Deel and Oyster are global payroll and HR companies that offer international contractor and Employer of Record (EOR) services. While they may seem very similar at first glance, a deep dive reveals key differences between these two providers.

In this guide, we will compare Deel vs. Oyster in depth to help you decide on the right choice for your business.

Jump to:

| Deel | Oyster | |

|---|---|---|

| Countries available | 150+ | 180+ |

| Global payroll | Yes | Yes |

| Contractor-only plan | Yes | Yes |

| Employer of Record services | Yes | Yes |

| Forever free plan | Yes | No |

Rippling automatically syncs all your business’s HR data, like hours, leave and absence, with payroll. You never need to fill out spreadsheets and upload to another system— we pay your employees and HMRC directly.

Deel offers three categories of pricing plan: contractor payroll, direct employee payroll and EOR payroll. However, there’s some variation within these three categories:

For more information, see the full Deel review.

Oyster also offers three tiers of pricing: Contractor, Employee, and Scale.

As a plus, anyone can create a Deel account and explore the system for free — the pricing plans only kick in once you’ve engaged a contractor or employee.

For more information, see the full Oyster review.

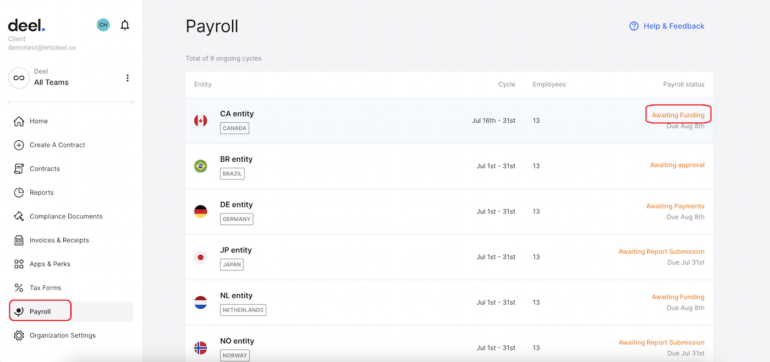

Figure A

Winner: Deel

Deel has a native payroll platform and staffs local payrolls experts for 100 countries to advise customers on tax and compliance issues. It also includes HR features such as benefits administration, a people database, onboarding and offboarding tools, HR reporting and analytics and employee engagement surveys. However, it does not include certain HR features like native time tracking or recruiting software.

SEE: The 8 Best International Payroll Services for 2023

In addition to running payroll in 120 currencies, Oyster lets you get a cost estimate before you hire an employee, streamline your onboarding process, and get advice from a team of dedicated legal experts to ensure compliance. It does include some additional HR tools, such as time off management and benefits administration, but not as many as Deel.

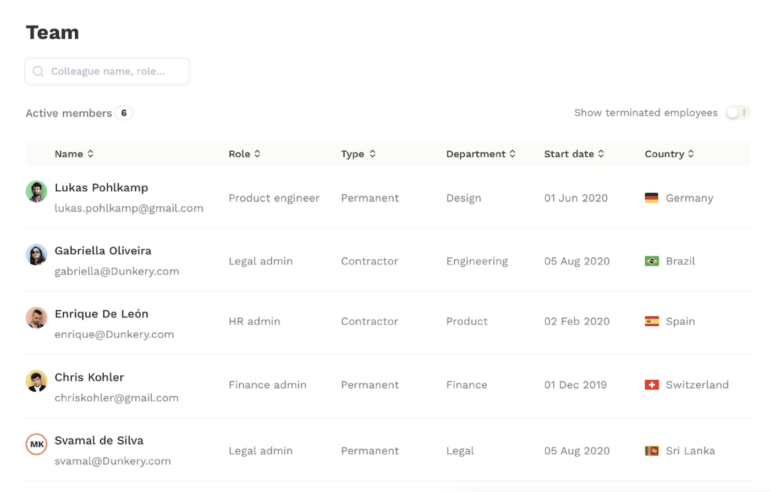

Figure B

Winner: Deel

Both Deel and Oyster are known for their Employer of Record (EOR) services, which means they act as a third-party organization that takes care of hiring and paying international employees, assuming the risk on your company’s behalf.

Deel currently offers EOR services in 90+ countries. Deel owns all of its own entities except for China, which means you’ll have a seamless experience no matter what country you plan to hire in. Localized benefits are provided for each country, and you can sign and edit contracts right in the Deel app to make document management easy.

SEE: The Top Oyster Competitors and Alternatives for 2023

Oyster currently offers EOR services in 125+ countries. Once you figure out your new hire, Oyster will provide a series of pre-created local benefit packages so you can choose a competitive one. The self-service process helps to reduce time-to-hire and get new employees onboarded fast. However, Oyster does not own all its local entities, so the experience might not be seamless depending on which country you are hiring in.

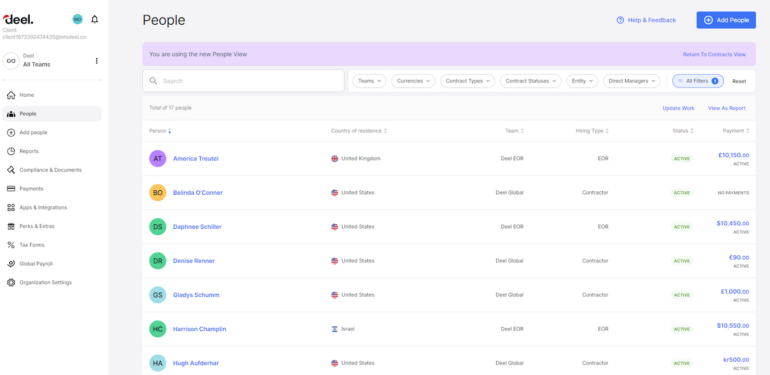

Figure C

Winner: Oyster

Both Deel and Oyster allow you to pay international contractors, though each offers a slightly different set of features in this arena. Deel offers the option to get a Deel card, a debit card that allows contractors to spend funds directly from their Deel balance in a stable currency.

The Deel Advance feature allows each contractor to get their payment up to 30 days early, and the service offers additional misclassification protections for employers on the upgraded Deel Shield and Deel Premium plans.

SEE: The Best Contractor Payroll Services of 2023

Oyster offers a self-serve platform that helps your team hire a new contractor in just four steps. For U.S.-based contractors, you can also automatically generate 1099 and W9 tax forms. If you want to offer health insurance to contractors, Oyster lets you do that at competitive rates in 180+ countries. Oyster’s contractor plan is also cheaper, costing $20 per employee per month vs. Deel’s $49 per employee per month.

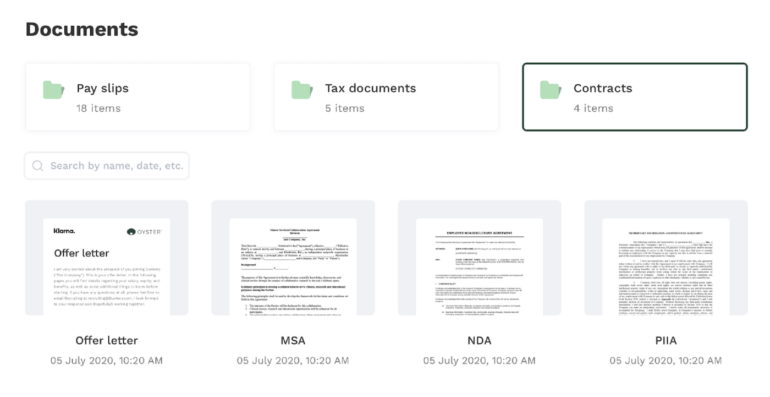

Figure D

To compare Rippling and Deel, we looked at their global payroll and HR tools. We also considered their Employer of Record (EOR) services and contractor payment plans, and we weighed other factors such as pricing, user experience and ease of use. Additionally, we consulted product documentation, user reviews and demo videos during the writing of this review.

Both Deel and Oyster offer Employer of Record services for companies who want someone else to handle the hassle of international hiring for them. If you know the specific countries that you want to hire in, we recommend checking both Deel and Oyster to make sure you’ll be covered. There is a slightly higher chance that Oyster will cover any given location, since it offers employee management in 180+ countries versus Deel’s 150+ countries.

However, Deel is unique because it offers a forever free plan to businesses under 200 employees, making it a great choice for small businesses on a budget. Deel’s more comprehensive HR features are also very helpful for businesses looking for a combined HR and payroll platform, even if they don’t intend to hire internationally. That being said, Deel’s international contractor plan costs more than Oyster’s per person, which may be a dealbreaker for businesses only looking to hire contractors.

Oyster requires you to pay once you hire your very first employee, which makes it a less cost-effective choice for small businesses. However, Oyster does offer special discounts for nonprofits and businesses hiring refugees, so it might be more affordable if your company belongs to these two very specific categories. Oyster is also more focused on global hiring and offers fewer HR features, so it may not be as helpful for companies looking for a general use payroll and HR platform.

Still not sure if either of these choices is right for your company? Check out our guide to the best payroll software of 2023 to expand your search.

Rippling automatically syncs all your business’s HR data, like hours, leave and absence, with payroll. You never need to fill out spreadsheets and upload to another system— we pay your employees and HMRC directly.