Hiveage fast factsPricing: Starts at $0 for up to 5 clients Key features: |

Hiveage is an invoicing app that’s targeted at freelancers and small businesses. It also includes tools for accepting payments, tracking expenses and generating simple financial reports.

In this review, we break down the pros and cons of Hiveage to help you decide if it’s the right choice for your small business.

Jump to:

The free version costs $0 for up to five clients as well as unlimited invoices, estimates, time tracking and expense tracking.

The Basic plan costs $16 per month if billed annually or $19 a month if billed monthly for up to 50 clients. It includes everything in the free plan, plus financial reports.

The Pro plan costs $25 per month if billed annually or $29 a month if billed monthly for up to 250 clients and five team members. It includes everything in the Basic plan, as well as automatic payment reminders and the ability to use your own domain, including sending emails from it. A 14-day free trial of this plan is available.

The Plus plan costs $42 per month if billed annually or $49 a month if billed monthly for up to 1,000 clients and 10 team members. It includes everything in the Pro plan, as well as personalized migration support and API access.

If you have more than 1,000 clients, you must contact Hiveage to get a quote for a custom plan.

Hiveage makes it simple to generate invoices fast. Choose from three invoice templates and customize them with your logo and business information. Then add your data, like time tracking and expenses, and send the final email to the client.

You can also add unlimited taxes, discounts and shipping charge entries on Hiveage and then add them to invoices for automatic calculations. Hiveage tracks when invoices are created, sent, viewed and paid so that you can always see the status. And you can set up automatic payment reminders and receipts so Hiveage reminds your clients for you.

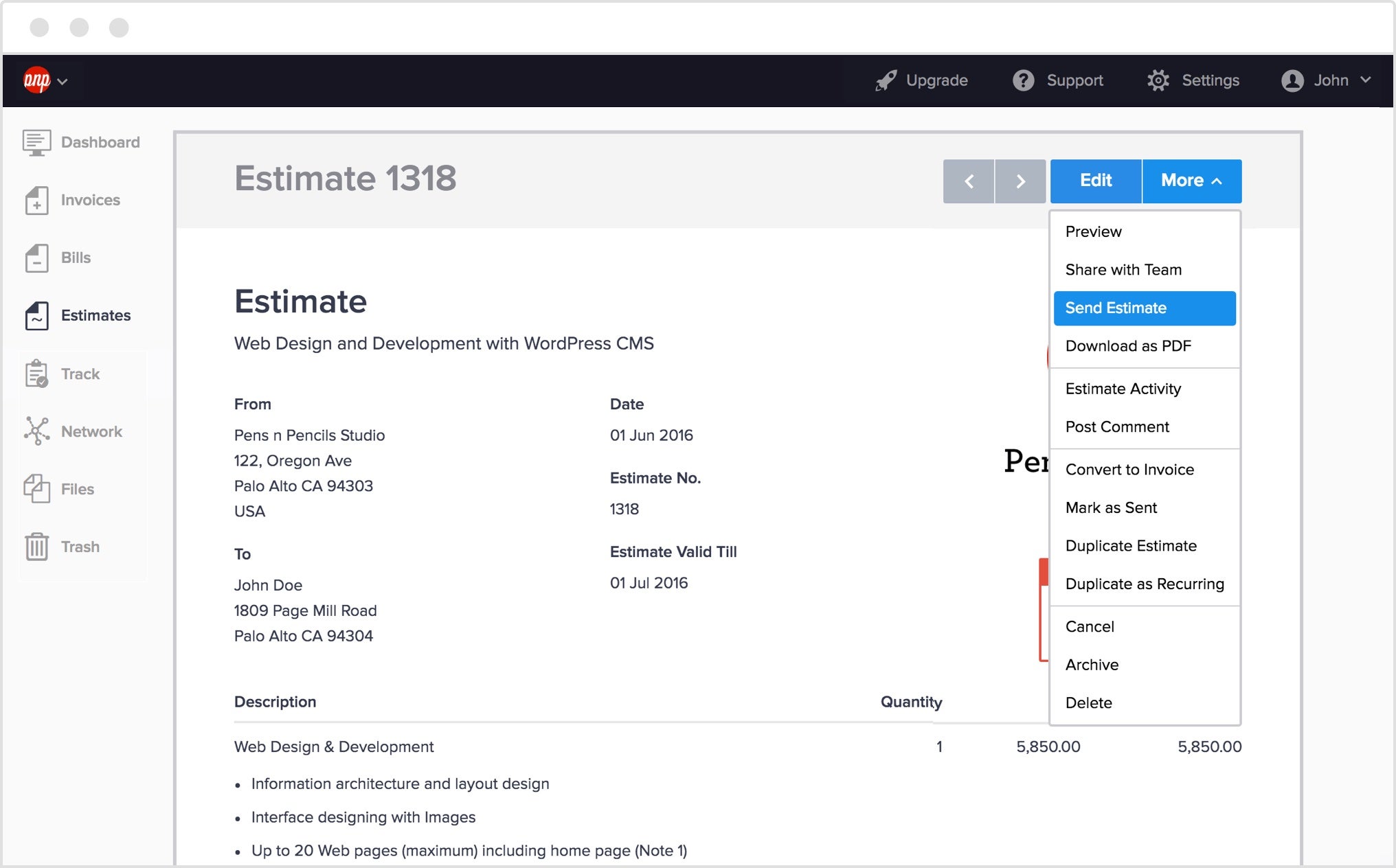

Figure A

Hiveage also makes it simple to generate estimates (Figure A) that clients can view and accept with only a few clicks. You can set an expiration date and send expiration reminders to speed up approvals, as well as view expiration activity. Once the work is completed, click the Convert to Invoice button to automatically generate an invoice.

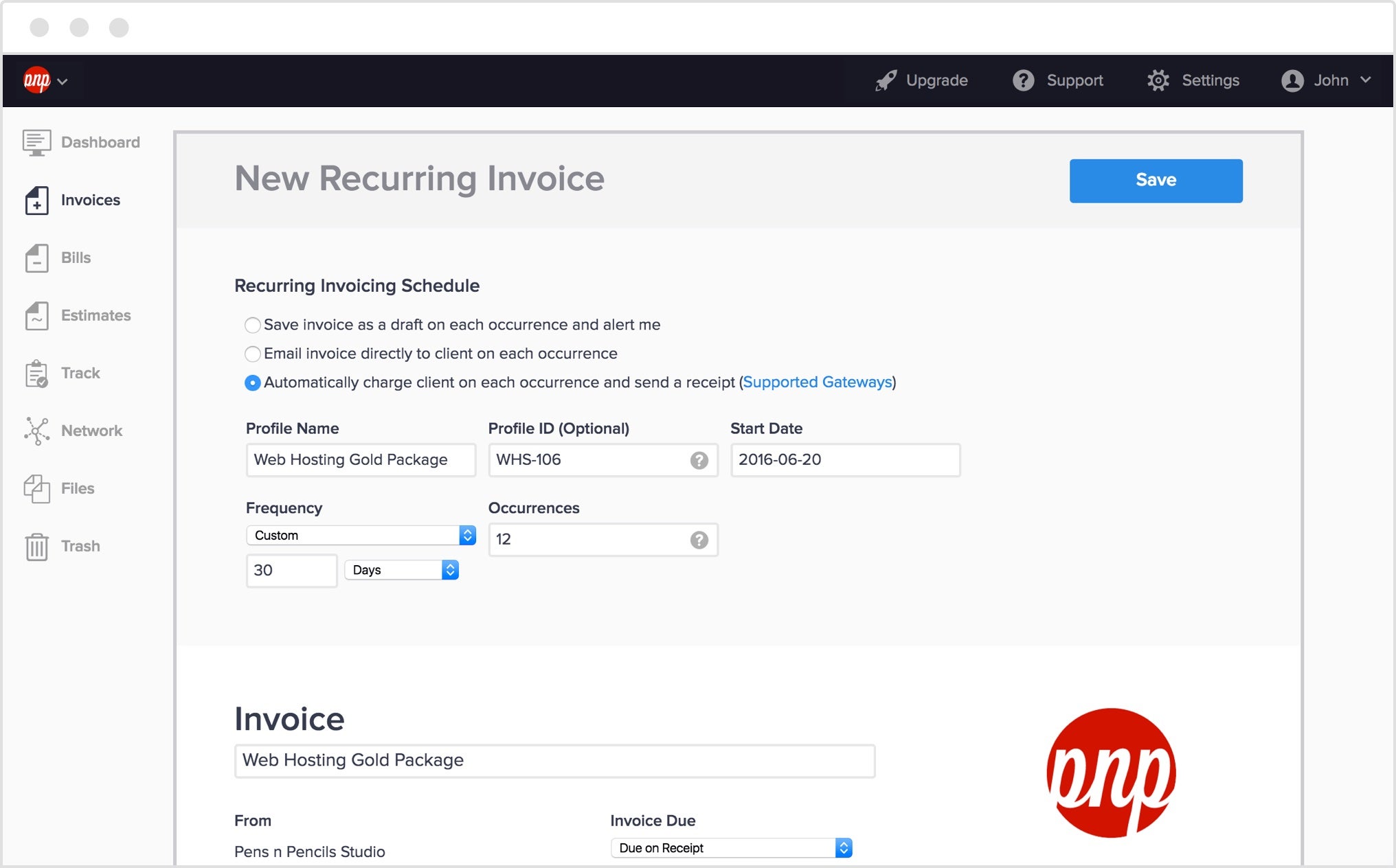

Figure B

If you have subscriptions or recurring invoices, Hiveage lets you set up daily, weekly, monthly or yearly recurring payments on your client’s credit card. You can also send out automated recurring invoices (Figure B) at a custom interval of your choice, and your clients can then make a payment.

If you already have an existing invoice that you want to set up as recurring, you can do that with a single click from the dropdown menu. You can also set the recurring invoices up for review so they don’t get sent without your approval.

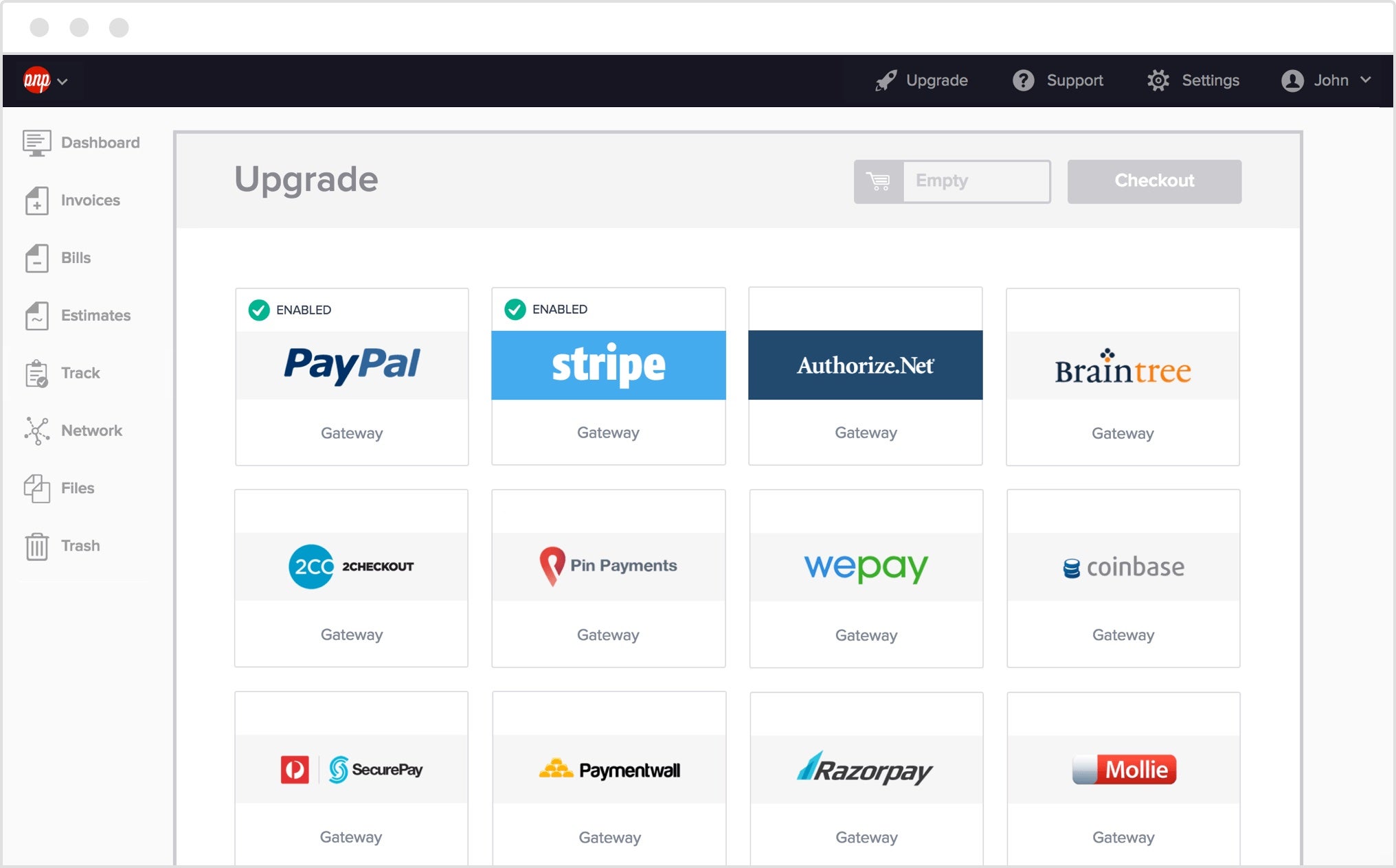

Figure C

Hiveage connects with more than a dozen online payment gateways (Figure C), including PayPal, Stripe and Square. Payment options are added directly to your invoice templates, and you can offer multiple payment options so customers can choose the one that works best for them. Customize your terms, such as accepting partial payments or automatically sending receipts.

If you’re located in the U.S., you can also accept credit card and debit card payments directly in your Hiveage account thanks to their partnership with Worldpay. Hiveage accepts all major cards, including Visa, Mastercard, Amex and Discover. It charges a fee of 2.9% per transaction, which is within the standard range.

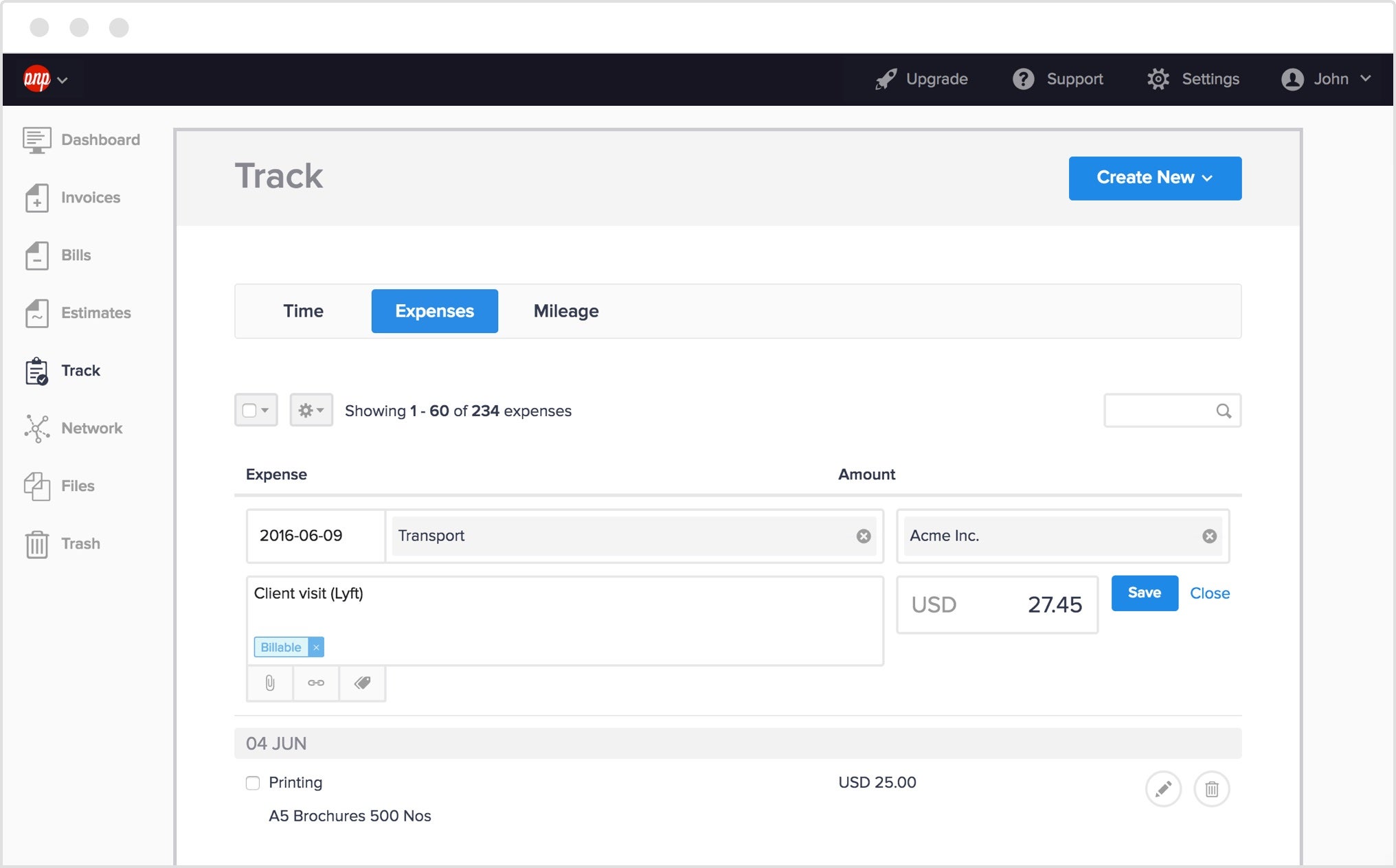

Figure D

In Hiveage, you can track both expenses and mileage for reimbursement (Figure D). You can save all the details, including setting taxes and attaching files. However, Hiveage does not offer receipt capture in its mobile app, which is something offered by many other expense management solutions.

You can also sort expenses based on tags and categories to improve organization. Mileage can be tracked in either miles or kilometers, and you can set different rates for different trips. Keep track of expenses’ status by marking them as billed or unbilled. Once you’re ready to bill, select the expenses you need to get paid for and generate an invoice or bill.

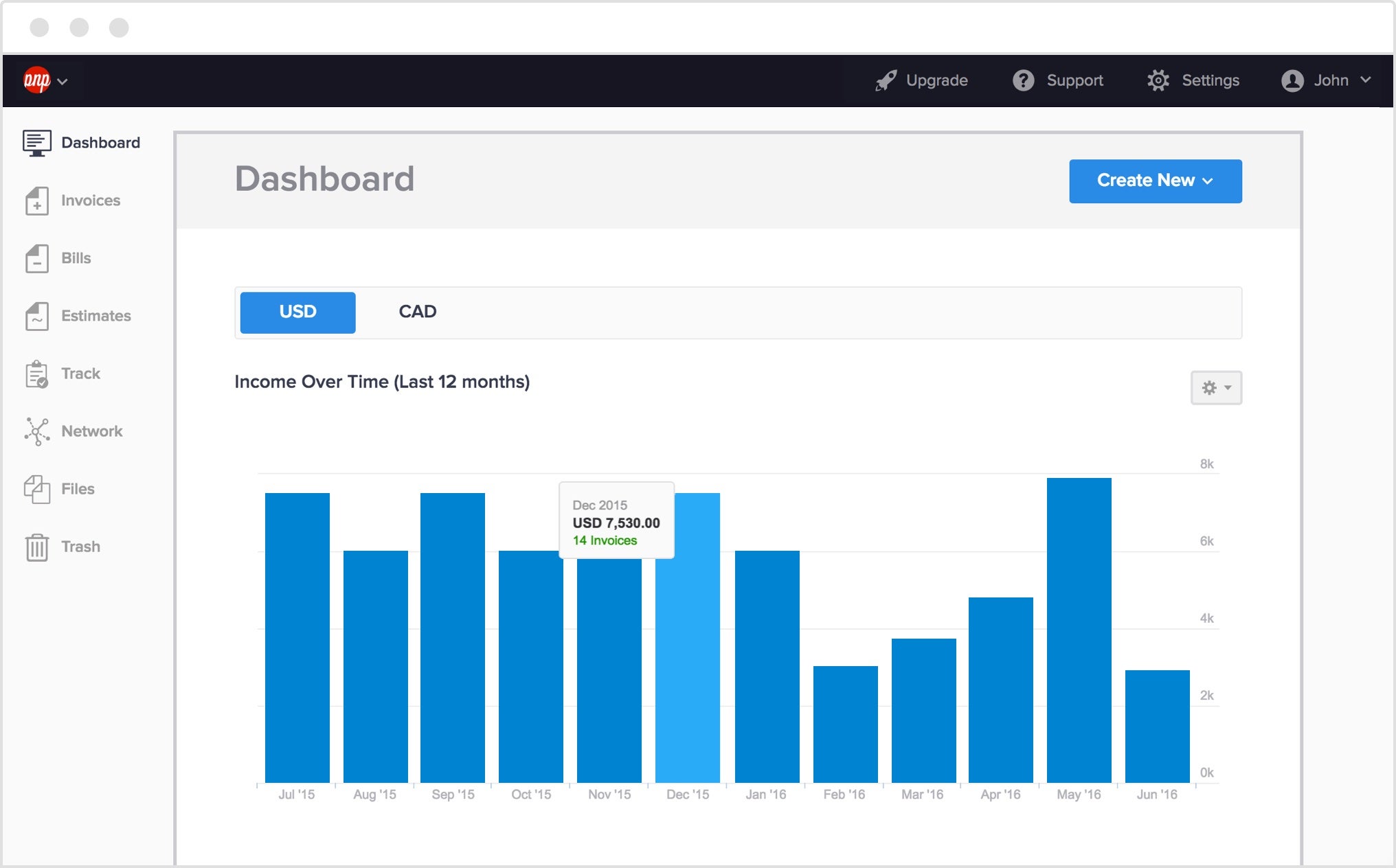

Figure E

Hiveage includes simple charts that are displayed on the dashboard when you log in (Figure E). These charts summarize income over time, accounts receivable and accounts payable. Hiveage also provides a monthly summary and year-to-date income vs. expenditure summary so you can look back on past financial performance.

If you have a paid plan, you can also generate five different reports in Hiveage: accounts aging, revenue by client, invoice details, tax summary and output vs. input tax summary. While these reports are helpful, Hiveage doesn’t offer as wide a variety of reports as competitors like HoneyBook or FreshBooks.

Except for the payment gateways, Hiveage relies on Zapier for integrations, which means you’ll need a Zapier account to access them. Here are some of the Zaps that are available for Hiveage:

Hiveage is a good choice for freelancers and small-business owners looking for a simple invoicing tool. It is easy to learn and presents a low learning curve, even for beginners who have never used invoicing software. Less customization is available than some other software — there are only three invoicing templates, for example — but this helps cut down on complexity. It’s also a great choice for people on a budget since it has a forever free tier of service.

Hiveage also includes basic tools for expense and mileage tracking as well as financial reports, though these features are not as robust as some competitors’. We appreciate that Hiveage connects with over a dozen payment gateways, although we wish that users outside the U.S. could process credit and debit card payments directly in Hiveage. If you want to use any integrations, you will have to set them up through Zapier, which requires a second account and potentially other fees as well.

Hiveage also does not include any tools for accounting, bookkeeping or payroll processing. As such, it should be used in conjunction with accounting software like QuickBooks or Xero Accounting. Thus, Hiveage is the best choice if you already have accounting or bookkeeping software and are just looking for an invoicing tool.

However, you should know that most accounting software, including QuickBooks, provides many of the same features as Hiveage, including invoicing, time tracking, expense tracking and financial reports (though some of these features might be confined to a higher pricing tier). If you already have this software, explore it to see what features you currently have and whether or not Hiveage will help fill in the gaps.

FreshBooks is intuitive accounting and bookkeeping software that is often named as a competitor to QuickBooks. FreshBooks starts at $17 a month, about half the price of QuickBooks, and includes tools for invoicing, payments and time tracking. Consider FreshBooks if you also need accounting software or want more robust reports than what Hiveage can offer.

If you are specifically looking for a free invoicing tool, then consider Zoho Invoice, which also offers a forever free plan. It integrates seamlessly with Zoho Books for accounting and Zoho Expense for expense management — both of which offer a forever free plan as well. Zoho is a great option if you are on a budget but still need software to manage the financial side of your small business.

HoneyBook is a unique software solution that combines invoicing with scheduling, CRM capabilities and other helpful features. It doesn’t include accounting features but has native integration with QuickBooks. So if you’re in need of scheduling or CRM in addition to invoicing support, HoneyBook might be a great all-in-one solution for your needs.

To review Hiveage, we signed up for a free trial. We also consulted product documentation and user reviews, considering features such as invoices, estimates, online payments, time tracking and expense tracking. We also weighed factors such as pricing plans, integrations, user interface design and customer support.