QuickBooks and Xero are two of the best accounting and payroll software options for small businesses and large enterprises, respectively. We researched both tools extensively to help you determine the best one for your company. In this article, we list their core features, pricing, pros and cons, as well as the type of company they are suitable for.

Jump to:

QuickBooks is an accounting software package developed and marketed by Intuit. Its products are geared mainly toward small and medium-sized businesses and offer on-premises accounting applications as well as cloud-based versions that accept business payments, manage and pay bills, and payroll functions.

For more information, read our in-depth QuickBooks review.

Xero is an online accounting software designed for mid-sized and large businesses. It helps businesses track expenses, manage invoicing, automate payments and manage inventory. It also provides access to a wide range of add-on applications from partners and third-party developers, including payroll, customer relationship management and point-of-sale solutions.

For more information, read our in-depth Xero review.

To help you determine how both tools stack up, here is a head-to-head comparison chart featuring pricing and other capabilities.

| QuickBooks | Xero | |

|---|---|---|

| Best for | Small and midsize businesses | All business sizes |

| Starting price | $15 per month | $13 per month |

| Free trial | 30 days | 30 days |

| Year founded | 1983 | 2006 |

| Accessibility | Cloud-based | Cloud-based |

| Inventory management | Yes | Yes |

| Sales tax management | Yes | Yes |

| 1099 tracking and reporting | Yes | Yes |

| Mobile app | iOS and Android | iOS and Android |

| Payroll | Yes | Yes |

| Customer support | 24/7 online customer support with all plans | Limited |

| Multicurrency | Yes | Yes |

| Invoice templates | Yes | Yes |

| Integration with third-party apps | Yes — over 700 apps | Yes — over 1,000 apps |

| Track mileage | Yes | Yes |

| Number of users | Unlimited | 25 |

| Customer strength | Over 7 million customers | Over 3.5 million customers |

Rippling automatically syncs all your business’s HR data, like hours, leave and absence, with payroll. You never need to fill out spreadsheets and upload to another system— we pay your employees and HMRC directly.

Both QuickBooks and Xero offer tiered pricing, and the best plan for you is one that includes the features you need. Both platforms offer a 30-day free trial to enable new customers to try it out before making a purchase decision. Let’s see how both platforms stack up in terms of pricing.

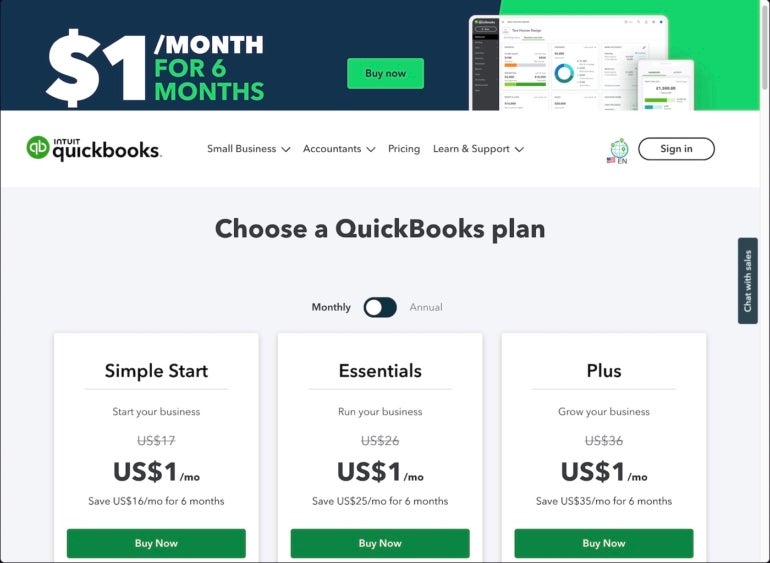

QuickBooks pricing varies depending on your country. The rates below are for United States customers. Buyers outside the U.S. may find the current QuickBook’s promotion of $1 per month for six months beneficial. (Figure A) On the other hand, U.S. customers get 50% off for three months.

Figure A

QuickBooks allows you to add payroll at an additional fee. The payroll plans also offer 50% off for the first three months.

Keep in mind that QuickBooks discounts don’t apply to additional employees and state tax filing fees.

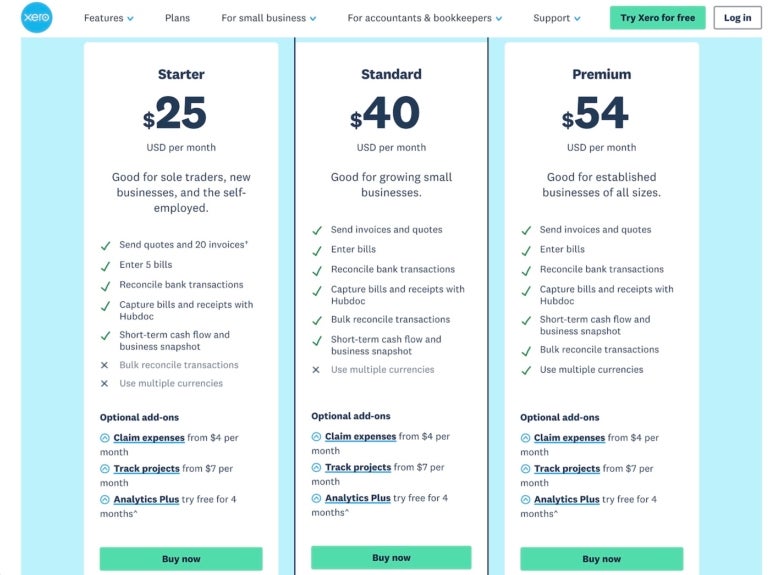

Like QuickBooks, Xero pricing depends on your location (Figure B). The rates below are for U.S. buyers. To get the price and the best rates for you, scroll to the bottom of the Xero website, click on “region” and select your country. If your country is not listed, select Global.

Figure B

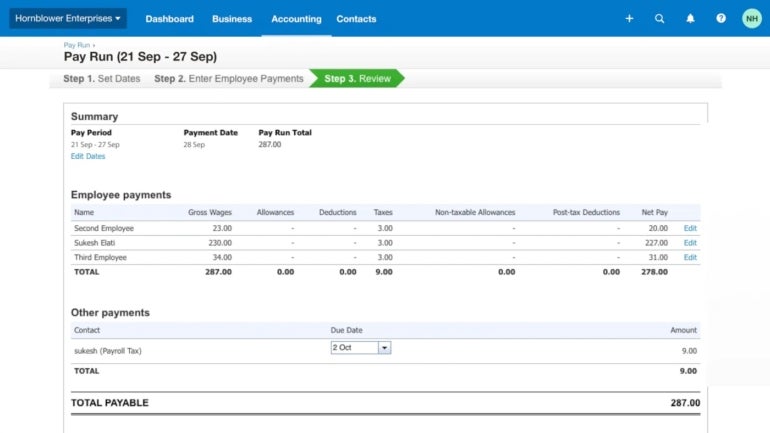

Xero integration with Gusto provides users with payroll capability, which enables them to calculate pay and deductions, pay employees and simplify compliance.

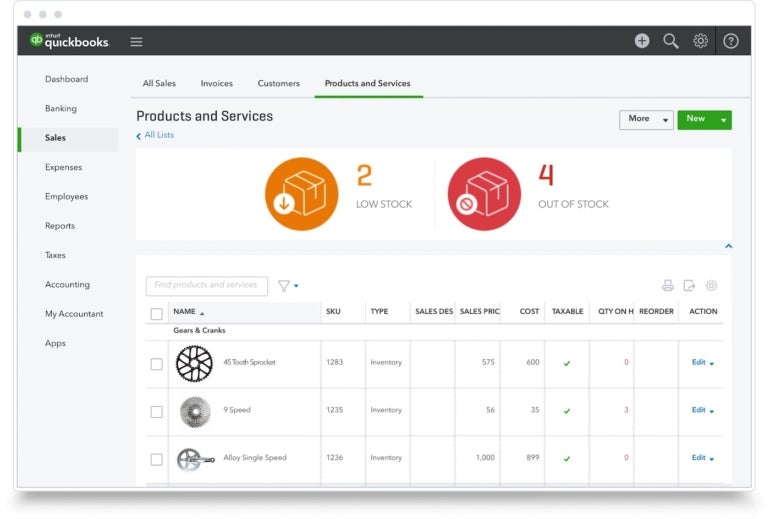

Generally, software with inventory management capability helps businesses track and manage their inventory levels, orders, sales and deliveries, which includes controlling the amount of product in stock, reordering stock when necessary and organizing the storage of products. Both QuickBooks and Xero support inventory management (Figure C).

Figure C

With QuickBooks, users can create purchase orders and manage vendors. It also allows businesses to track product inventory with three levels of location tracking (for instance, row, shelf, bin; section, area, pallet) as well as the cost of goods.

SEE: Discover how FreshBooks and QuickBooks Online compare.

QuickBooks sends out notifications when inventory is low to enable business to restock on time in order to meet customers’ demands. QuickBooks also allows users to import their data from Excel or sync with Amazon, Shopify and Etsy.

Key capabilities of QuickBooks inventory management are:

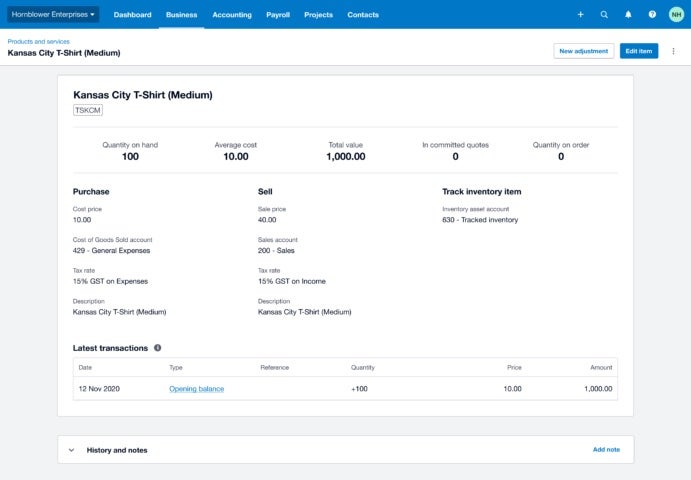

With Xero inventory management (Figure D), users can track up to 4,000 finished items, inventory levels, set reorder points and monitor stock on hand. Although Xero inventory management isn’t as robust as that of QuickBooks, it’s still a powerful tool for managing business inventory.

Figure D

Key capabilities of Xero inventory management are:

For this category, QuickBooks is the winner.

Customer support is an important factor to consider when shopping for the best payroll software or accounting tool. Companies with efficient customer support provide technical support, product training, an extensive knowledge base and help users troubleshoot and resolve issues in the shortest possible time.

For this category, we rank Xero first due to its free 24/7 online customer support across all its plans. QuickBooks’ support is available Monday through Friday, 6 a.m. to 6 p.m. Pacific time and Saturdays, 6 a.m. to 3 p.m. PST. QuickBooks’ customers with issues may have to wait for business hours to get a resolution.

Generally, current and past users’ feedback from review sites shows that both platforms offer decent support services. However, their services are not foolproof, meaning they can still improve their offerings to serve the customers better.

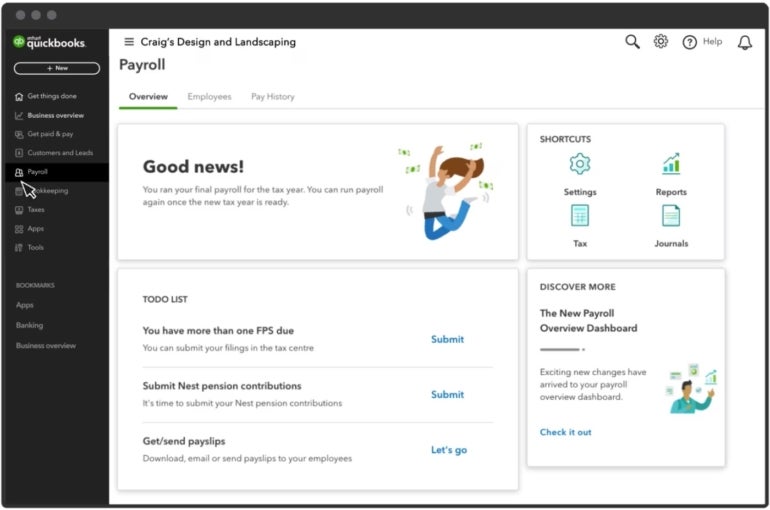

Both platforms offer payroll capabilities, but they differ in how they’re implemented. QuickBooks (Figure E) has a core payroll function built into its system, while Xero requires users to integrate with Gusto to handle payroll.

Figure E

Those looking for an all-in-one accounting and payroll system may find QuickBooks a suitable choice. However, QuickBooks is generally more expensive than Xero and requires more setup time. Xero (Figure F) is an affordable option because the Gusto pricing plan starts at $40 per month plus $6 per month per person. QuickBooks payroll starting price after your first three months is $45 per month plus $5 per employee per month.

Figure F

What you will get from QuickBooks basic plan (Payroll Core)

What you will get from Gusto basic plan (Simple) after integrating it with Xero

If you’re looking for a complete accounting and payroll system, you may find QuickBooks suitable, but it is more expensive. Budget-conscious customers should consider Xero.

The QuickBooks accounting software is a popular choice for small and mid-sized businesses, but it has drawbacks. Here are some of the pros and cons of using QuickBooks.

While it has numerous advantages, there are a few drawbacks to consider before deciding if Xero is the right choice for your business.

We evaluated the features, pricing and customer support offered by both QuickBooks and Xero. In addition, we gathered data about user reviews from third-party sites to learn about customers’ experience using both tools — what each tool does well, their limitations and what can be improved.

The best solution for your organization is the one that meets your business-specific needs.

Choose QuickBooks if:

Choose Xero if:

Note that the best solution for you depends on your organization’s needs and preferences. We recommend trying both tools for free for 30 days before settling for one. If neither tool meets your needs, we welcome you to explore our comprehensive reviews of the best payroll software for small businesses or our top-rated payroll software for enterprises.

Rippling automatically syncs all your business’s HR data, like hours, leave and absence, with payroll. You never need to fill out spreadsheets and upload to another system— we pay your employees and HMRC directly.