Square Payroll and Gusto are two popular payroll platforms for small businesses. While they may appear very similar at first glance, the difference becomes more apparent once you start to dig deeper.

In this review, we compare Square Payroll vs. Gusto when it comes to pricing, features, pros and cons to help you choose the best payroll software for your business.

| Square Payroll | Gusto | |

|---|---|---|

| Our rating | 4.2 out of 5 | 4.6 out of 5 |

| Starting price | $35 per mo. + $6 per person per mo. | $40 per mo. + $6 per person per mo. |

| Unlimited payroll runs | Yes | Yes |

| Automatic payroll option | Yes | Yes |

| Automatic tax calculations and filing | Yes | Yes |

| Benefits add-ons | Health, 401(k), workers’ comp | Health, 401(k), life, disability, HSA, FSA, workers’ comp |

| Onboarding | Yes | Yes |

| Hiring and recruiting | No | Yes |

| Scheduling and timesheets | Limited | Yes |

| PTO management | No | Yes |

| Visit Square Payroll | Visit Gusto |

Square Payroll offers two pricing plans, full-service payroll and contractor-only payroll:

Various add-ons are available, including health insurance administration, 401(k) retirement benefits, an employee handbook builder and direct access to HR experts.

For more information, see our full Square Payroll review.

Gusto offers three pricing plans to support growing businesses of all sizes, with the HR features increasing with each tier:

Various add-ons are available, including health insurance, workers’ compensation, life and disability insurance, HSA and FSA accounts and commuter benefits.

For more information, see our full Gusto review.

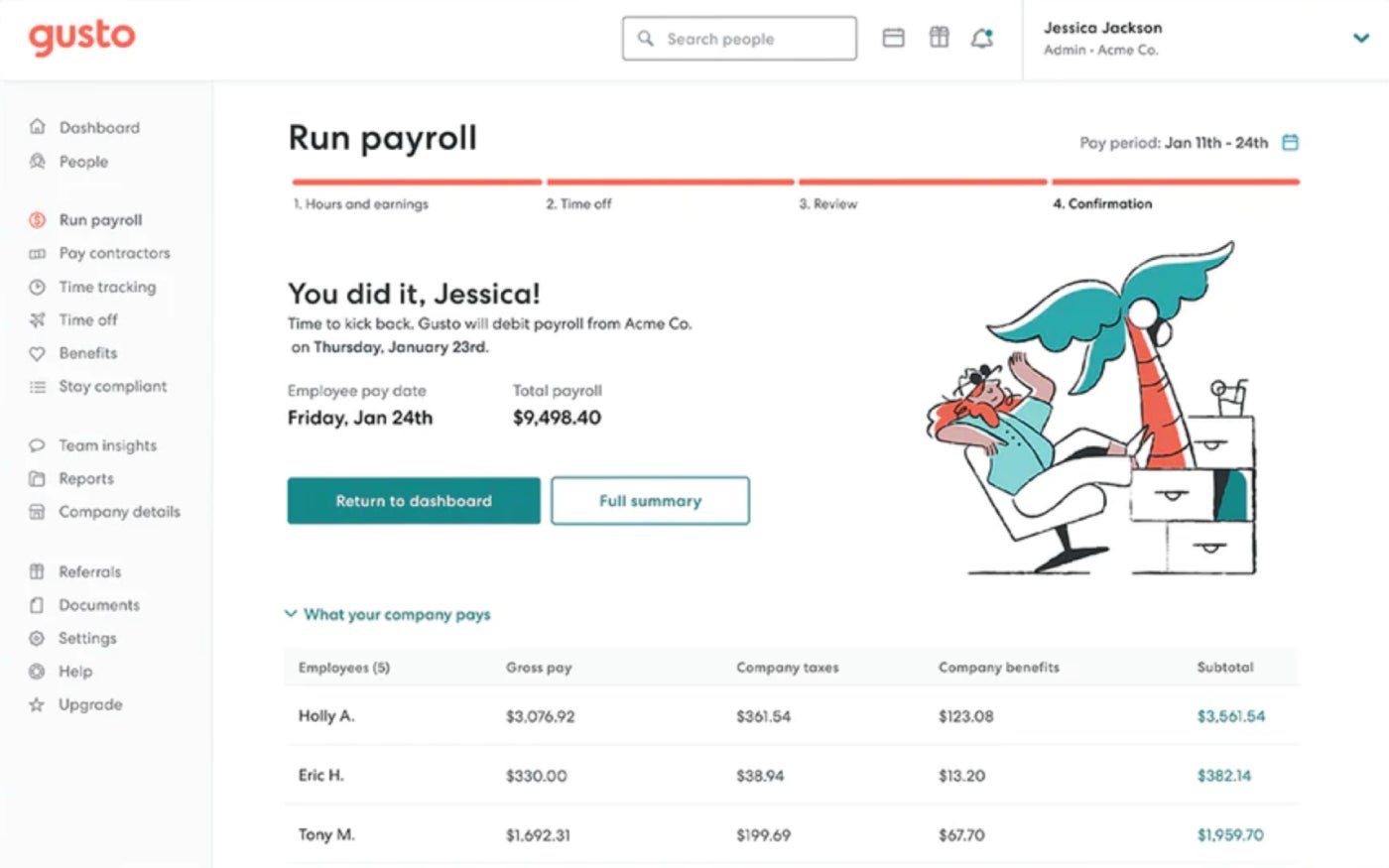

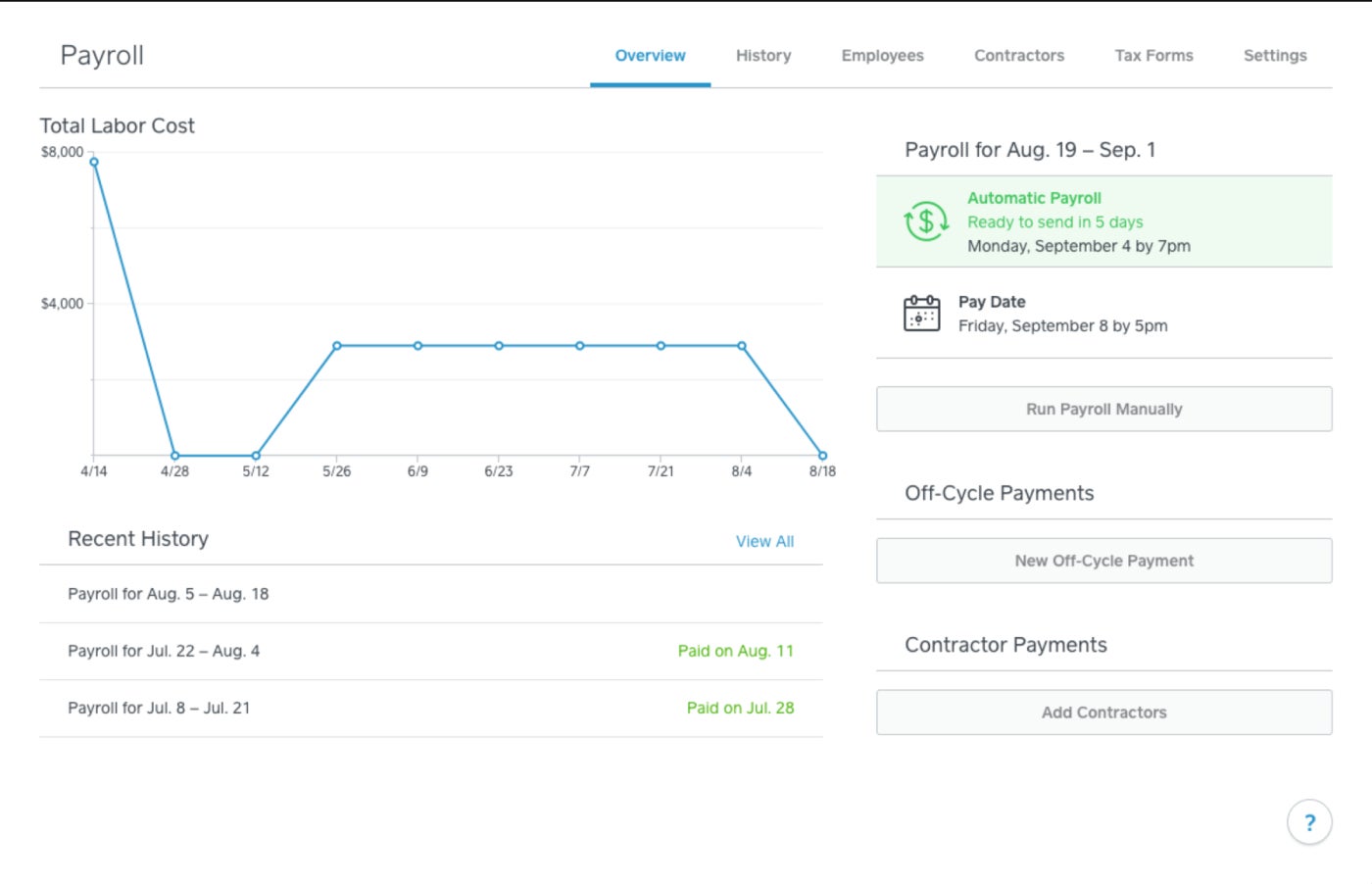

Both Square Payroll and Gusto (Figure A) offer unlimited payroll runs, which is a must-have payroll software feature. Some competitors have a per-run pricing model where you’re charged for each separate payroll run, which can get expensive for organizations with frequent payroll runs.

Both Gusto and Square also provide the option to set up automatic payroll, though this feature isn’t available on Square’s contractor-only plan.

All federal, state and local payroll taxes get calculated, filed and paid automatically with Square Payroll (Figure B) and Gusto. Both payroll software will file W-2s and 1099s and send them to the employees and contractors.

However, Square’s contractor-only plan doesn’t support this feature. And if you need to run payroll and file state taxes in multiple states, then you’ll need to upgrade to Gusto’s Plus plan.

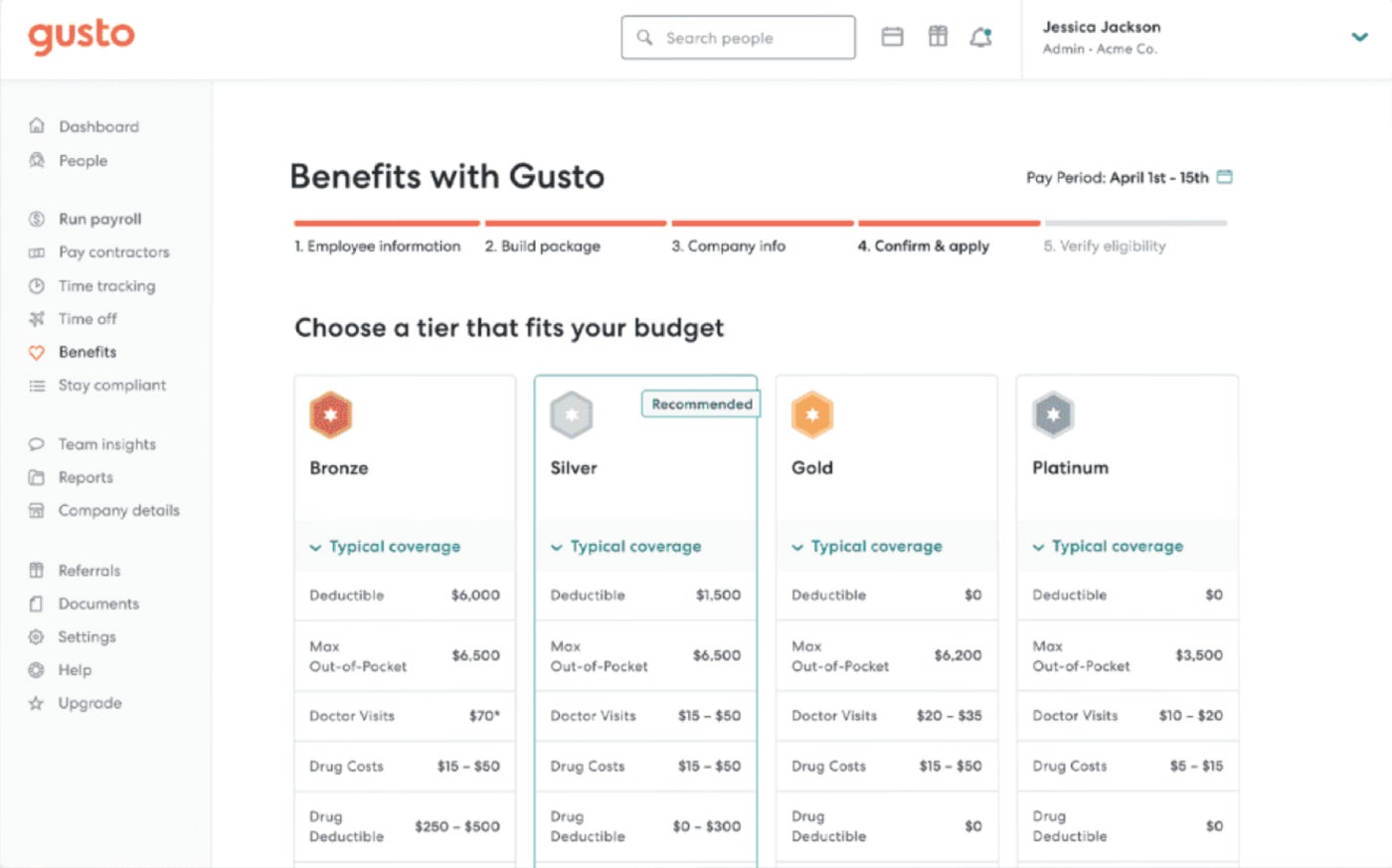

Square’s full-service payroll plan allows you to add on optional health insurance and 401(k) retirement benefits, but it doesn’t offer more robust benefits administration beyond that.

On the other hand, Gusto provides all sorts of employee benefit add-ons. In addition to health insurance (Figure C) and retirement savings, you can manage worker’s compensation, HSAs and FSAs, life and disability insurance and even commuter benefits all through Gusto. Note that most of these features are add-ons and will raise the price accordingly.

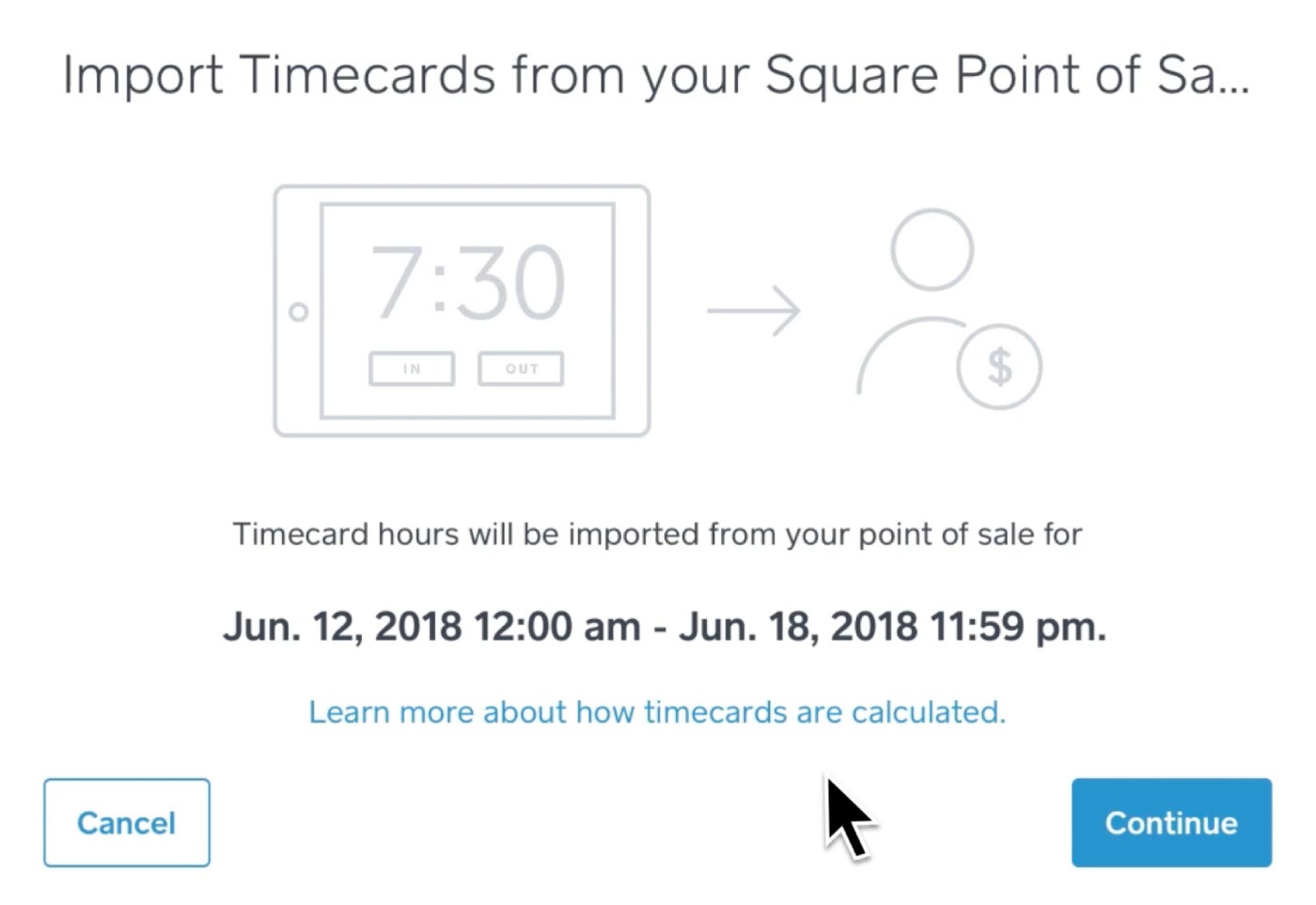

Square Payroll offers limited time tracking and scheduling tools. Managers can import time cards from the Square Point of Sale system or Square Team app (Figure D), and they can create schedules up to 10 days out and also calculate overtime when necessary.

Meanwhile, Gusto offers much more robust tools not just for scheduling and time tracking but also for PTO management. You can manage time off requests and approvals and create time off calendar syncing all within Gusto, and you can even set up your own custom paid holidays.

Square Payroll’s more limited HR tools cover employee self-onboarding, but they don’t really extend beyond that.

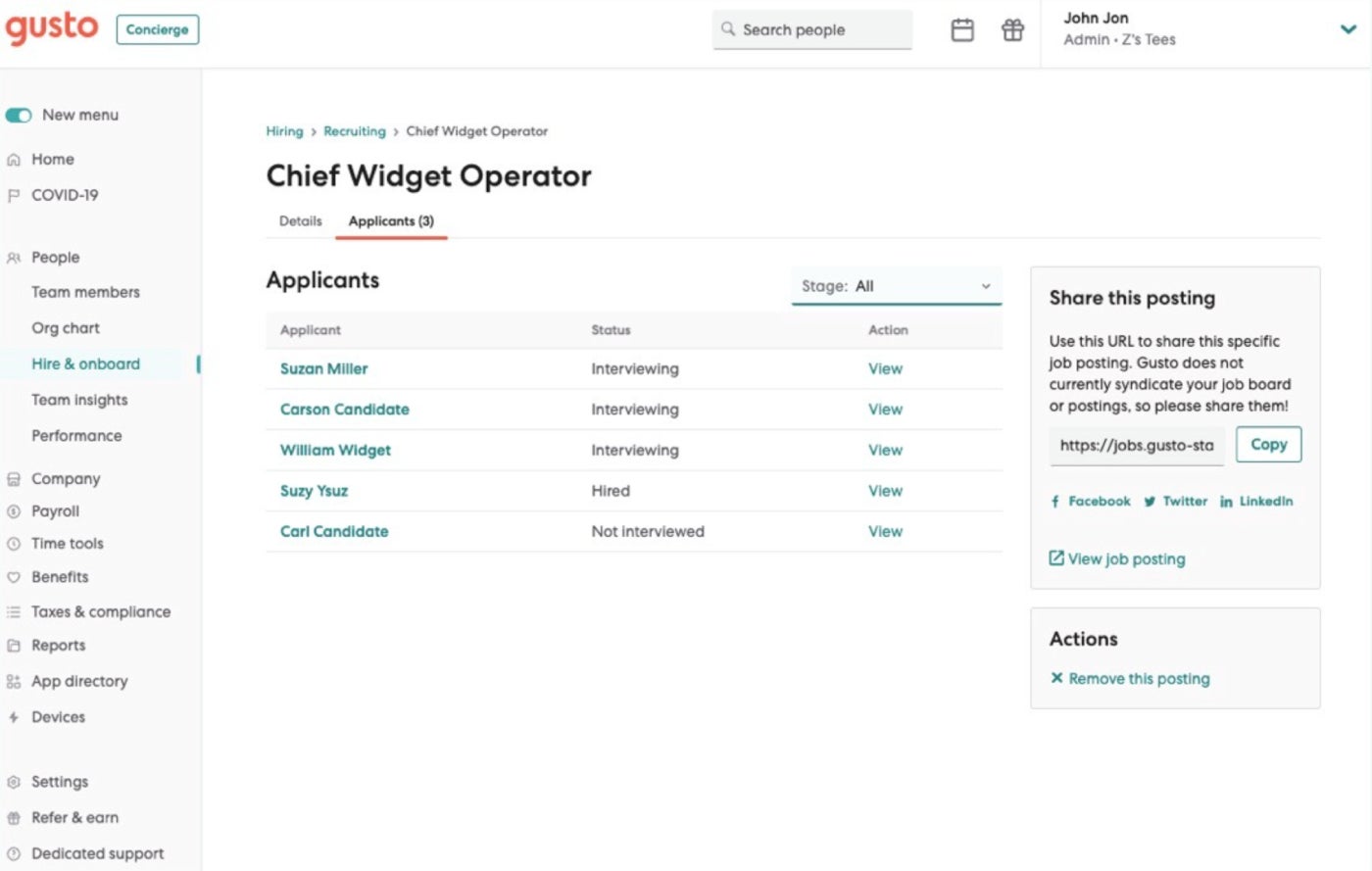

On the other hand, Gusto offers many different tools to support hiring and onboarding, including custom offer letter templates, background checks, email provisioning and document storage. More advanced plans get access to job postings as well as an applicant tracking system (Figure E) to help your business advertise job openings and recruit the best candidates.

Gusto offers more integrations compared to Square Payroll. While you get deep integration with Square POS, Square Appointments and other Square products, there is a limited scope of integrations with third-party applications for Square Payroll.

Need some more help deciding between Square Payroll vs. Gusto? Check out our payroll services comparison tool to get some additional guidance for your payroll software search.

To compare Square Payroll and Gusto, we consulted product documentation and user reviews. We considered features such as payroll, taxes and compliance, benefits, time tracking and scheduling, HR resource libraries and more. We also weighted factors such as pricing, user experience, customer service and transparency.