Patriot Payroll: Fast facts [Star rating: 3.8 out of 5]Starting price: $17 per month + $4 per employee (self-service)

|

Patriot Payroll’s comprehensive software works best for small and midsize businesses that need excellent customer support, thorough payroll tools and a below-average starting price. However, Patriot Payroll’s minimal HR features and limited integrations mean it won’t work as well for businesses that want to bundle HR, benefits administration and payroll in one tidy package.

Not sure if Patriot Payroll will work for your small business? Keep reading. Our Patriot Payroll review explains Patriot’s pricing, features, pros and cons as well as the best Patriot alternatives.

Jump to:

Patriot Payroll has two affordable payroll plans, both with lower-than-average base prices. More importantly for your bottom line, both plans charge just $4 per employee. The more employees you have, the more cost-effective Patriot becomes compared to competitors like Gusto and OnPay, which both charge $6 per employee.

Patriot’s Basic Payroll plan costs $17 per month plus an additional $4 per employee or contractor paid.

As a self-service payroll plan, Basic Payroll includes automatic paycheck calculation, direct deposit, printable or electronic pre-filled W-2 Forms and optional 1099 Form filing. While Basic Payroll includes payroll-tax calculation, you’re responsible for withholding and remitting the taxes to the correct tax agency.

Patriot’s full-service payroll plan costs $37 per month plus an additional $4 per employee or contractor paid.

Patriot’s Full Service Payroll plan includes the same features as its Basic Payroll plan, plus federal, state and local tax withholding and filing. Patriot’s industry-standard tax-filing guarantee promises that if Patriot makes any mistakes with your taxes, it will fix the errors and pay any associated fines levied by the IRS.

Patriot Payroll offers the most important payroll features at a low monthly cost:

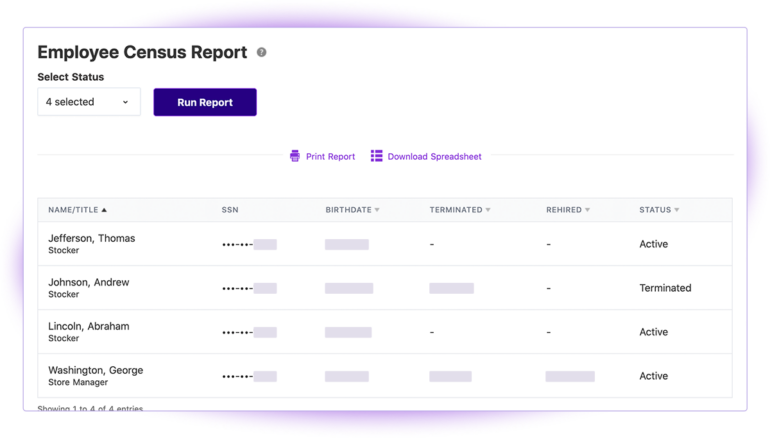

Comprehensive payroll reports, including time-off reports and payroll registers (Figure A).

Figure A

Customers on third-party review sites call out Patriot’s exceptionally user-friendly interface, uncomplicated payroll tools and extremely responsive customer service team.

While Patriot excels at providing key payroll tools, it doesn’t offer the basic human resource features that Patriot competitors like Gusto, OnPay, Paychex and ADP include with every plan. For instance, Patriot’s payroll plans don’t include access to an HR library. Businesses using Patriot to process payroll cannot integrate the software with any benefits beyond 401(k) plans.

Patriot’s add-on time and scheduling software starts at $6 per month plus $2 per employee per month. The tool includes basic features that should be enough for most small businesses with hourly employees:

However, the tool lacks absence, leave or shift management features. Most importantly, although employees can clock in and out on Patriot’s online interface, the time-and-attendance tool lacks a mobile app. As a result, it works best for business owners who don’t need complex time-and-attendance features and are comfortable with a browser-only time clock.

Extremely affordable payroll software. Short of free payroll software, few payroll companies can compete with Patriot’s low-cost plans. (SurePayroll is the notable exception.) Patriot’s low per-employee cost saves you more as your team expands, especially compared to top competitors.

| Monthly cost | One employee | Five employees | 50 employees | 100 employees |

|---|---|---|---|---|

| Patriot | $41 | $57 | $237 | $437 |

| Paychex Flex | $44 | $64 | $289 | $539 |

| Gusto | $46 | $70 | $340 | $640 |

Free expert setup. While new users can use Patriot’s setup wizard to start running payroll on their own, Patriot also offers free white-glove setup that ensures your payroll processing goes smoothly from the outset.

Outstanding customer service reputation and customer support. While Patriot doesn’t offer 24/7 customer service, its U.S.-based team is available between 9 a.m. and 7 p.m. ET every weekday. You can reach customer service via live chat, email or over the phone. Verified users on most third-party review sites give Patriot high marks for the above-average quality of its customer support — making it a rarity among payroll providers.

Limited scalability. Since Patriot has just two plans — self-service and full-service — it isn’t scalable for companies that want to add workforce management, talent management and comprehensive HR tools as they grow. Additionally, Patriot only supports U.S.-based domestic payroll, so companies that hope to eventually go global will need to switch to an international payroll provider.

Limited HR features, even with add-on HR plans. Patriot Payroll’s main HR-adjacent feature is its free integration with your company’s 401(k) benefits. Other than that, Patriot doesn’t offer many HR features — even if you add its HR plan, which costs an extra $6 a month plus $2 per employee. Since the HR plan only includes basic HR reports, online document storage and some admin permissions, we can’t recommend it as a useful HR tool for most companies.

Only one non-Patriot integration. With the exception of QuickBooks Online, Patriot Payroll doesn’t integrate with any time-tracking or accounting tools beyond the company’s own scheduling and attendance software. Worse, the payroll company’s integration with QuickBooks is less than seamless and has been temporarily paused while Patriot resolves its integration issues.

No payroll apps. Although Patriot’s mobile-friendly site supports online payroll processing for employers and self-service portal access for employees, the company doesn’t offer any mobile payroll apps. That includes time-tracking apps: Employees clocking in and out with Patriot’s time-tracking tool can only do so via the online interface.

SurePayroll is one of the only full-service payroll companies that charges less than Patriot while offering the same solid payroll features. Like Patriot, SurePayroll offers two-day direct deposit, automatic payroll tax calculation and support for multiple pay schedules. It also includes federal, state and local tax remittance, charging an extra $9.99 per additional state per month.

SurePayroll’s HR features are fairly limited but still more expansive than Patriot’s: Its HR Advisor tool has compliance how-to guides, business document templates and labor law posters. SurePayroll offers health benefits and integrates with them for easy, automatic administration.

SurePayroll’s full-service plan costs $29.99 per month plus $5 per employee. Its self-service plan costs $19.99 per month plus $4 per employee.

SurePayroll also offers a six-month free trial, which makes its affordable price even more accessible for small-business customers on a limited payroll budget.

Gusto’s thorough payroll features are fairly comparable to Patriot’s. Both payroll companies offer free, unlimited monthly payroll runs with two-day direct deposit and end-of-year tax filing at no additional charge.

But in contrast to Patriot, which has few to no HR features, Gusto is one of the best payroll and HR providers for small businesses that need HR basics. Its in-house insurance brokerage provides insurance coverage in 37 states. Gusto also offers more niche benefits like college savings accounts and commuter funds.

Gusto is still a payroll-first solution rather than a total HR and payroll solution — for instance, its HR library and compliance alerts are only available with the most expensive plan. However, it’s a much better fit than Patriot for businesses that want basic HR and thorough payroll from the same provider.

Gusto starts at $40 a month plus $6 per employee per month.

While Gusto has no free trial or free plan, its contractor-only plan has no base fee for the first six months. After six months, the contractor-only base fee is $35 per month plus $6 per contractor paid.

If you’re looking for easy-to-use payroll software with a low cost of entry, thorough payroll tools and stand-out customer support, Patriot is a fantastic pick.

Patriot’s free white-glove setup means it’s especially well-suited to small businesses that only recently hired their first employees and aren’t yet familiar with the ins and outs of payroll software. Its low per-user fees keep costs low for small and midsize businesses that don’t have complex HR demands.

However, beyond integrating with 401(k) plans, Patriot Payroll doesn’t support benefits integration and administration. It charges an additional fee for standard HR services like document e-signatures and online storage, and its lack of accounting and time-tracking software integrations limit Patriot’s audience to businesses that use QuickBooks Online.

Wondering where to turn instead? If you like Patriot’s prices but need more HR support, SurePayroll and Gusto could work better for you. If cost is less of an issue for you than scalability, Rippling, Paychex and ADP can expand with you as you grow. And if you need a more fully featured workforce-management solution, check out BambooHR or Zenefits instead.

To evaluate Patriot Payroll, we viewed the company’s demo and set up an account so we could test drive the software. We also combed through verified user reviews on sites like Trustpilot and Gartner Peer Insights to better understand Patriot’s target audience and how their experiences with the software differed from our own.

We score each payroll brand we review in five key areas. Each area is weighted to reflect the category’s importance to our audience of tech stakeholders:

We relied on in-house, hands-on testing as well as available demos, trustworthy customer reviews and information from sales representatives (when possible) to assess each brand using the metrics above.