B2B merchants typically handle a large volume of transactions and manual payments and need an extra layer of security and protection. This is why the best B2B payment processors offer lower processing fees, can accept MOTO (mail order/telephone order) payments through virtual terminals, offer invoicing, accept other varied types of payments, and should have fraud prevention and chargeback management tools.

To easily compare my recommended B2B payment processors, I have listed their monthly and processing fees below, arranged according to their rating against our in-hours rubric. All providers offer Level 2 and 3 (aka B2B) credit card processing.

| Processing fee (starts at) | |||

|---|---|---|---|

| Interchange plus 0.15% + 15 cents | |||

| 2.9% + 30 cents | |||

| Interchange + 8 cents | |||

| 2.9% + 30 cents | |||

| 2.59% + 49 cents | |||

| 2% – 4.3% |

Our rating: 4.53 out of 5

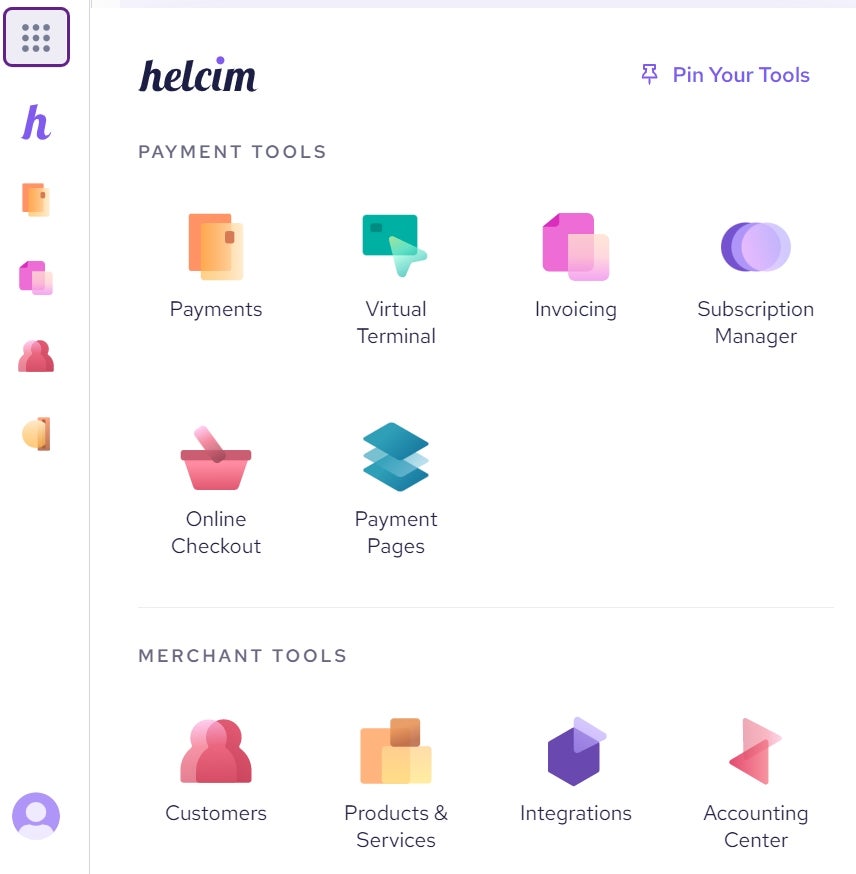

Helcim is my top pick for a B2B payment processor because its wide range of payment options (invoicing, recurring billing, and ACH payments) is well-suited for B2Bs. And, unlike other providers that charge a monthly fee or require a paid add-on to use a feature, Helcim has zero monthly fees, zero fees for other payment services, and offers interchange plus pricing. Moreover, Helcim’s automated volume discounts and zero-cost processing make it one of the cheapest B2B payment providers.

I like Helcim’s pricing transparency — zero cost processing, zero monthly fees, and automated volume discounts — it’s easily the cheapest B2B payment processor. It also has a free invoicing tool and customer portal that is very useful for B2B companies and their clients.

And unlike other B2B payment platforms like Stripe, Helcim has native Level 2 and 3 data processing and, with the help of AI, optimizes the interchange to automatically retrieve transaction information needed to qualify for Level 2 and 3 discounts.

| Cons | |

|---|---|

|

|

Our rating: 4.41 out of 5

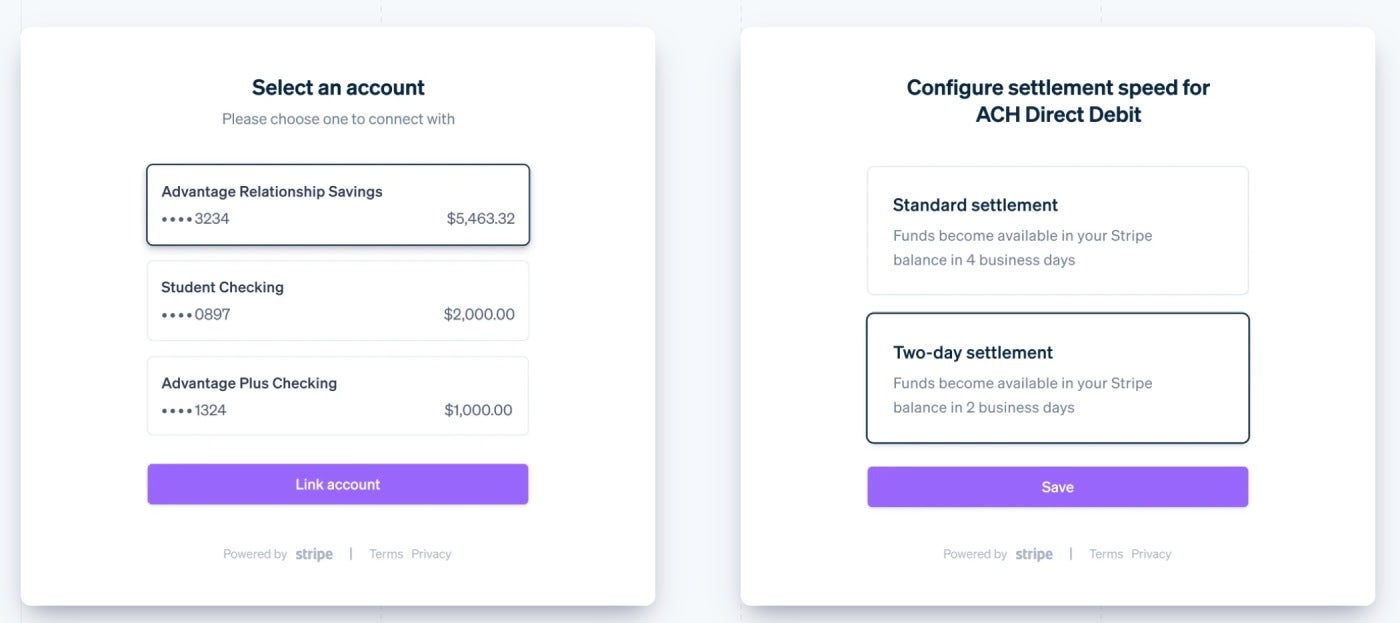

Stripe can support more than 135 currencies and process payments up to $999,999.99, making it the best B2B payment solution for businesses that take international payments. It also supports the widest range of payments among all providers in my list, providing in-person and online/remote payments, wire transfers, ACH/e-checks, and cards — both domestic and international, as it has direct integrations with global card networks and issuers.

I like Stripe’s stable support for global payments — it currently has a presence in 46 countries, enabling you to accept payments in-person or remotely through a POS system or a webpage with real-time authorization. But its greatest strength is its customization options, where you might need to pay a little more for some features, such as building your own checkout solution.

B2B businesses can also benefit from Stripe’s invoicing tool and inexpensive ACH transaction fees — the lowest among the software in this list (0.8%, $5 cap), even Helcim (0.5% + 25 cents), because it has no cap limit. Stripe also offers custom interchange-plus rates for large-volume and enterprise-level companies, even though it offers flat-rate processing fees for the rest.

| Cons | |

|---|---|

|

|

Our rating: 4.41 out of 5

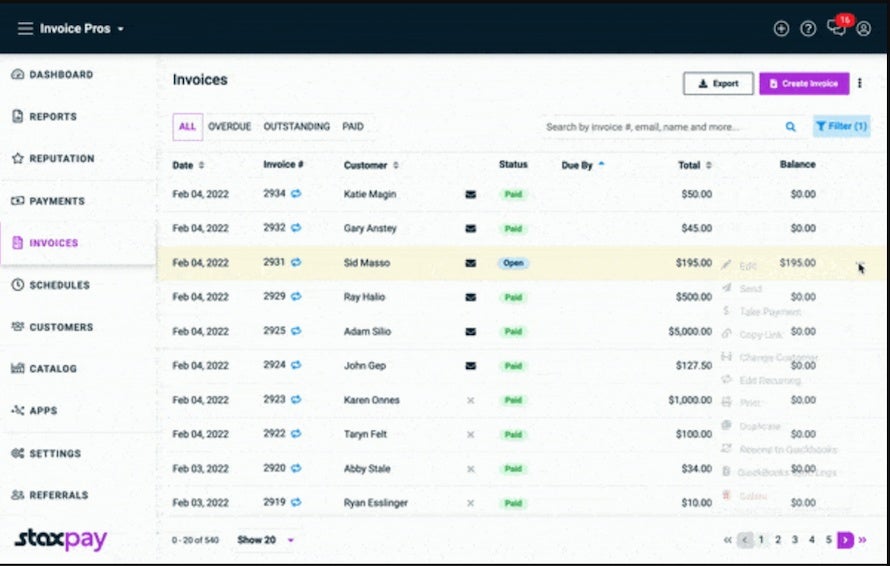

Stax is well-suited for B2B companies that regularly process a large volume of transactions because it offers interchange optimization, like Helcim, but combines it with wholesale rates instead of interchange plus fees. This results in bigger savings.

Even with its higher monthly fee compared to others in this list, Stax scored second to Helcim in my evaluation when it comes to pricing. Monthly plans can be a bit costly upfront. However, there are no long-term contracts with cancellation fees, and you’ll actually save because of the interchange and wholesale rates—but only if you frequently process large payments or a high volume of transactions each month.

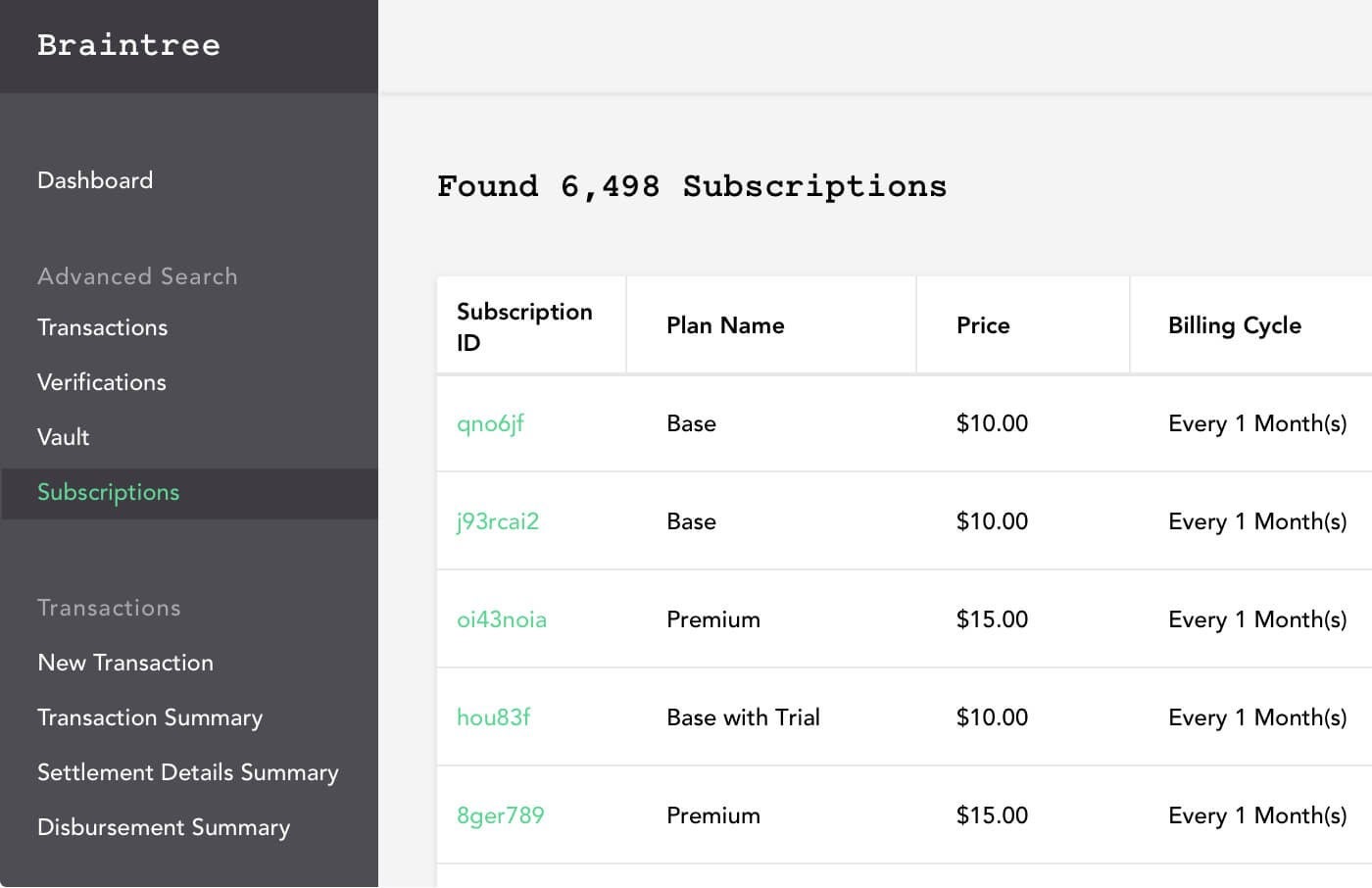

I also like that Stax can work with most POS systems with integrations, unlike Helcim. Its subscription tools rival Braintree, my recommended solution for B2B subscription billing.

| Cons | |

|---|---|

|

|

Our rating: 4.29 out of 5

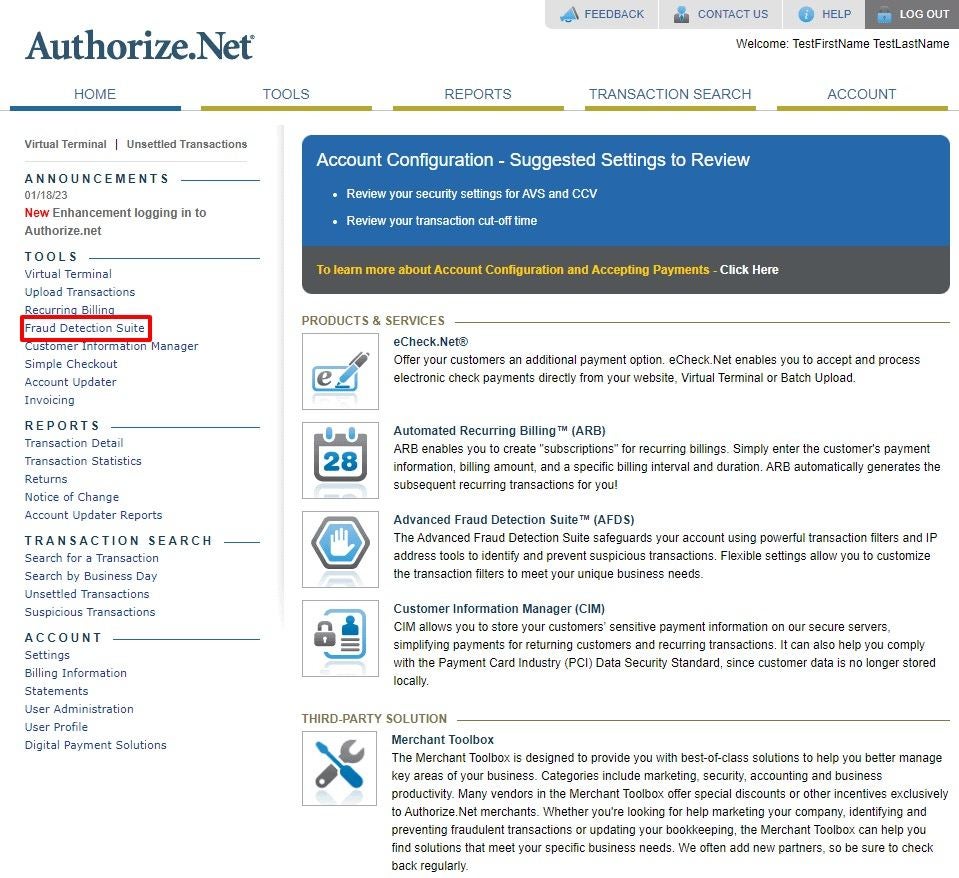

As one of the oldest, most trusted, and most popular platforms, Authorize.net is one of our top picks for best payment gateways. Its extensive integrations range from shopping carts and POS hardware to accounting and B2B platforms. It’s ideal for custom-built integrations as it comes with an open API for greater flexibility. You also won’t need as much coding or developer help with the customization, unlike Stripe, which also offers extensive integrations but requires coding knowledge and technical know-how.

Flexibility is one of Authorize.net’s greatest strengths. You can use the platform as a full payment processor or just as a payment gateway and go with a different merchant account. As a full payment processor, you can process cross-border, B2B payments, invoicing, and recurring transactions. The platform also seamlessly integrates with 900 platforms and works with 160 software developer platforms and more than 400 certified technology partners — the most extensive on my list.

Security is another area where Authorize.net shines. Its top-notch security and anti-fraud features can be further customized to your business needs — geographic limitations, payment velocity settings, minimum thresholds, and more. This level of security is considered premium and requires a paid upgrade for some providers, while Authorize.net provides its merchants this feature for free.

Additionally, Authorize.net provides support for high-risk merchants, similar to PaymentCloud. The rest of the providers on this list do not accept businesses in high-risk industries.

| Cons | |

|---|---|

|

|

Our rating: 4.20 out of 5

Braintree’s robust recurring billing tool is well-suited for B2B merchants that rely heavily on subscription models, such as those with regular supply orders. You can create custom subscription plans and set up discounts, rewards, add-ons, and promotional periods. You can also set automatic prorated billing for those who change subscriptions mid-month and accept multiple currencies and varied payment methods.

As a PayPal-owned company, Braintree specializes in online payments and offers full PayPal integration at no extra cost. I like its all-in-one solution — gateway, processor, and merchant account. You can process multiple payments in more than 130 currencies and 45 countries.

Similar to Helcim and Stripe, Braintree charges zero monthly fees, and its flat-rate processing rates are very competitive — the lowest among the providers on my list.

I like Braintree’s subscription or recurring billing features because it simplifies the management of complex payment workflows. Dunning management, automated prorated billing, discounts, promos, and rewards are just a few of the features you get with recurring billing. Stax offers dunning management, but Braintree covers more payment methods.

| Cons | |

|---|---|

|

|

Our rating: 4.11 out of 5

PaymentCloud specializes in providing merchant services to businesses belonging to high-risk industries. If you find it hard to get accepted with payment processors or merchant services, PaymentCloud will be a good fit for you. Large-volume and card-not-present (such as MOTO (mail order/telephone order) and manual/keyed-in) transactions are normal when it comes to B2B and high-risk merchants, and PaymentCloud provides these services with a wide range of accepted payment methods.

I chose PaymentCloud because of its excellent customer service; it’s the only one with perfect scores for user reviews, along with Stax. Like Authorize.net, it supports a wide range of high-risk merchants, but unlike the former, PaymentCloud specializes in servicing high-risk industries — with a same-day setup upon approval and a reported 98% approval rate.

I also like that PaymentCloud can work with any payment gateway. It can also provide a payment gateway with Level 2 and 3 data processing needed by most B2B merchants.

While PaymentCloud doesn’t post its exact pricing, this is expected because of its custom pricing for high-risk merchants. It provides added fees for usual service fees such as invoicing and virtual terminals that are normally free for other providers, but since it services high-risk merchants, this is also to be expected.

| Cons | |

|---|---|

|

|

To choose the right B2B payment solution for your businesses, it is critical that you learn more about your business operations first.

From there, gather a list of B2B processing companies. Evaluate the pricing structure of each B2B payment gateway. Consider the total cost — transaction fees, monthly fees, and any additional charges. If your business has a high volume of transactions, choose B2B payment processing companies that offer interchange-plus pricing models (such as my top pick, Helcim). They can offer significant savings.

Then, take a look at B2B payment platforms that have integrations with your existing business systems (accounting, CRM, for example) to ensure a seamless integration with your business operations. B2B payment providers like Stripe and Authorize.net are renowned for their extensive integration capabilities.

Consider also the payment methods these platforms support, and whether they offer invoicing and recurring billing, or subscription services. If you have a global business and take payments in different currencies, go with a payment processor that supports multiple currencies and offers favorable exchange rates. Stripe is known for its international payment functionalities, while Braintree has robust B2B subscription models.

Finally, read each provider’s user reviews. The ability to deliver 24/7 support is critical to resolving issues quickly, but the quality of support should also be looked into.

As a B2B company, you will benefit from a provider that provides scalability and flexibility as your business needs change and grow. Helcim, my top recommended B2B payment processor, is able to provide support with its comprehensive features to scale your business.

Leveraging my experience helping retail businesses build their ecommerce stores and providing support to B2B businesses that need to accept B2B payments, particularly multiple currencies, I looked at popular and equally highly-rated payment processors that offer Level 2 or Level 3 processing.

From my initial list, I graded them using an in-house rubric of 26 data points based on pricing and contract terms, payment types, account features, security and user experience, and real-world user and expert reviews.

This article and methodology were reviewed by our retail expert, Meaghan Brophy.

Business-to-business (B2B) solutions are specifically created to help other businesses improve and streamline their operations, reduce costs, and, more importantly, generate and increase revenue. Typical examples include software platforms, marketing tools, and supply chain management systems.

A B2B transaction occurs between two businesses, so the payment process is a bit different from that of a B2C (business to consumer) payment. The B2B payment process usually starts with the seller issuing an invoice for the buyer. The invoice then needs to get approved from the buyer’s (other business) side, and once approved, payment is prepared — by wire transfer, ACH, or other method.

Once payment is sent, it is validated and authorized. And once it is received in the seller’s bank account, the seller reconciles the payment and updates the buyer’s records.

The main difference between B2B (business to business) and P2P (peer-to-peer) payments is the speed of transaction — from issuing and receiving payments. Unlike P2P payments where transactions are typically smaller, payments are instant, and receivers usually get the funds in their account right away.

B2B payments are more complex than B2C (business to consumer) and P2P payments, as they usually undergo a lot of steps. The transactions are typically larger and are usually received after the transaction (exchange of products or services) has happened. B2B payments go through invoicing, approval, preparation, issuing, validation, and receiving before they are finally acknowledged and recorded on the buyer’s end.

B2B payments typically cost more than B2C payments because of the volume transaction, but payment service providers offer volume discounts to B2B companies. So, while the overall cost is higher, the percentage that processors charge for B2B payments is often lower.