Running your first payroll is exciting, but it can also be overwhelming and even a little intimidating. How do you know if you’re doing everything correctly? What if you don’t have all the information you need?

To help you out, we’ve put together the ultimate step-by-step checklist for your first payroll run, including a list of all the essential documents that you’ll need.

You will need multiple documents to run your first payroll, including an Employer Identification Number (EIN) and forms W-4 or W-9 for employees. We’ve put together a master checklist of all the documents you’ll need in the next section, so refer to that as you prepare to run your first payroll.

To run payroll, you will need a business bank account, not a personal one. Most companies use a dedicated bank account for payroll only so that money doesn’t get mixed in with other funds. If you don’t currently have a business bank account set aside for payroll, consider setting one up.

Next, you’ll need to decide how often you are going to pay employees. Many businesses follow a biweekly payment schedule, while others prefer twice a month or even once a month. Check out our guide to pay periods if you need help determining a payroll schedule for your company. Be sure to comply with all relevant government regulations when selecting a pay period.

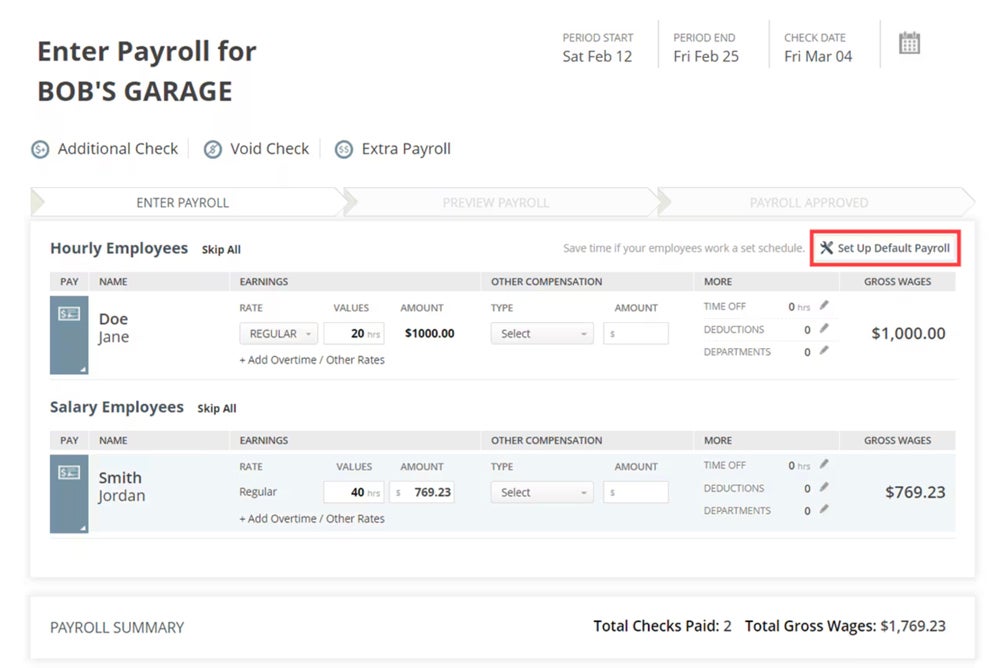

If you’re using payroll software (as opposed to running payroll manually), you’ll need to set up your payroll software before running payroll for the first time. A user-friendly payroll software such as SurePayroll will walk you through the setup process to ensure you have everything you need to run your first payroll successfully.

Haven’t decided on a payroll software platform yet? See our top picks for the best payroll software of 2024.

Out of all 50 states, 49 of them mandate that businesses must have worker’s compensation insurance to operate and pay employees (Texas is the only exception). Some states require it, even if you are going to pay a single employee. Review your state’s requirements and get compliant worker’s compensation insurance so you’ll be ready to run your first payroll.

Now it’s time to actually start figuring out how much to pay employees. To start, you need to calculate gross pay for each employee (a.k.a., wages before taxes, benefits and other deductions are taken out).

For hourly employees, you’ll need to review their timecards for accuracy and calculate any necessary overtime and paid time off. For salaried employees, you don’t have to worry about overtime, but you will need to calculate any paid time off.

You’ll also need to account for any additional pay, such as commissions, bonuses and retroactive pay, for all employees. Payroll software like SurePayroll will automatically do these calculations for you, speeding up the process and increasing accuracy.

Next, you need to calculate all deductions and subtract them from the gross pay to get each employee’s net pay. First, calculate pre-tax or tax-exempt adjustments, which include benefit premiums, retirement fund contributions, HSA contributions and expense reimbursements.

Then calculate taxes and withhold federal income tax, Medicare tax, Social Security tax, state income tax, local taxes and wage garnishments. Finally, account for after-tax withholdings, such as Roth IRA contributions. Again, using payroll software will automate these calculations on your behalf.

Whether you calculate payroll manually or use payroll software, you should review the math before processing payroll to ensure all calculations are correct. This will help you to avoid costly mistakes, disgruntled employees and even government penalties for incorrect taxes.

Once you’ve double-checked everything, it’s time to actually pay your employees. Most employees will be paid via direct deposits, but you can also pay them through physical paper checks or pay cards. You should also generate a pay stub for each employee and send it to them so you both have a record of the payroll run.

Below, we’ve put together a checklist of all the documents you will need to run your first payroll. For a more in-depth explanation of these documents, see our dedicated guide that explains the documents you’ll need for payroll in more detail.

When setting up payroll for the first time in the United States, you should obtain an Employer Identification Number (EIN) and gather other necessary documents. In the U.S., you cannot run payroll unless you have an EIN, so you need it to move forward.

A payroll checklist is essential so that your calculations are as accurate as possible. If you don’t have a payroll checklist, then you might forget to include overtime, miscalculate deductions or forget to withhold taxes — all of which are costly mistakes to fix.

From start to finish, it can take up to a week for payroll to be processed. Depending on how big your company is, it may take several days to actually run payroll and get all the necessary approvals. Once payroll is finalized and submitted, it typically takes one to four days for direct deposits to actually be made to employees’ bank accounts.