Software-as-service spend management software firm G2 reported that products with artificial intelligence functionality — particularly large language models — are among the top three fastest-growing software classes across the over-2,000 categories the company tracks.

Findings from its 2023 G2 Software Buyer Behavior Report seem to bear that out. The study found AI capabilities are sine que non for enterprise: 78% percent of the 1,704 respondents to G2’s survey said that they trust the accuracy and reliability of AI-powered solutions, with only 2% saying they don’t trust it at all.

Jump to:

G2’s study suggests businesses are increasing their software spend as they vie for advantages, fears of a tech pullback notwithstanding. Forty-nine percent of buyers polled said they would increase spend on software this year, while only 9% said they would tighten their purse strings for software.

Of those who said they would cut spending for 2023, 39% said they would then increase it in 2024, compared to 25% their budgets would decrease (37% say it will stay the same as this year).

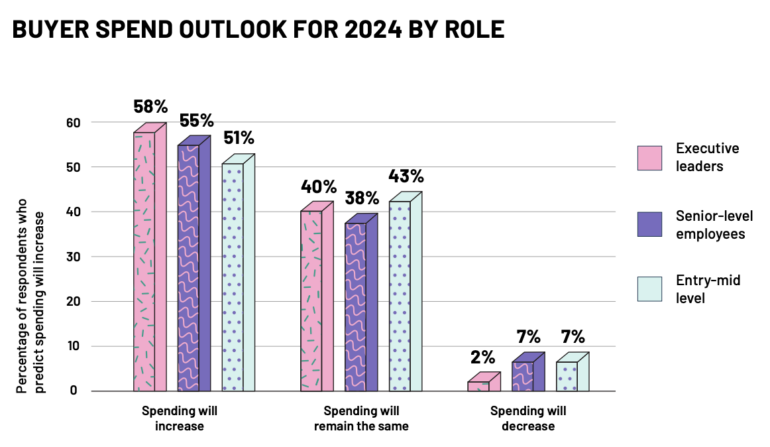

Executive leaders were the most optimistic about spending in 2023 and 2024, per the report, which said executives envisioned higher spending than did senior-level employees (managers, directors, high-level individual contributors) and entry and mid-level employees (Figure A).

Figure A

The study found that generative AI is decisive in determining purchase decisions around new software, the study found: 81% of respondents put a premium on software having AI functionality. Fewer than 5% of the executives G2 polled said AI functionality is not important at all.

Additionally:

The G2 study authors wrote that the role of legal departments in purchase decisions will grow “Because generative AI solutions increase the necessity for legal involvement.”

“Vendor customers want platforms with generative AI capabilities — 81% of buyers who are interested in AI are looking to make a business value impact and see generative AI capabilities as the route to achieving it,” said Chris Voce, VP of market research at G2.

“However, their legal departments are often stopping them, and I think this will occur more often where, because of the nature of generative AI solutions, businesses will have to be accountable both to how data is being ingested and to the output, which could involve such issues as inadvertent violation of copyright.”

He also said AI constitutes a moment in which vendors will need to step up and increase their responsibility to customers.

“There’s a lot of listening they need to do with legal teams across their customer base in order to be responsive,” he said. “Just as we have been doing for decades about easing cybersecurity concerns. Vendors need to engage — they need to take a step back, look across at issues raised by customers, and organize coordinated ways to respond to buyers and implement solutions.”

James Robinson, deputy CISO at global cybersecurity company Netskope, said he sees similarities to rapid drug development for COVID when it comes to vendor/customer transparency for AI policy.. “Our customers are asking us to do a lot more in terms of governance frameworks for AI, and how we are securing our own use of the technologies,”‘he said.

“Vendors generally should be doing that, and I would say we need to be figuring out how to make [AI adoption] less of a burden to business, in terms of protecting models from bias, but also protecting the information, and do so in a secure way while articulating how we are doing that to customers,” added Robinson.

The study also looked at what executives say about the friction point between business imperatives that drive software purchase regimens and security imperatives meant to validate those products.

Also see: Get an AI content generator that goes far beyond creating copy for just $50

Eighty-six percent of software purchasers polled conceded that they required a security and privacy pre-assessment before purchase, and 84% of respondents said their IT departments are responsible for conducting security or privacy assessments when evaluating software.

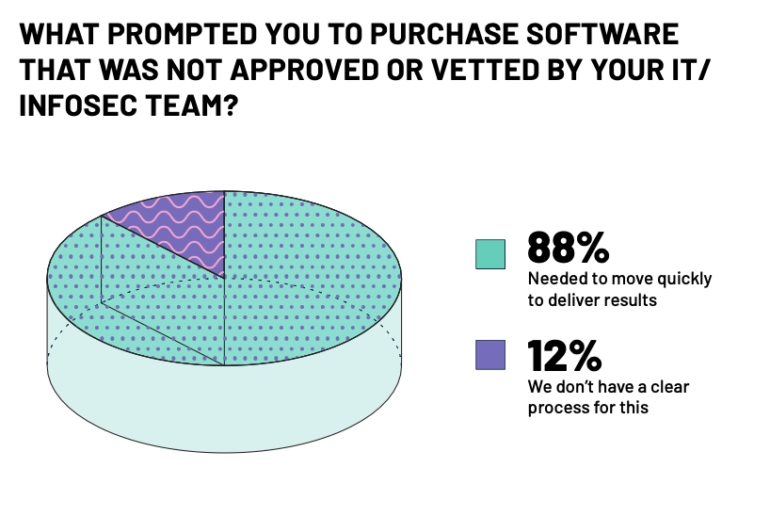

Yet, sometimes business pressures leave security operators out of the picture: of those who said they chose to ignore doing a security assessment, 88% said they did so because they needed to move quickly to deliver results from software (Figure B).

Figure B

“Businesses all feel a pressure to deliver results or have business impact and demonstrate that impact,” Voce said. “There’s urgency and this drives behavior. Sometimes even if there is a sound process to vet the security of a solution, that pressure drives them to cut corners,”he added.

Also, overall:

The firm suggested that to accommodate buyers with their security vetting, vendors should lead with product security credentials, conduct buyer interviews to dive into their security and privacy vetting process and design information or implementation according to buyer needs and resources.

Eighty-three percent of the companies G2 polled said they have a software buying process in place, and for 36% of those, research is the most time-consuming aspect, with evaluation coming in second at 29%.

Out of a list of 14 considerations for purchasing software, the top five were consistent regardless of company size:

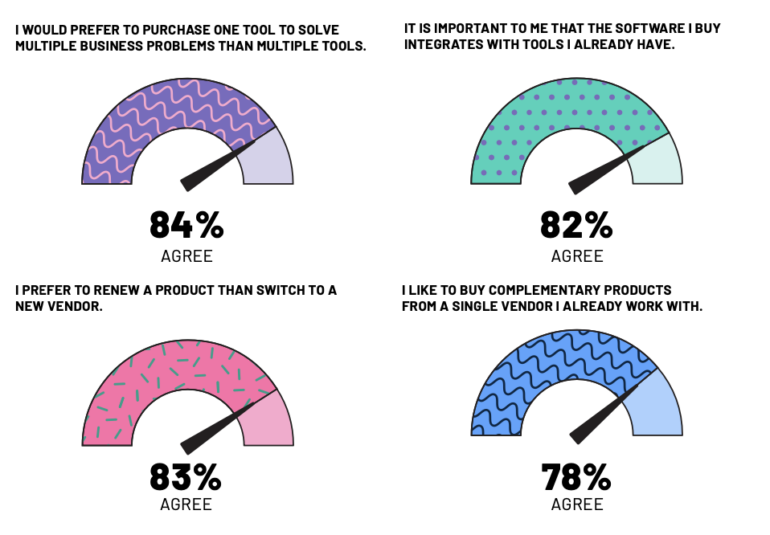

Eighty-two percent of respondents to the G2 study said software should integrate with their existing solutions, with buyers ranking ease of integration higher than the cost of the software, the kind of security it provides, or cost of ownership.

Over three-quarters of the buyers polled said they prefer to work with fewer vendors, and 84% said they favored a single solution over multiple tools. When multiple solutions are required, 77% of buyers prefer to buy complementary products from the vendors they already work with (Figure C).

Figure C

In a finding that has analogs in endless political careers and therapy that doesn’t end until you do, buyers prefer to work with sellers whose products they already use: 83% of buyers prefer buying products from the same vendor instead of switching vendors, according to the study.

As for the products, 60% always conduct research and consider new alternatives, but 45% renew without considering new options.

“This is because using multiple vendors to build a tech stack offers buyers a chance to explore best-of-breed solutions but adds complexity,” the authors wrote. “It requires managing more contracts and potentially complicates integration.” Also, 82% of buyers cited the importance of software to integrate with tools they already have.

G2 offered several suggestions for helping vendors more effectively reach prospective buyers and offer them a broader view of product value.

The G2 authors said buyers aren’t taking calls, but are doing their own research: per the firm, the top 85% of most influential sources include industry experts, colleagues or professional networks, online reviews and other internal influencers.

The study found that a vendor salesperson is the least influential source in purchasing processes at 1%, down from 3% in the prior year, and the importance of vendor-published content dropped from 10% to 7% in the prior year.

“Vendors must build product awareness across communities, experts, and review platforms,” said the authors.

G2’s study suggests buyers may want the majority of the implementation process to be self service, to which they attribute ease of implementation, but just 41% of enterprise buyers want all of the process to be self service

The firm suggests that because buyers are flooded with pitches, they are unlikely to want to receive more especially if it involves divulging information. The study found 61% of respondents are less likely to purchase software if the vendor requires personal information (email address, name, etc.) prior to releasing pricing data or product demos. This indicates buyers want time to conduct research before entering into discussions with sales.

The firm suggested that simple ROI won’t cut it: vendors need “To capture the full impact of a solution’s potential on a customer’s environment,” said the study, noting that vendors are more frequently employing business value advisory consultants to learn about and advise on how solutions create business value over time.

Voce said businesses need to articulate the virtue of their products beyond the silo of specific implementations. “Often vendors have difficulty in communicating the larger business value and impact their solutions might deliver,” he said.

He said he parses a comprehensive software value proposition into four buckets — two involved in cost reduction and risk, and two on strategic growth:

Expense reduction: How do you help a customer reduce operational expenses and cost?

Risk reduction: How do you avoid a competitive disadvantage from outages, downtime, loss, compliance, fines, etc?

Business growth: How do I help a custom use my product to see more incremental value and more growth?

Strategic growth: How might I help them improve customer experience, tap into new areas of opportunity, around areas like remote work, employee experience, or reducing complexity?

“Reducing complexity has been an important theme to IT security values for years, as their environments are becoming increasingly complex,” he said, noting that 84% of respondents said they would prefer one tool for multiple problems instead of multiple tools. “They want simplicity; software that integrates with the tools they have. Whether it comes from a single point or a suite of turnkey solutions: they want to buy the recipe, not the ingredients.”