OnPay is a cloud-based payroll and human resources software that simplifies payroll processing, tax compliance, benefits administration and employee management. The professional employer organization platform is popular among accountants and bookkeepers as it provides the necessary tools and integration capacities for advanced operations.

Founded in 2007, OnPay has grown to serve thousands of businesses across the United States. With over 15 years in the business, the company constantly modernizes to provide the latest PEO technology. OnPay is popular and known for its ease of use, accuracy, affordability and customer service.

SEE: Read our OnPay review to get more information about how it works.

The platform offers a transparent pricing model (one plan at $40/month plus $6/month per employee) that includes unlimited pay runs, direct deposit, tax filings and payments, time-tracking and more.

OnPay also provides access to certified HR professionals, health insurance plans, 401(k) retirement plans and workers’ compensation insurance. The solution has a rating of 4.4 on Trustpilot. However, its most significant downside is that it does not provide payroll, HR, or compliance support for international or global operations.

Jump to:

| Product | Standard direct deposit | International payroll | Health benefits | Tax filing and payment | Starting price (per month) |

|---|---|---|---|---|---|

| OnPay | Same-day | No, U.S. employees only | Yes, all 50 U.S. states | Yes | $40 fixed + $6 per employee |

| Gusto | Two days, automated for default date payments | Yes | Yes, for 35 + U.S. states | Yes | $40 fixed + $6 per employee |

| Paychex | Next day (same day available with premium and elite plans) | Yes | Yes, all 50 U.S. states | Yes | $39 fixed + $5 per employee |

| Rippling | Two days, automated for default date payments | Yes | Yes, all 50 U.S. states | Yes | $8 per employee |

| Papaya Global | Two days, automated for default date payments | Yes, compliance and payroll support in 160 countries | Yes, all 50 U.S. states | Yes | $12 per employee |

| QuickBooks | Same-day, next-day, two days | Yes, through integrations | Yes, all 50 U.S. states | Yes | $45 + $5 per employee |

| Paylocity | Two days | Yes, through Blue Marble | Yes, all 50 U.S. states | Yes | Custom pricing |

The PEO market has been rising, driven by global digital transformation, hybrid work and data-driven trends. From payroll automation to advanced employee lifecycle management to accounting, reports, bookings and compliance, PEO vendors have taken payroll and HR to the next era.

In this competitive market, OnPay competes heavily with several leading providers, including Gusto, Paychex Flex, Rippling, Papaya Global, QuickBooks Payroll and Paylocity. While all vendors offer similar basic features necessary for modern PEO tasks, each specializes in particular sectors. All these software vendors try to differentiate themselves in the market by providing unique characteristics, services and technologies.

This report dives into each of OnPay’s top competitors, explores what they are best known for and lists the top features and use cases, so decision-makers have all the information they need before deciding which is the best fit for their business.

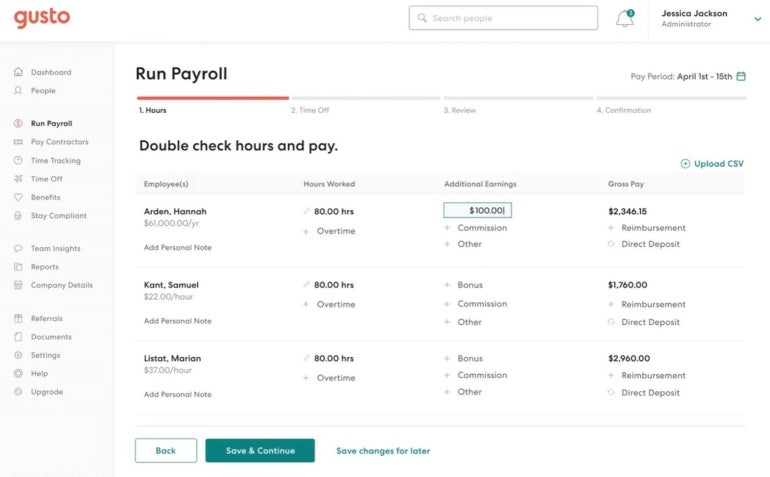

Gusto is popular among startups and small businesses looking for a one-stop-shop solution for HR and payroll. The platform differentiates itself by providing a simple, easy-to-use user interface while leveraging automation for teams to do more with less. Launched in 2012 as ZenPayroll, Gusto serves more than 300,000 businesses nationwide.

With Gusto, companies can hire, pay and manage workforces. While the platform does offer payroll and onboarding for international contractors, it does not provide compliance in that category.

Gusto allows integrations, can automatically file taxes, run compliance reports and do rapid onboarding. Despite having extensive features, Gusto has several shortcomings. Its health benefits features are not available for all 50 U.S. states. Additionally, as companies scale and hire more employees, Gusto can become expensive. The basic plan costs $40/month plus $6/month per person, the Plus plan costs $80/month plus $12/month per person and the Premium has an exclusive price.

Read our payroll software review of Gusto to learn more about its pros, cons and features.

| Features | OnPay | Gusto |

|---|---|---|

| Promotional offer | 30-day free trial with no limitation and full access | 30-day free trial |

| Mobile app | No, access via web browser only | Yes |

| 24/7 customer support | Yes | No |

| Direct deposit | Yes, same day | Yes, two days |

| IT support | Yes | No |

| Global payroll | No | Yes |

| Health insurance benefits | Yes, available in all 50 U.S. states | Yes, available in 35+ U.S. states |

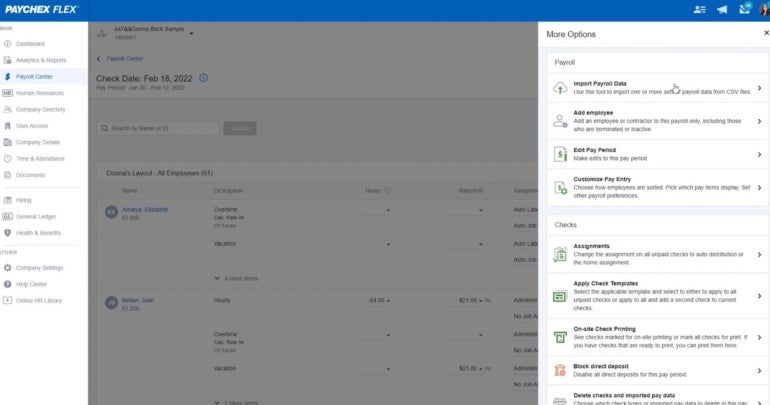

Paychex has worked in the payroll and HR market since 1971. It offers cutting-edge technologies for companies looking for advanced features.

Paychex maintains competitiveness by checking all the boxes that small, medium and large companies seek. It offers health benefits and compliance for all 50 U.S. states, provides support for global payroll and international contractors and offers 24/7 support.

Small companies can access the stripped-down version for $39 a month, plus $5/month per employee. The downside is that many of the more advanced features are only built into the more expensive plans.

Read our Paychex Flex software review to learn more about its pros, cons, pricing and features.

| Features | OnPay | Paychex |

|---|---|---|

| Promotional offer | 30-day free trial with no limitation and full access | 30-day free trial |

| Mobile app | No, access via web browser only | Yes |

| 24/7 customer support | Yes | Yes, multi-channel support |

| Direct deposit | Yes, same day | Yes |

| Skills and training | Yes | Yes |

| Global payroll | No | Yes |

| Health insurance benefits | Yes, available in all 50 U.S. states | Yes, available in all 50 U.S. states |

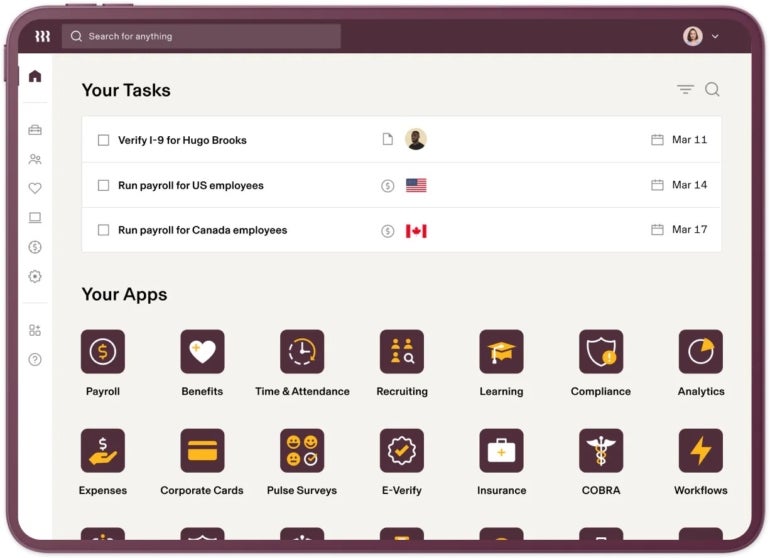

Rippling is the only PEO offering an all-in-one payroll, HR and IT platform. Its cloud solutions are known for being minimalistic and easy to use. Automation is at the heart of Rippling, allowing HR and payroll teams only to input most data once.

Rippling is a perfect fit if your teams do not have long years of experience or advanced technology skills. It offers step-by-step guides for most processes, from onboarding to payroll and reporting.

Despite its simplicity, Rippling can run tax, onboarding and payrolls like other platforms. It also offers reports, training, competitive pricing and global payroll capacities. Rippling starts at $8 a month per user, but you’ll have to contact Rippling for complete pricing information.

Read our Rippling software review to learn more about its pros, cons, pricing and features.

| Features | OnPay | Rippling |

|---|---|---|

| Promotional offer | 30-day free trial with no limitation and full access | No free trial. Demo with limited capabilities available |

| Mobile app | No, access via web browser only | Yes |

| 24/7 customer support | Yes | Yes |

| Direct deposit | Yes, same day | Yes |

| IT support | Yes | Yes |

| Global payroll | No | Yes |

| Health insurance benefits | Yes, available in all 50 U.S. states | Yes, available in all 50 U.S. states |

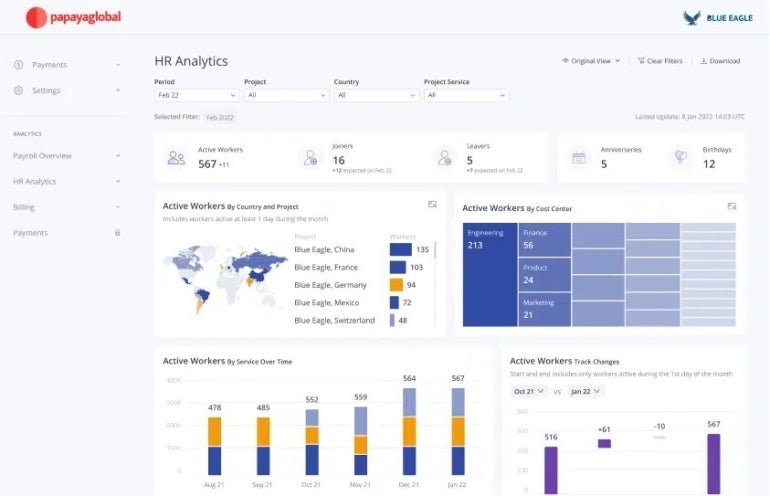

Papaya Global is a platform that specializes in managing HR for international companies with global workforces. The platform offers a comprehensive suite of payroll, taxes, benefits, compliance and other features.

The Papaya Global interface is centralized and requires no advanced technical skills to be managed. The platform offers excellent visibility and automation, but is one of the most expensive PEO options in the market.

Papaya Global offers advanced international support to meet compliance with national laws in more than 160 countries. While the company has accessible full-service payroll – starting as low as $12 per month per employee – most of its advanced features are included in other plans and components may need to be purchased separately.

Read our Papaya Global software review to learn more about its pros, cons and features.

Figure H

| Features | OnPay | Papaya Global |

|---|---|---|

| Promotional offer | 30-day free trial with no limitation and full access | No |

| International contractors | Yes, but no advanced compliance support | Yes |

| Global workforce payroll and compliance | No | Yes, in over 160 countries |

| Applicant tracking | Yes | Yes |

| Time and attendance | Through third-party integrations | Yes |

| Onboarding | Yes | Yes |

| Employee portal | Yes | Yes |

| HR tools | Yes | Yes |

QuickBooks Payroll is an accounting software package developed and marketed by Intuit. Chosen by over 1.4 million small businesses, QuickBooks can automate payroll and HR, W-2, paid time off, make free direct deposits and provide HR services.

While it can automate payroll, fast direct deposits and abundant reports, QuickBooks Payroll has some limitations. It is mainly designed for companies with small workforces and while it can support larger enterprises, scaling comes with the cost of different monthly plans. The platform also requires integration for several features like international payments, HR services and multi-state compliance, which usually come built-in with other PEO solutions.

Read our QuickBooks Payroll review to learn more about its pros, cons, pricing and features.

| Features | OnPay | QuickBooks Payroll |

|---|---|---|

| Promotional offer | 30-day free trial with no limitation and full access | 30-day free trial |

| Mobile app | Yes | Yes |

| 24/7 customer support | Yes | Yes |

| Direct deposit | Yes | Yes |

| IT support | Through integrations | No |

| Global payroll | No | Through integrations |

| Health insurance benefits | Yes, available in all 50 U.S. states | Yes, in all 50 U.S. states (through SimplyInsured) |

While Paylocity rarely makes it to the lists of best PEO solutions, the platform is one of the most robust alternatives in the market. It has been operating since 1997 and is based in Illinois.

Traditionally, Paylocity mainly focused on payroll and HR for medium and large enterprises, but in recent years the company has also been directing its focus on small companies and startups.

Paylocity is an all-in-one HR and payroll solution that can manage benefits, time and attendance, employee experience and more. While Paylocity’s pricing is not revealed transparently on its website, aggregated reviews report its basic plan costs just $2 per month per employee. Companies should expect to pay much more for advanced features and large workforce management.

If you’re looking for a PEO service to handle your payroll, benefits, compliance and HR needs, you might wonder if OnPay is worth using. OnPay is a cloud-based PEO solution that offers a simple and affordable plan for small and medium-sized businesses. But how does it compare to other top PEO features in the market?

One of the advantages of OnPay is that it provides comprehensive benefits administration for all 50 U.S. states, including health insurance, retirement plans and workers’ compensation. OnPay also integrates with popular accounting and time-tracking software like QuickBooks, Xero and TSheets. OnPay’s customer support is highly rated, with phone, email and chat options available during business hours.

SEE: Keep on top of things with our review of the best payroll software for businesses.

However, OnPay has some limitations that might make it less appealing for some businesses. The main drawback is that it provides no support for international workers. Therefore, if your workforce is located outside of the U.S., there are better solutions for your business.

Another drawback is that OnPay does not offer any HR training or development programs, which could be useful for improving employee skills and performance. Additionally, OnPay does not have any advanced IT risk management features, which could help protect your business from cyberattacks.

Compared to other PEO services, such as Gusto, Paychex Flex and Papaya Global, OnPay has competitive pricing and solid features. In the end, it will come down to your needs and type of operations, the size of your company, your location and the technology skill level your talent teams have.

OnPay, like any software, has its pros and cons. Let’s explore the pros and cons of OnPay, its capabilities, limitations and its top features.

While many PEO solutions offer similar features, each is suited for different types of businesses. If your company has an international presence, international workers and contractors and is outside of the U.S., OnPay is not the solution for you. Other alternatives like Papaya Global, which provides global pay runs and international compliance, may be a better fit.

The main strength of OnPay is that it is highly optimized for bookkeepers and accounting. Therefore, if your payroll and HR teams are focused on these areas, OnPay is likely the right solution for you.

If you are looking for more simple-to-use and user-friendly platforms, you could check out Gusto or Rippling. These vendors make PEO management look easy and provide more flexible accessibility by lowering the bar of technical knowledge required to use the software.

OnPay is a robust cloud software platform that centralizes payroll and HR service operations while providing all the advanced features most PEO vendors offer. It is always recommended to seek the advice of your IT, HR and finance teams, who will be able to provide insight into their technology needs and match them with the tools and skills your business requires to operate efficiently.

To write our review and evaluate the top OnPay competitors, we examined sites that compile aggregate data based on verified user reviews, such as Trustpilot, Gartner Peer Insights and others. We also reviewed demos on vendor sites, test-drove the software when possible and scoured through the official sites of each vendor to evaluate their software features, customer service, user-friendliness, price and scalability.