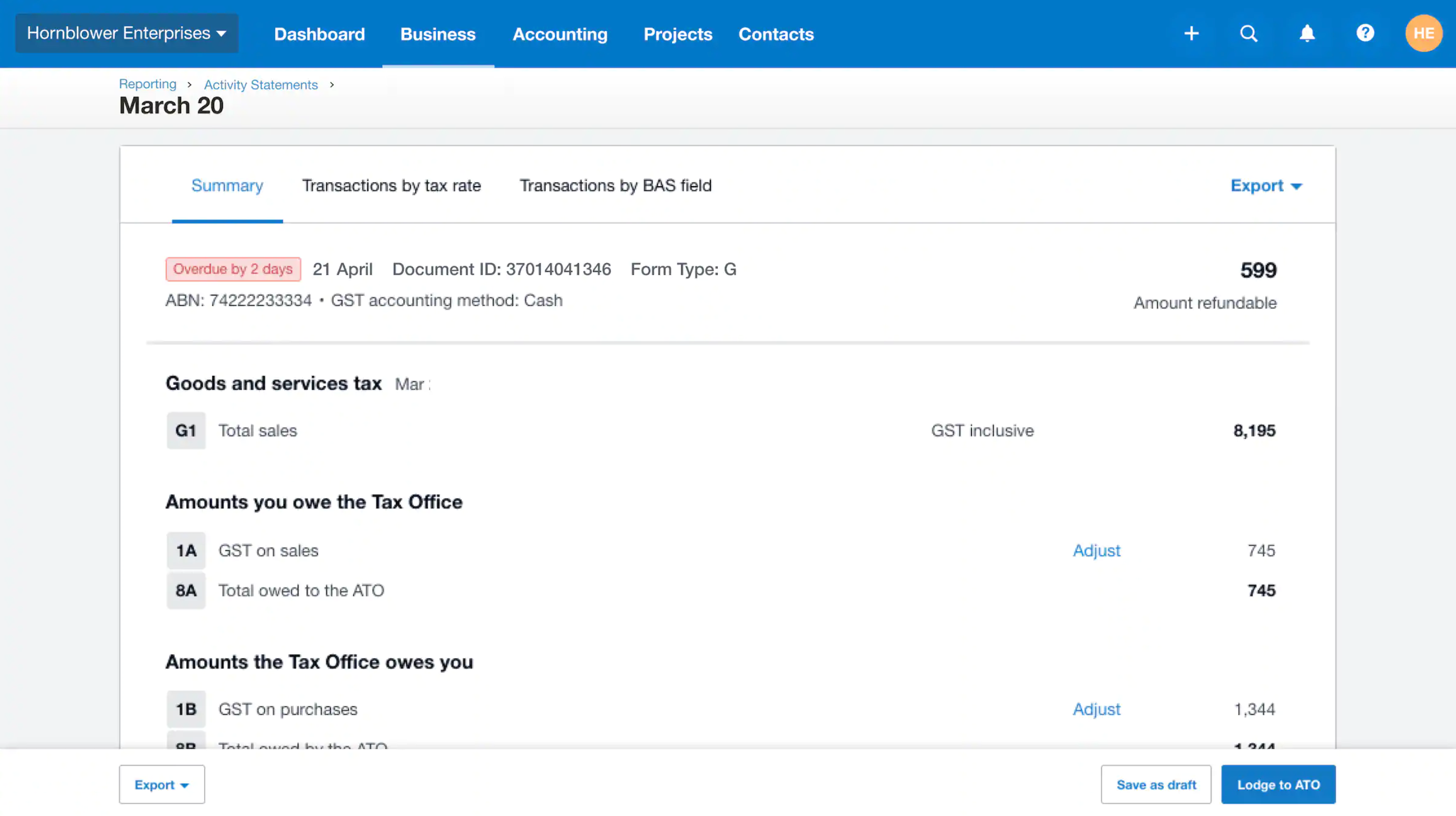

If you’re a small-business owner looking for simple financial reporting software, Xero is a great option to consider. This accounting software offers a limited selection of default reporting templates, such as profit and loss statements, assets and liabilities, and budget variances.

You can also create your own custom reporting templates and save them for later to make it easy to generate future reports. Xero also provides a good selection of other accounting features, such as invoice creation and expense management.

Xero accounting also three different pricing tiers to choose from:

Xero also offers a 30-day free trial so that you can test drive the software before committing to a paid plan.

For more information, read the full Xero review.

Zoho Books currently offers 24 accounting and financial reports to choose from, making it a worthy contender for your financial reporting software pick. The reports can be scheduled to automatically sent at specific time intervals and you can also configure role-based access to the reports. Zoho Books also offers four more ways to automate work — workflows, webhooks, email alerts and custom functions — to cut down on repetitive manual tasks.

Zoho Books offers six different pricing plans, which are billed per organization instead of per user. The base pricing plans are:

Zoho Books also offers the following add-ons:

For more information, read our full Zoho Books review.

The best financial reporting software should already come with a library stocked full of common financial reports, such as profit and loss statements. These pre-built templates make it possible to generate a new report in just a few minutes.

In addition to the pre-built templates, the financial reporting software should also let you create and save your own reporting templates. You should be able to build your own from scratch as well as edit and save existing templates.

Financial reporting software should integrate with all your data sources, and most come with pre-built connectors to do just that. The software should also give you the option to manually upload data via an Excel sheet or another file format.

Once the final report is ready, you should be able to share it through multiple avenues. Some of the most common are downloading a PDF and emailing it to colleagues, but some financial reporting software also allows you to publish to the web or present it online.

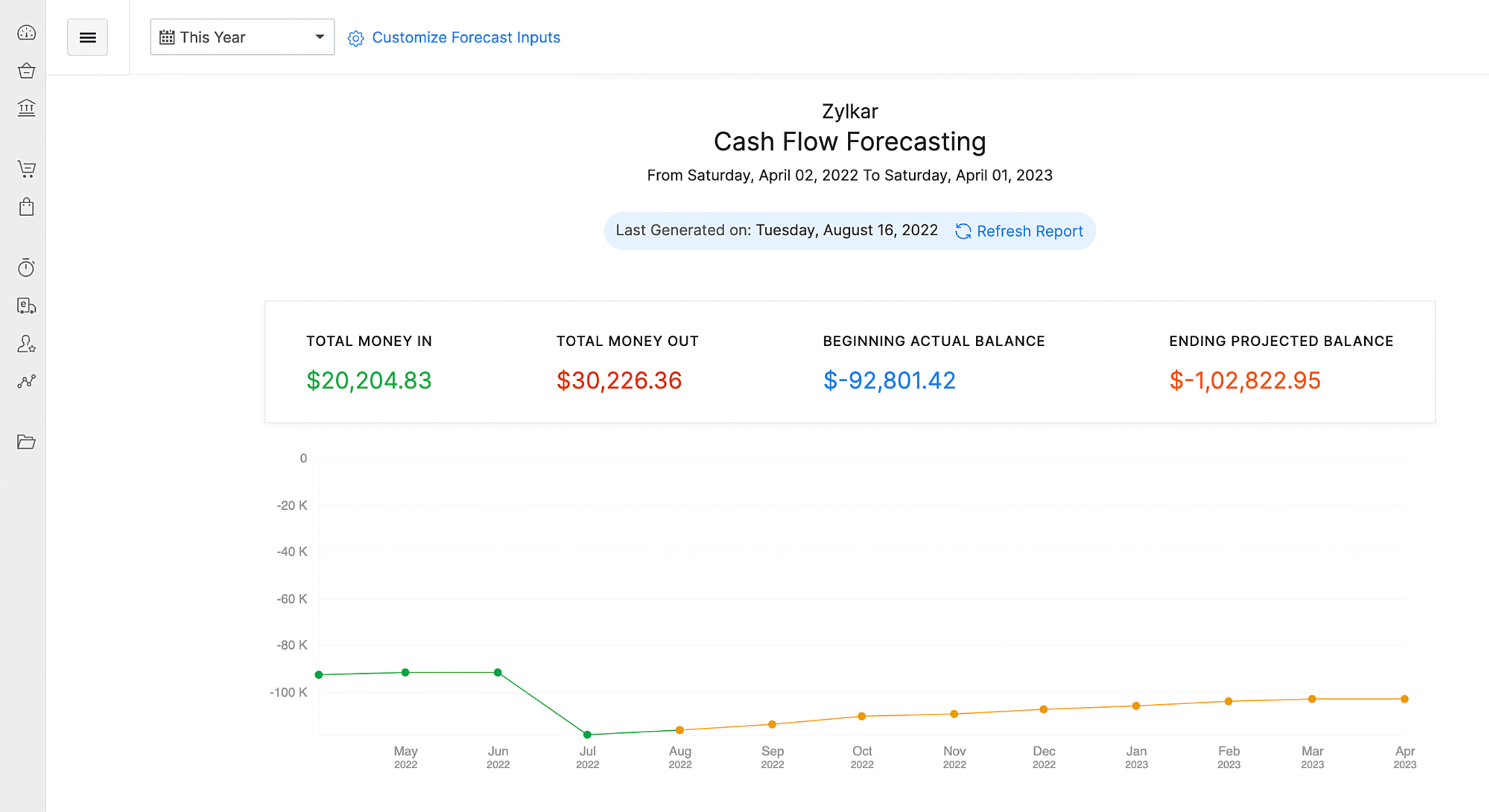

In addition to generating reports for past data, the best financial reporting software will also be able to create forecasts for the future based on data-driven trends. This helps your business to make evidence-based decisions grounded in data.

To choose the best financial reporting software for your business, consider your needs as well as your budget. A small business will likely be satisfied with a handful of basic reporting templates at a lower price, while enterprises will be willing to pay more for advanced features like multi-entity reporting.

Make a list of your must-have features and prioritize those during your search. If you have a strict budget, you might have to be willing to compromise on some of them to keep costs low. Ask yourself if the lower costs are worth skipping the missing features or having to do time-consuming manual workarounds.

During your search for the best financial reporting software, take advantage of free trials, free accounts and free software demos. For the demo calls, come prepared with specific questions and requirements so you can confirm the software will integrate with the rest of your business software stack.

To choose the best ecommerce accounting software, we consulted product documentation, demo videos and user reviews. We evaluated products based on pricing, customer service, user interface design and scalability. We also considered features such as reporting templates, data import, forecasting and integrations.