Your company’s payroll processing software impacts most aspects of your business, from how happy your employees are at work to how much time you have to spend on time-consuming payroll problems.

Two of the most popular cloud-based payroll software for small businesses — QuickBooks Payroll and Patriot Payroll — were tailor-made specifically to address these issues: Both payroll providers are exceptionally user-friendly with 24/7 customer service, accessible employee portals and time-saving payroll features.

For the most part, QuickBooks Online Payroll is the better choice for users who can afford to spend more on payroll and who want to offer employee benefits. Patriot Payroll, on the other hand, is a solid pick for the smallest of small businesses, especially businesses with a tight payroll budget or with just one or two employees.

Jump to:

| Features | QuickBooks Online Payroll | Patriot Payroll |

|---|---|---|

| Our star rating | 3.6 stars out of 5 | 3.8 stars out of 5 |

| Starting base price | $45/mo. | $17/mo. |

| Starting per-payee price | $5/payee | $4/payee |

| International payroll | No | No |

| Time tracking | With higher-tier plans | Additional fee |

| Workers’ compensation integration | Yes | Yes |

| Optional employee benefits | Yes | No |

| Benefits administration | Yes | No |

| Accounting software integration | QuickBooks Online | Patriot Accounting, QuickBooks Online |

| Learn more |

Plan and pricing information up to date as of 7/12/2023.

QuickBooks Payroll costs more than Patriot Payroll, but it also comes with more employee-centric features. It also has more plans, each of which includes more HR features as they increase in cost:

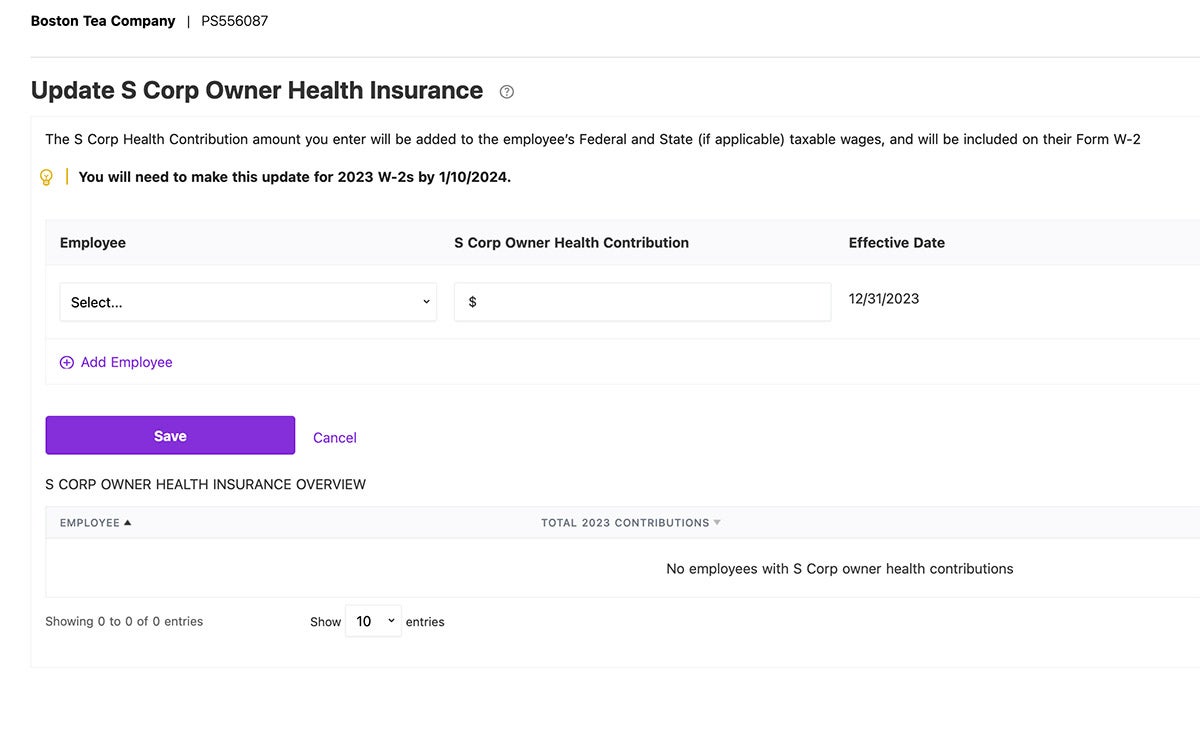

All three plans have more or less the same payroll features, including automatic payroll processing, full-service tax administration, 1099 preparation and e-filing, employee benefit administration and more.

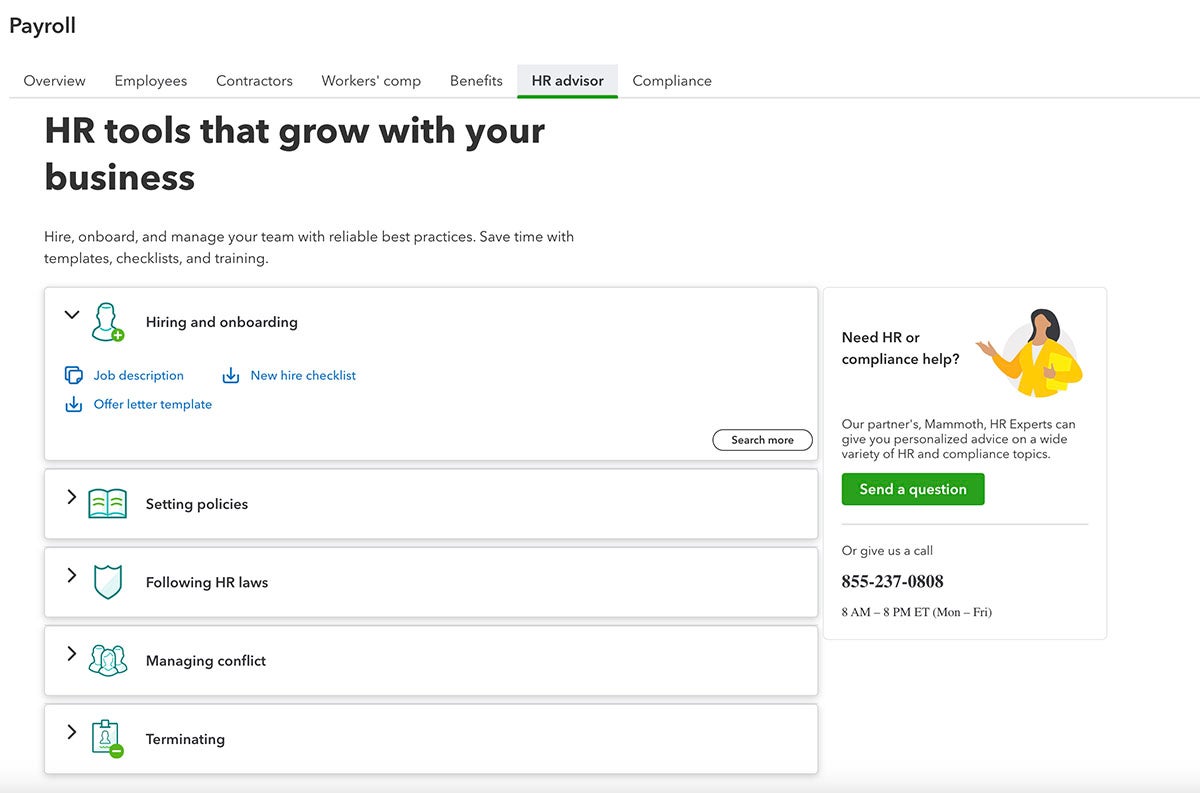

With the two pricer plans, users get same-day direct deposit (rather than next day), They also gain access to an HR resource center administered by QuickBooks’ partner Mineral, Inc. Elite users can also contact an on-demand HR advisor for personalized human resource help.

QuickBooks Payroll does have a few extra fees that interested businesses should be aware of:

Patriot Payroll’s cost is one of the lowest in the business — though add-on fees can push its pricing up quickly. Patriot’s two plans are identical in every way apart from their tax service: While both plans include tax calculation, only the full-service plan offers automatic tax deduction and remittance:

Both plans include features like unlimited monthly payroll runs, two-day direct deposit (for some customers), employee self-service and unlimited users with admin permissions. Both plans also share the same add-on fees for certain crucial services:

Winner: Tie

Both QuickBooks Payroll and Patriot Payroll calculate paychecks for hourly workers, salaried workers and contractors. They also calculate payroll taxes, including the following:

All three QuickBooks Payroll plans include automatic tax service, as does Patriot’s full-service plan.

Local tax filing isn’t available with QuickBooks Payroll’s cheapest plan, QuickBooks Payroll Core. However, only QuickBooks has an autopilot feature that enables you to create a pre-set schedule for your payroll runs (though it’s only available for paying salaried employees).

Winner: QuickBooks Payroll

Both of Patriot Payroll’s plans include two-day direct deposit, but only for certain qualifying customers. (Unfortunately, Patriot’s website doesn’t explain which customers qualify or why.) Meanwhile, QuickBooks’ cheapest plan, Payroll Core, comes with free next-day direct deposit. Its two higher-tier plans have same-day direct deposit.

QuickBooks charges an additional fee for contractor direct deposit, but there are no fees for paying salaried or hourly employees via direct deposit.

Winner: QuickBooks Payroll

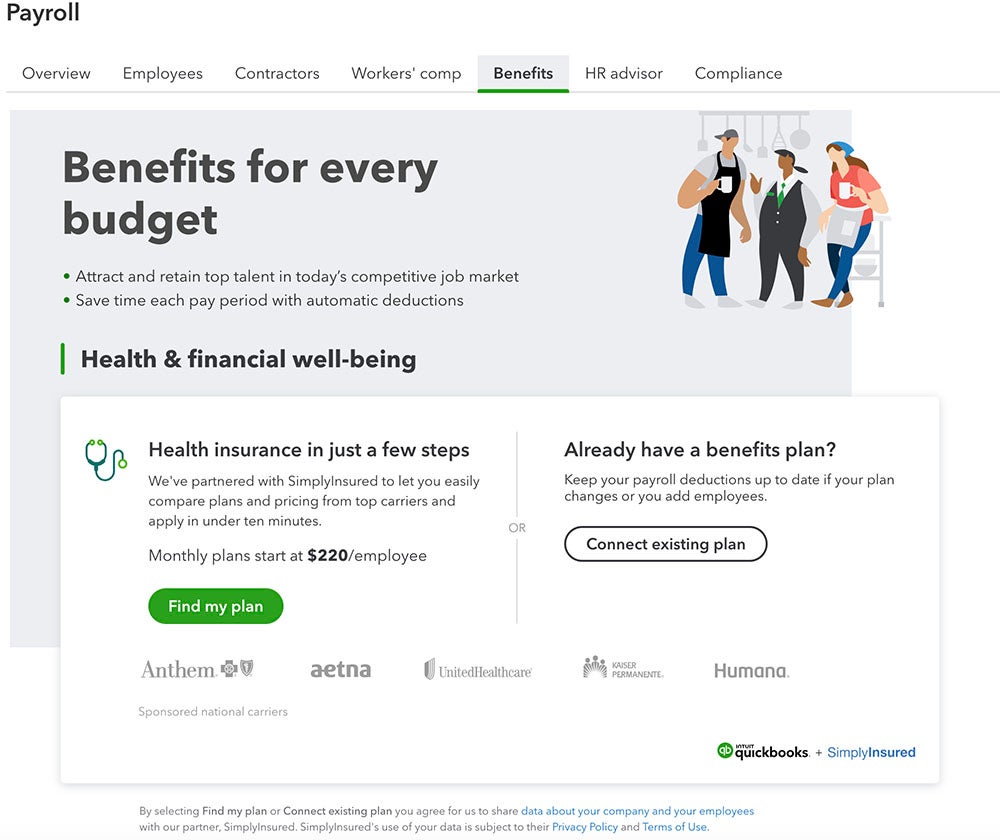

With Patriot Payroll, users can manually set up payroll deductions for employee benefits. Patriot also integrates with workers’ compensation insurance at no additional fee (unlike QuickBooks, which charges extra for integration). And while Patriot doesn’t offer 401(k) plans, it does offer free 401(k) integration for easier deductions.

In contrast, QuickBooks Payroll enables automatic employee benefit administration (admittedly for an additional fee). It also partners with insurance providers to help business owners find affordable, comprehensive employee benefits directly from their payroll dashboard.

Winner: Patriot Payroll

Of the two payroll providers, only QuickBooks Payroll has 24/7 customer service. Patriot’s customer service is available 9 a.m. to 7 p.m. ET over the phone. But on nearly every review platform, users call out Patriot’s excellent customer service department, noting its fast response times, friendly agents and real-person support.

In contrast, QuickBooks is notorious for its low customer service ratings. Customers report having a hard time getting in touch with a real person, much less getting helpful support as needed.

QuickBooks also staggers its customer support levels based on which plan you choose: Payroll Core users can only access basic customer service while Payroll Elite users get top-notch customer care. Payroll Core users don’t have the option of paying extra for better customer service, which is another point of frustration for some users.

Winner: Tie

Some payroll companies, like Gusto and SurePayroll, sync with multiple third-party time trackers so users can choose their preferred tool at their preferred price. However, QuickBooks Payroll and Patriot sync only with QuickBooks Time (QuickBooks Payroll and Patriot) or Patriot Time & Attendance (Patriot only).

While both time-tracking tools are perfectly functional, it’s frustrating that users can’t choose the time tracker that best suits their needs. Plus, Patriot Time & Attendance costs an additional monthly fee ($6 per month) and employee fee ($2 per employee). Meanwhile, QuickBooks Time is only free for higher-tier QuickBooks Payroll plans. QuickBooks Payroll Core users have to pay a separate subscription fee to use QuickBooks Time, which starts at $20 a month.

To evaluate QuickBooks Online Payroll and Patriot Payroll, we set up free trial accounts with both providers so we could explore their interfaces, features and setup processes firsthand. We also read verified customer reviews from review sites like Trustradius, Apple’s App Store, Google Play and Gartner.

While conducting our research, we scored both products according to our internal algorithm, which ranks payroll software in the following weighted categories:

Our expert’s opinion and hands-on experience with the payroll software makes up the final 10% of our algorithm.

QuickBooks Payroll and Patriot Payroll work equally well for businesses that need easy, cloud-based payroll processing services. Both services have free two-day direct deposit to ensure your employees get paid on time, every time. Depending on the plan you choose, both payroll companies will calculate, deduct and remit your employees’ federal, state and local taxes.

If you’re not sure which product will work best for your company, we recommend signing up for a 30-day free trial with both providers. (Just remember to cancel your QuickBooks Payroll account before your 30 days are up if you don’t want to be charged automatically for the next month.)

Of course, QuickBooks Payroll and Patriot Payroll are far from the only payroll options for small and midsize businesses. If neither provider suits your preferences, we recommend looking into one of the following comparable solutions:

Read next: The 8 Best International Payroll Services for 2023

QuickBooks from Intuit is a small business accounting software that allows companies to manage business anywhere, anytime. It presents organizations with a clear view of their profits without manual work and provides smart and user-friendly tools for the business.

Justworks Payroll is a lightweight solution that simplifies Payroll and HR operations so you can focus on what matters most – running your business. Our user-friendly navigation, paired with reliable support, helps you monitor and maintain compliance, onboard and manage your teams, and navigate the complex world of payroll with confidence.

Designed for today’s needs and tomorrow’s ambitions, our adaptable solutions will elevate your operations & provide the tools for your business to thrive.

Payroll and HR that move you in the right direction. We give you everything you need to navigate payroll, HR, and benefits — so you can keep running your business smoothly.

Get your first month free, or join a demo to see everything we can do!

Paychex is a cloud-based payroll management system offering payroll, HR, and benefits management systems for small to large businesses. Paychex covers payroll and taxes, employee 401(k) retirement services, benefits, insurance, HR, accounting, finance and Professional Employer Organization (PEO).

Homebase automates your payroll process, so you can pay your team in a matter of clicks. Instantly convert your timesheets into hours and wages in payroll. When your team clocks in and out in Homebase, we instantly calculate hours, breaks, overtime, and PTO—and sync it all to payroll to help you avoid mistakes. Guess what? We’ll even transfer your payroll data to Homebase for you, so the switch is completely effortless and risk-free. Start today!