FreshBooks: Fast FactsStarting at $17 per month or $204 per year

|

Jump to:

FreshBooks is an accounting, invoicing and billing software program that helps small businesses get paid accurately and on time. Its invoicing feature is its biggest strength: Users can create, customize and send an unlimited number of invoices with FreshBooks, which also offers thorough time-saving automations like automatic late payment reminders.

Although FreshBooks has basic accounting features like expense tracking, receipt scanning and accounting reports, its primary focus is on invoicing and billing rather than comprehensive bookkeeping. While some small businesses and freelancers can get by with just the accounting tools FreshBooks offers, businesses that sell inventory or have complex financial needs might need a more robust accounting solution, such as QuickBooks Online.

In our FreshBooks review, we’ll review FreshBooks’ pros and cons, explore its most important features and recommend comparable accounting software products that could work for you if FreshBooks doesn’t.

Can’t wait? Skip to the end to see our conclusion.

Rippling automatically syncs all your business’s HR data, like hours, leave and absence, with payroll. You never need to fill out spreadsheets and upload to another system— we pay your employees and HMRC directly.

FreshBooks has three main plans targeting freelancers, small businesses and midsize businesses. It also has an enterprise-level plan with customizable pricing and features.

All FreshBooks plans come with a 30-day free trial. FreshBooks also runs frequent sales that lock in deep discounts for your first six months. Opting for the discount requires you to waive your 30-day free trial, but FreshBooks’ 30-day money-back guarantee ensures you won’t have to pay for the full six months if you decide FreshBooks doesn’t work for you (as long as you do so within your first month of use).

| Plan name | FreshBooks Lite | FreshBooks Plus | FreshBooks Select |

|---|---|---|---|

| Unlimited customized invoices | Yes | Yes | Yes |

| Number of billable clients per month | FreshBooks Lite | Up to 50 | Unlimited |

| Expense receipt capture | No | Yes | Yes |

| Mobile app access (iOS and Android) | Yes | Yes | Yes |

| Starting price per month | $17 | $30 | $55 |

Plan details up to date as of 5/31/2023.

Price: Starts at $17 per month

FreshBooks Lite is an invoice-centric plan that works best for freelancers and other self-employed business owners who don’t need much more than the bookkeeping basics. Its key features include unlimited customizable invoices, client access portals, online payment acceptance and basic financial tracking tools.

While the Lite plan doesn’t limit the number of invoices you can send, the software only lets you bill five clients per month. If you bill more than five clients in a given month, you’ll be charged for the more expensive Plus plan, which includes up to 50 clients.

Price: Starts at $30 per month

FreshBooks Plus works best for businesses that work with between five and 50 clients per month. Along with unlimited recurring invoices (a feature included with every FreshBooks plan), FreshBooks Plus lets you set up recurring billing and send unlimited proposals.

Most importantly, FreshBooks Plus adds more thorough accounting features that small businesses with employees can’t afford to pass up. It includes the following features:

Price: Starts at $55 per month

FreshBooks Premium is a good fit for midsize businesses with multiple employees and more than 50 clients. It adds the following accounting and billing features:

FreshBooks Premium costs $55 per month or $660 for a full year.

Price: Custom pricing only

FreshBooks Select is a fully customizable accounting plan for enterprises. FreshBooks Select customers get a much heavier level of support and customization than other FreshBooks users, including a dedicated account manager, data migration services and white-glove, company-specific onboarding.

FreshBooks users can add the following features for an additional fee:

Unlike Xero’s cheapest plan, which limits users to sending only 20 invoices a month, every FreshBooks plan includes unlimited customizable invoices. Users can also draw up estimates, share estimates with customers via the FreshBooks client portal and turn estimates to invoices in one click after client approval.

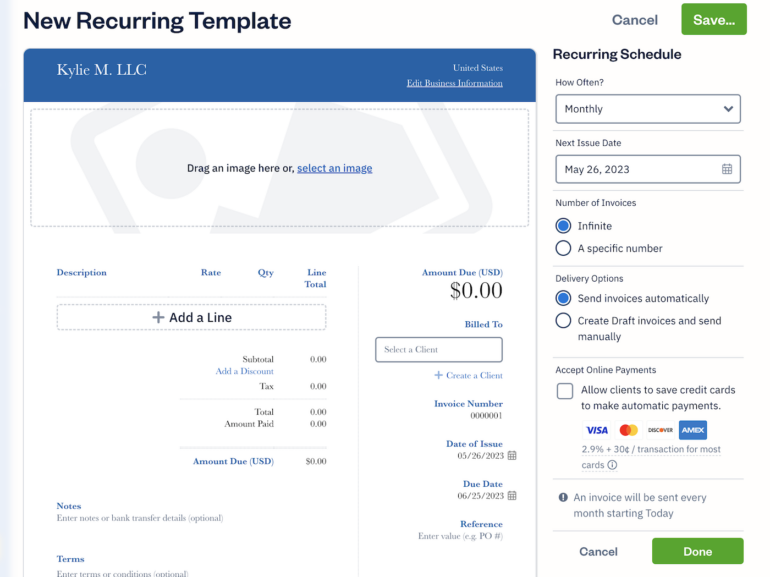

FreshBooks also automates more aspects of invoicing than most competitors with these stand-out invoice features:

Figure A

FreshBooks syncs with your bank account to show you an up-to-date snapshot of your business expenses. Users can also upload their own expenses, assign expenses to clients and attach them to invoices.

Additionally, the software automatically categorizes expenses to simplify tax write-offs and cash-flow tracking.

Figure B

Many of FreshBooks’ competitors require you to add a third-party integration to track time. With FreshBooks, though, time tracking is a built-in tool included with each plan for no additional fee.

When you track time on FreshBooks, the hours you log can be easily added as line-items to any invoice for easier billing. As an employer, you can sort hours worked by client, team member, date and project to understand how work time is being spent.

Finally, you can add notes that clarify what was worked on during the logged time. As with most elements of FreshBooks, your time-tracking notes can be easily added to your invoices.

Figure C

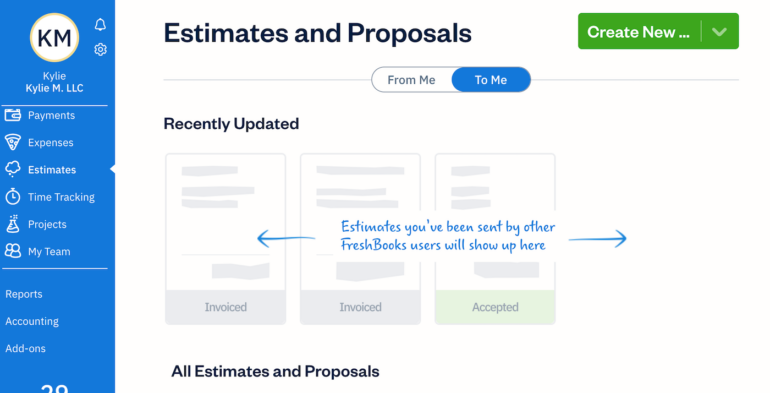

Along with creating invoices, FreshBooks users can create an unlimited number of estimates and proposals. Estimates, invoices and proposals are easy to send to clients using FreshBooks’ client portal, where your customers can view, accept or reject the paperwork you send over.

Once a client approves an estimate within the portal, you can convert it to an invoice with one click. You can also use FreshBooks to store, approve and reject any estimates and proposals sent to you by anyone else who uses FreshBooks’ accounting software.

Figure D

| Feature | Xero | QuickBooks Online | Wave Accounting | FreshBooks |

|---|---|---|---|---|

| Invoice limit (with cheapest plan) | 20 per month | Unlimited | Unlimited | Unlimited |

| Expense tracking | With some plans | Yes | Yes | Yes |

| Inventory management | Yes | With some plans | No | Basic tools only |

| User limits | Unlimited | Up to 25 | Unlimited | $11 per extra user |

| Third-party integrations | 1,000+ | 500+ | Limited | 100+ |

| Starting price per month | $13 | $30 | Free | $17 |

Plan details up to date as of 5/31/2023.

Starting price: $13 per month

Like FreshBooks, Xero helps freelancers, small-business owners and midsize-business owners track their finances, accept online payments and send invoices. Xero integrates with HubDoc so you can upload bills and receipts for easier financial management.

Unlike FreshBooks, Xero includes inventory tracking with every plan. It also lets you add as many users as you want at no additional cost, which makes Xero’s accounting software ideal for financial collaboration.

Learn more about how FreshBooks and Xero compare in our comprehensive analysis of FreshBooks vs. Xero.

Starting price: $30 per month

Intuit QuickBooks Online is one of the oldest, most popular and most comprehensive accounting software in the world. Its plans support businesses of all sizes, from self-employed freelancers and contractors to enterprises.

Generally speaking, QuickBooks Online has more bookkeeping and accounting features than FreshBooks. Both accounting solutions let users track expenses, send an unlimited number of invoices per month, accept payments online and generate estimates. QuickBooks’ higher-tier plans add features like bill management, project profitability tracking and inventory management.

Learn more about how QuickBooks Online and FreshBooks compare in our comprehensive analysis of QuickBooks vs. FreshBooks.

Price: Free for life

Wave Accounting is one of the best, most fully featured free accounting solutions for small businesses. Many of its features overlap with FreshBooks’, including its customizable invoicing tool, expense tracking and online payment expenses.

Wave also lets you sync an unlimited number of bank accounts and credit cards to your Wave software so you can get a completely accurate view of your finances. Unlike FreshBooks, Wave uses double-entry accounting, lets you add an unlimited number of users and offers thorough income tracking.

Learn more about how Wave Accounting and FreshBooks compare in our comprehensive analysis of Wave Accounting vs. FreshBooks.

To evaluate FreshBooks, we set up a free account, viewed a demo and created invoices within the software as part of our hands-on test project. To ensure our perspective wasn’t the only one informing our piece, we also carefully considered third-party reviews of FreshBooks from verified users on sites like Trustpilot, Gartner Peer Insights, Consumer Affairs, the Better Business Bureau, the App Store and Google Play.

During our research and hands-on testing processes, we paid particular attention to how FreshBooks compared to competitors in the following crucial areas:

FreshBooks’ unlimited invoicing, client collaboration portal, automatic expense tracking and easy estimate-to-invoice conversion make it one of the best accounting software options for invoice-centric businesses.

Additionally, its extremely user-friendly browser interface and apps make FreshBooks perfect for first-time business owners. If you’re in your first year of business and are still getting the hang of complicated financial tracking — especially understanding your business tax obligations — FreshBooks is a great pick.

If FreshBooks doesn’t seem like the right fit for you, we recommend Xero for inventory management and unlimited users, QuickBooks Online for more thorough accounting features and Wave Accounting for truly free bookkeeping.

Or, if your business has more complex financial needs than FreshBooks can reliably support, look at the best accounting software for enterprises to find comprehensive accounting tools with hefty, enterprise-level support.